Jun

2023

Dazed and confused

DIY Investor

3 June 2023

Property discounts remain stubbornly wide. Why is that, and what would make them start to narrow?…by Alan Ray

The word ‘cliché’ is very often used with a slightly pejorative edge and, if one is being forced to listen to one’s friend’s tired old blues licks played slightly out of tune on guitar, then we’d be right there using it pejoratively, too.

But we also think clichés are a useful way of communicating ideas efficiently and one of our personal clichés is ‘it’s a cliché for a reason’.

One of the laziest clichés going is ‘markets hate uncertainty’. Lazy it may be, but it doesn’t mean it’s not true and it can be a very useful starting point for understanding what’s going on. The lazy bit is the shoulder shrug that often comes with it, possibly with the additional clarifier ‘it is what it is’, which is a great way to convey so much and so little at the same time.

UK commercial property trusts have, in one version of the narrative, seen their share prices plummet over the last 12 months due to great uncertainty regarding property valuations.

As a result, most trade at very wide discounts and continue to do so, even after significant markdowns to their net asset values in the December 2022 quarterly valuation round. This being due to uncertainty seems like quite a neat summary, doesn’t it?

A few weeks ago, we wrote a piece about how understanding why the market has moved a share price is the starting point to understanding whether one can take a contrary view. One cannot, after all, contradict something one doesn’t really understand.

The following line of thinking is a somewhat related idea. Let’s go through all the things that the market might be uncertain about and see how uncertain they really are.

Oh, you mean interest rates?

The first element of this uncertainty is, it seems to us, rising interest rates. Well, we would argue that the stock market was very certain about what that would mean for property valuations, and share prices moved very swiftly to reflect that certainty. Nothing really uncertain at all, one might say.

At this point, we could just say ‘case closed’, as this does seem like quite a big certainty that the stock market got right without the benefit of hindsight. As an aside, the stock market ‘getting something right’ seems like quite an unusual phrase to see written down, doesn’t it? Perhaps there will be another article in the future on that topic?

Wait, maybe it’s more than just that…

Let’s think through some of the other uncertainties within the property sector. Property touches everyone’s lives, so it’s a relatable asset class in many ways. Let’s take one of the most relatable uncertainties: traditional retail assets.

This is really a very mature uncertainty and, really, we think there are a couple of certainties: the sector is chronically oversupplied, often with assets that won’t easily meet evermore demanding ESG standards, and consumer behaviour has moved on from ‘a day out to the shops to see what’s available on the shelves’.

In writing that sentence, we aren’t telling anyone anything they don’t already know, with high streets up and down the country showing all the signs of too much supply and too little demand. Again, does this really seem like a big uncertainty?

In fact, our universe of listed REITs has, largely, taken the same view. There will always be individual examples of retail assets with a unique or local characteristic that makes for a good investment.

There’s also plenty of opportunity, for the right investor, for a change of use. It’s not that cheap to turn a shopping centre into a residential development, though, and our income and steady-return REITs are, and have been for some time, significantly underweight this part of the retail space. As a group, they are all quite certain about this.

Hold on – have you been to the office lately?

Let’s take one of the most polarising uncertainties: offices. Clearly, in a post-pandemic world, there is a tug of war between ‘back to the office’ and ‘flexible working’ arguments. Both sides make some good points, but perhaps the most certain uncertainty is that the nature of office-based work is changing rapidly, and this is likely to accelerate.

The technology genie is out of the bottle, both in terms of the ways in which humans communicate, and more recently in terms of how artificial intelligence (AI) will reshape how and what humans work on. It would be very easy to be lost in this topic for several paragraphs of speculation.

What our universe of REITs is positioned for in this sector is that, again, ESG factors, not least energy efficiency, immediately rule out a large part of this market without significant expenditure. Again, local factors mean that there will always be exceptions, but by and large, prime offices still have an important role in corporate life, although the future of regional offices is less certain.

That is very far from saying non-existent, however: after all, people around the country still work every day in offices. Again, for a different, more hands-on investor, there is probably a value opportunity.

But, for the steady income and growth model, it seems too uncertain. Once again, our universe is underweight this, with a shared view that it is certain that regional offices are risky and uncertain.

We’re all online shoppers now, even when we’re in the shops…

In conclusion, managers in the sector have all seen the changes to the way people shop, the way that industry works and the way that supply chains have evolved. The principal overweight sectors in our universe are industrial and logistics, and retail warehouses.

These are somewhat interlinked themes, as a retail warehouse may double as a tenant’s ‘last mile’ logistics hub, serving the click and collect market. If we were to summarise this as the ‘Amazon economy’, we think most readers would follow what we mean.

Even if it’s not Amazon itself, the economy is still reshaping itself around this model and it seems quite certain that it’s not reversing. Assets in the space are not in oversupply and for the steady growth, income-seeking trusts, this is an attractive attribute, as is the fairly straightforward nature of the assets themselves, being more readily adapted to meet ESG standards.

ESG standards aren’t, by the way, an optional extra, as regulations will be getting tougher over the next few years. In terms of certainty, it seems highly certain that these assets will continue to be in demand.

What is also certain is that neither are new themes and one very fair question is: have valuations got ahead of themselves? Helpfully, Industrials REIT (MLI), which specialises in – you guessed it – industrial assets, recently agreed to a £750m cash offer at close to net asset value from a private equity fund. This at least shows that there are willing sellers and buyers at around current levels, which is a good start.

Big discounts, big opportunity. Right?

So, to conclude, with large discounts to net asset value, generally conservative gearing, M&A activity and portfolios positioned in what we feel comfortable as describing as growth sectors, it’s very tempting to identify the current situation as a one-off opportunity.

It’s especially tempting as one trust within Kepler’s universe of REITs, CT Property Trust (CTPT), has just announced an agreed all-share bid from LondonMetric Property (LMP), a FTSE 250 REIT.

CTPT fits our template perfectly: a strategic move away from traditional retail and offices towards industrial and retail warehouses has been executed successfully over several years, with conservative gearing and cash available for acquisitions. It’s a perfect fit for LMP, which is focussed on much the same sectors. So, if one was being picky, one could say that this is a relative value transaction by an established player in the same sector.

Will Fulton, the manager of UK Commercial Property REIT (UKCM), laid out his views on the property market very recently in a presentation hosted by Kepler, which you can watch here.

Richard Kirby, manager of Balanced Commercial Property (BCPT), has also positioned his trust very positively towards these sectors and we will have a note on BCPT very soon. Both are conservatively geared and trade at discounts close to 30%, with attractive dividend yields. Nick Montgomery also set out his views at a Kepler event in March and you can view that here.

We’re not 100% sure about that…

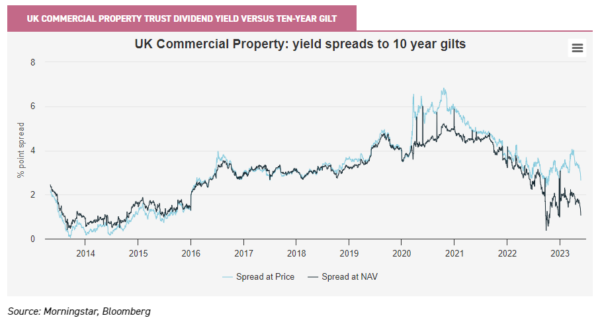

Which brings us to our main uncertainty, which we can’t solve with a single snappy sentence. There’s an old rule of thumb in property that the long-term average spread over ten-year gilts should be about 200bps to 300bps.

At the time of writing, the ten-year gilt is yielding over 4% and, no doubt, gilts are suddenly being considered as an investment by some for the first time. Dividend yields on the property trusts are indeed averaging about 6%, albeit with some outliers with much higher headline yields.

These dividend yields are, however, the result of an approximately 30% discount to net asset value, so the underlying property yields are somewhat lower than that. The chart below shows the average dividend yield at both share price and net asset value for the UK commercial property peer group, illustrating this point.

Property yields grow, of course, and although UK leases don’t tend to have inflation indexation, there is a long-term correlation with inflation. As we’ve discussed, our universe of trusts is well-positioned in the right sectors.

This means one needs to see gilts yields falling and rental growth coming through strongly to believe that discounts will narrow rapidly to net asset value. Neither of those things is implausible and the latter seems quite likely. So, the listed property trusts are at a point where a long-term investor should be considering their next move. However, despite the M&A, they aren’t at a point where investors can just rely on mean reversion to close the discounts. It is, as they say, what it is.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Alternative investments Commentary » Brokers Latest » Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.