Jun

2023

Defensive investing in troubled markets

DIY Investor

13 June 2023

As possible further tightening by the Fed and ECB looms this week, and with the Bank of England expected to keep raising rates in light of latest wage growth and employment numbers, here are some insights from Jon Gumpel

“The view that is determining the positioning of the Citadel Fund, is that a slowdown is looming and not fully priced by markets.

“The last month saw a spike in US and UK interest rates. Inflation looks sticky and the lagged effects of rate rises to date have not quite borne fruit. In my view, the supports for growth and, to a lesser extent, inflation are dropping away quite quickly. Bonds and bank shares are typically good indicators of this, and both bond volatility (MOVE) and regional bank share (KRE) volatility have increased sharply, indicating at the very least uncertainty going forwards.

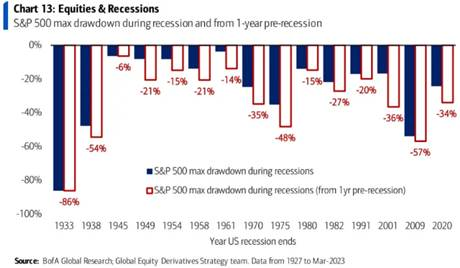

“Equity volatility (VIX) remains decidedly complacent. The gap between VIX and Rates is almost the highest since 2000 and between VIX and Banks is almost the highest since 2008. It would seem the S&P500 is ignoring both rate risk and bank risk to an unprecedented degree. Given these two are both indicators of recession, it is sensible to consider the historical impact of recessions on S&P drawdowns. Some people are suggesting that, given the falls last year, it could be that the equity correction happened in advance of the recession. So, in order to determine whether this is magical thinking or soundly based, we have to consider the history of recessions and their effect on equity markets. The chart below shows that the greater part of the max drawdowns take place during the actual recession, and not the 12m prior.

“Given the high levels of valuation in the larger contributing stocks in the S&P500, this might be particularly the case for the US this time. For this reason, the Fund holds SPX puts and VIX calls as an insurance against equity market complacency, and in this highest valuation market, only owns defence and healthcare stocks.

“While US rates go higher in search of more things to break in the cause of slowing US inflation, and in hope the Fed doesn’t have to break very much more while getting there, the Chinese economy is currently showing a very unbalanced and unconvincing recovery. The reasons are manifold and unsurprising.

Lockdown-scarred consumers are relishing cinema, food and travel but don’t look ready for large commitments, foreigners keep disinvesting and the property infrastructure driver, that kept the GDP show on the road since 2008, is over as central and local governments count the cost. Housing sales, steel demand and cement shipments tell a story here. I only own Alibaba and CSPC Pharma in China.

“One thing both the US and China are apparently doing is investing in their energy infrastructure for the new electric world (significantly powered by coal probably, though it’s considered impolite to say). It’s certainly the case in Chinese grid spending – this degree of investment globally should surely be driving the copper price higher. Sadly, it’s not. Is Dr Copper trying to tell us something about the global economy?

“What do I own then – well, I am seeking to own good risk/reward assets. My bond weightings are up, both short and also some long-dated investment grade assets. The short-dated bonds are giving attractive yields again and I am looking to raise my average duration slightly, as opportunity arises.

“The Fund’s bond and equity alternatives positions look ideal in this environment, having significantly repriced for higher interest rates and with various forms of inflation and capital protection. Like the equities, many also have a range of catalysts and drivers that will provide additional support to returns over the next few years. They may suffer some pain in the short term but should give attractive returns over the next few years.

“Equities are rather focussed on discounts, deep value, low gearing, and liquidity and have a preponderance in the industrial, healthcare, energy and materials sectors, which are either defensive, good value or already seem to be discounting recession, so might surprise to the upside. All with multiple catalysts and drivers and both fundamental valuation support and technical support. Technical support is often helpful at times like this, though needs a fundamental basis as well.”

Jon Gumpel is Investment Manager of the SVS Aubrey Citadel Fund says:

Leave a Reply

You must be logged in to post a comment.