Dec

2020

Confidence and the Imposter Syndrome

DIY Investor

22 December 2020

Since starting WheelieDealer 6 years ago, I have been super-fortunate to have met loads of private investors, traders and professionals; it has been a wonderful bonus to meet so many people that I now consider good friends – I really did not see that coming.

Since starting WheelieDealer 6 years ago, I have been super-fortunate to have met loads of private investors, traders and professionals; it has been a wonderful bonus to meet so many people that I now consider good friends – I really did not see that coming.

I have also met lots of inexperienced people who are eager to learn, as well as those highly talented who I have been lucky enough to learn new techniques and approaches from.

The Legendary Bash

During the Summer I try to be in the pub as much as I can – I try to sneak out and spend lunch and the afternoon with investing mates of all skill levels; each year since 2015, I have arranged ‘The WheelieBash’ just outside Windsor in a lovely country pub with a massive and very pleasant garden.

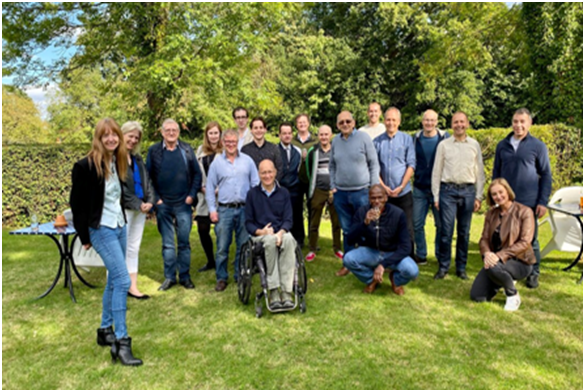

Sadly, this year’s Bash was a bit more restrained because of C-19, but the market gods took pity on us and the event went ahead in early September, albeit with a chilly breeze, and about 25 people attended. Here is a photo from the Virus Bash and you can find pictures from previous Bashes on the ‘Events’ page on my Website.

In keeping with tradition, the atmosphere was friendly, everyone enjoyed themselves and found it useful; some enduring friendships were initiated, others were cemented on the day.

I am really honoured that people travel to my neck of the woods to attend the Bash and appreciate the efforts they make – many travelled from ‘Up Norf’ and my good friend Aston Girl @Reb40 came down from the top of Scotland where she lives on Ben Nevis; if you are reading this then ‘thanks !!’ again.

In 2019 more than 50 people attended and I look forward to a Monster Bash in September 2021 to celebrate us all getting together in a more ‘normal’ situation.

The Bash is always free to attend and open to everyone; it is stress-free and people just need to rock up – whatever skill level you have you are welcome and people are always willing to share their knowledge to help people starting out and wanting to learn more.

Confidence (or not)

I meet people involved in the markets, some new to investing, others with years under their belt but looking to step up a gear – perhaps planning to retire or looking to change how they do things.

Having been retired for nearly 11 years – escaping ‘real work’ at the ripe old age of 44 – I have a pretty good understanding of how to extract money from the markets. I also have a good sense of the expenditure side of things and considerations such as making sure you are busy and have a purpose in life – otherwise retirement can be very difficult and not all that pleasant.

This I know from experience; when I left work I was very motivated and focused on taking investing to a new level. I did lots of reading and spent time thinking about what I had learnt in my previous 11 years of investing and how I could improve my returns.

Sadly it wasn’t long before things started to derail and I got bored and unenthused about pretty much everything; only when during a visit to Cliveden House near Maidenhead was the concept of WheelieDealer dreamt up with a friend over tea and cake, was my enthusiasm for the markets regenerated, and I have maintained that ever since.

In previous blogs I described the challenges of investing as ‘lifelong learning’ but there have been several periods in my own journey where my knowledge and skills and enthusiasm have plateaued; I definitely got to this kind of stasis just before I started the WD silliness.

Getting WD going changed things immensely with hugely beneficial side-effects such as the discipline it forces upon me and the opportunity to meet more talented investors and hoover up their knowledge to push my own capabilities higher.

Another thing that saps confidence is the financial services industry goes out of its way to make investing seem a black art’

I have also learned ideas and techniques from more short-term traders which I have been able to adapt to my own more long-term methods; much of trading and investing is incompatible, but there are synergistic threads across both disciplines.

I constantly find that investors lack confidence in their own knowledge and abilities; I hope it does not sound arrogant for to me say that I can tell very quickly whether someone actually makes money. The types of stocks they buy, the number they hold and their attitude to risk, fairly quickly indicate to me whether they are successful or not.

If they are new, I soon figure out if they are on the right path, or likely to be banging their head against a wall.

Many are on the right track, talk a lot of sense and are holding and/or looking at precisely the kind of quality stocks that are likely to work out well; often they have dabbled with stocks or funds for at least 10 years but had their main focus on demanding jobs or businesses and the usual family distractions.

I suspect other facets of their lives eat away at their confidence in their investments; perhaps more accurately, they do not build confidence because they don’t have time to monitor returns effectively and are not getting the positive feedback loops to clearly show they are doing well.

Investing more money on a regular basis may make calculations around returns more difficult (WD – if you use the XIRR function in Microsoft Excel that will work out returns where you regularly add or subtract more money to your portfolio).

Another thing that saps confidence is the financial services industry goes out of its way to make investing seem a black art and that us ‘mere mortals’ couldn’t possibly master the techniques and skills required. Nothing could be further from the truth.

A manifestation of low confidence is when investors are not great at choosing their own stocks, requiring the ‘confirmation bias’ of someone in a magazine or tip-sheet making a recommendation to buy.

I am not complaining – even though I am not a tipster, and nobody should blindly copy what I buy or sell – I am pretty sure that my comments assist that confirmation bias and help investors make decisions regarding a particular stock. This boosts my following on Twitter and increases traffic to my websites – I write the stuff so it is pleasing when people actually read it!

Lack of confidence can also lead people to retire later than they could; taking the step to retire is a big one and should never be rushed, but I am certain that many people work years longer than they need, to be ‘on the safe side’, at the cost of less years of freedom as we get older.

Legendary Investor Warren Buffett observes that as he gets older, each day he has left alive becomes marginally more valuable, so he only does what he chooses to do; he is into his 90s now I believe.

‘We’re not worthy…’

A related concept is ‘imposter syndrome’ whereby truly talented Investors underestimate how good they are compared to others; they do not lack the confidence to pick stocks and run their portfolio, but when they meet other very capable investors, they feel like they don’t fit in.

In my experience, investors who are immensely wealthy are never flashy, are always modest, friendly and easy to talk to – and happy to share their knowledge.

I am a big fan of MotoGP bike racing where a chap called Danilo Petrucci recently won his second victory after being in the top class for several years; he didn’t come through the usual ‘feeder classes’ of Moto3 and Moto2 which probably prompted him to say in an interview ‘I didn’t feel like I was good enough to be here’ – classic imposter syndrome thinking, clearly he is.

I had a sizeable dose of imposter syndrome when I started the WD journey; I thought I was a half-decent investor, nothing special, (that’s not changed, I’m just a bit more wrinkly!) but that by focusing on education, it would be useful for other people, especially newbies.

In truth you can find tips and recommendations everywhere, but very little useful and practical information on how to run a portfolio consistently over time, with real world experience.

I found that that lots of extremely talented and experienced investors wanted to talk to me and realised that I was perhaps more talented than I had believed before; whether new or experienced, the more discussions I had, the more I appreciated my own level of knowledge and understanding.

The best way to learn something is to teach it to others, and doing WD has enabled me to practice this principle.

How to Build Confidence

Self-confidence comes from seeing your returns over time, becoming aware of how you react in nasty market sell-offs and when things go – this will happen a lot! – but even those with many years under their belt can struggle with self-belief issues.

Simply copying other people can work, and may be fine initially for a newer investor, but it is fraught with risks, such as the source of your ideas disappearing and leaving you high and dry.

It is far better, and to me more enjoyable and satisfying, to choose your own socks and make buy and sell decisions yourself; progressing to self-reliance very soon is likely to be far more successful and sustainable – anybody can pick quality stocks, the talent is in detailed portfolio management.

Key to dealing with low self-confidence is realising you have a problem that you need to address head-on and improve; you are almost certainly more capable than you think you are.

In my experience pretty much anybody can become a competent and successful long-term investor; short-term trading is much more difficult and the vast majority will fail at it.

This mindset will help very quickly; there is no problem in taking ideas from other people – I do it all the time – but don’t blindly and unthinkingly do it. Certainly never rush into any buy or sell decision – if you are pumped up and excited, you are most likely about to make a very expensive mistake.

Another highly important consideration is how well a stock fits with the others in your portfolio; what does this potential new investment ‘bring to the party’ in terms of diversification and overall risk management.

Get into the habit of hunting out your own ideas and I have written a lot of material over the years about doing exactly this which you can find on my websites; Twitter is also a great source of potential new ideas for you to investigate further @wheeliedealer

To understand how you compare to other investors, take advantage of the various social events such as the WheelieBash and there are others such as the Mello Events run by David Stredder and the free shows in London such as Master Investor and the UK Investor Show. Other good events are put on by ShareSoc and piWorld and Blackthorn Focus.

It is a good idea to get on Twitter or hunt out people like myself if you already use it, and engage with the vibrant community that has built up; as with any type of social media you need to keep your wits about you and control your usage because it can drive you a bit mad at times, but if you follow the right people, it is all very civilised and positive.

You may find there are investment cubs in your local area; if you get on Twitter and engage with other investors you can probably find like-minded people who live near you.

If you do wish to find people in your area, then feel free to contact me and I will happily let my readers know that you are about and would like to meet anyone who is interested.

If you do wish to find people in your area, then feel free to contact me and I will happily let my readers know that you are about and would like to meet anyone who is interested.

Lastly, and I would say that, wouldn’t I? The Twin Petes podcast is an excellent source or regular information and debate; click the logo to give it a try, and feel free to leave suggestions for future editions:

Regards, WD

Click to visit:

Leave a Reply

You must be logged in to post a comment.