Dec

2019

December market: The UK Stock Market Almanac

DIY Investor

1 December 2019

The latest edition of Stephen Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again as

Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again as

Market performance this month

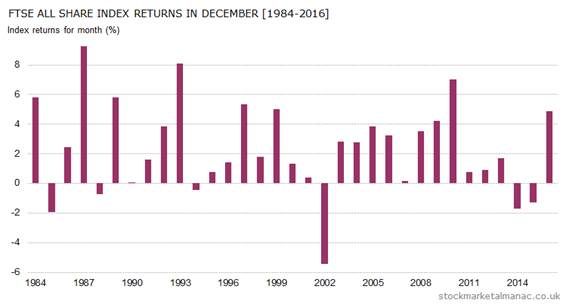

Towards the end of the year shares tend to rise strongly – a characteristic sometimes known as the end of year rally, or the Santa rally. It makes December the best month of the year for investors.

Since 1984 the FTSE 100 index has risen in 78% of all years with an average monthly return of 2%.

Incredibly, the index has only fallen three times in December since 1995 although two of those times were in 2014 and 2015 – so things may be changing.

In addition, the volatility of December returns is significantly less than any other month.

The market tend to increase gently in the first two weeks of the month, but then goes into overdrive and rises strongly in the final two weeks. Indeed this is the strongest two week period in the whole year, with the three strongest days of the year all in this two week period.

However, the solid performance of the market in December is only part of a wider trend, namely that from the end of October shares tend to be strong through to the end of the year. This is a result of the Sell in May effect (aka Halloween effect), where equities are relatively strong over the six-month period November – April. So, the market does have a fair following wind at this time of the year, and then in December shares often become super-charged.

Dividends

While December has been a good month for capital gains, it’s the worst month for income investors with only five FTSE 100 companies paying interim or final dividend payments in the month.

Sectors

The FTSE 350 sectors that have tended to be strong in December are: Electronic & Electrical Equipment, Construction & Materials, and Media; while the weak sectors are: Banks, General Retailers, and Fixed Line Telecommunications.

Leave a Reply

You must be logged in to post a comment.