Jun

2023

Commodities and Inflation

DIY Investor

30 June 2023

Fresh evidence sheds new light on investing’s most misunderstood asset class and its power as an inflation hedge – by our friends at justETF

If you ever checked the returns of a Commodities ETF from 2008 to 2020 then the chances are you moved swiftly on while making a complicated hand gesture to ward off evil. Commodities seemed like a cursed asset class during those years – until they suddenly roared back into life as inflation accelerated during 2021 and 2022.

But the arrival of a commodities revival in tandem with an inflation surge is not a coincidence according to the recent work of several investing research teams.

The researchers have pieced together new long-run datasets for commodities that reveal the asset class to be a strong inflation hedge and excellent portfolio diversifier to boot.

The research is complex so, in this article, we’ll focus on the main points that impact portfolio construction, show you the key evidence, and talk over some of the question marks that still hang over commodities’ role in your strategic asset allocation.

justETF tip: This post discusses investing in ‘broad’ commodities. That’s shorthand for investing in the futures contracts of a diverse basket of raw materials including agricultural products (e.g. coffee and livestock), industrial metals, precious metals, and fuels such as oil and natural gas. This distinct asset class is investable using Commodity ETFs and we’ve written a short explainer on the topic if you’d like a quick intro.

Commodities research findings: the headlines

- Critically, the data shows that commodities deliver potent annualised investment returns over the long-term. A diversified investment in commodities comfortably outstrips bonds across the past 150 years and can even beat stocks over substantial time periods too.

- The record shows that commodities add diversification value to portfolios because they typically have a low correlation with equities and bonds.

- What’s more, the researchers show that commodities offer outsized protection against high and unexpected inflation relative to other major asset classes.

However, commodities match stocks for volatility and risk. While the long-term trendline tracks upwards, it is pock-marked by boom and bust. The deepest declines are severe and lost decades are not uncommon.

Commodities are not for the faint-hearted.

It’s also important to emphasise that these findings do not apply to investments in single commodities. The strategic role of the asset class only holds in the form of broad commodity futures. These benefit from additional sources of return and the hedging effect of assets as diversified as lean hogs and platinum.

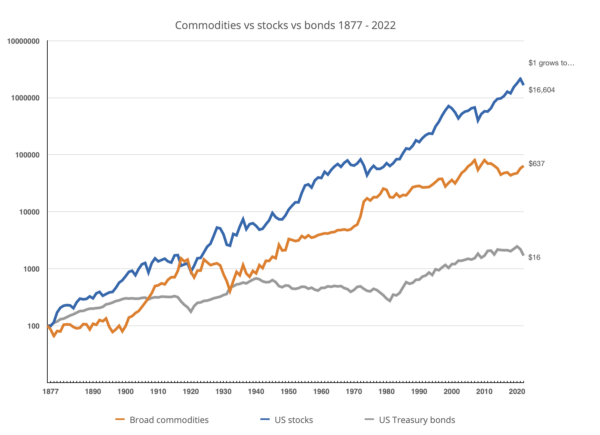

Commodities vs stocks vs bonds

This chart reveals why the long-run data for broad commodities makes us sit up and take notice:

Hint: All returns quoted in this article are real total returns i.e. they are inflation-adjusted and include dividends and interest.

- Of course, it’s hard to stop your eye from following the blue US stocks line. It represents a staggering long-term growth figure of 6.9% annualised.

- But the orange commodities line also shows a strong annualised return of 4.5%. That’s a good return in anyone’s language. It beats the long-term results of most non-US stock markets, for example.

- And commodities thrash the 2% long-term return of US government bonds as you can see in the chart above.

Indeed, broad commodities do even better when the timeline runs from 1900-2022. The renowned financial academics Dimson, Marsh and Staunton (DMS) presented those calculations in their recent evaluation of the commodities evidence:

“In every country, and for the world, the excess return on commodity futures dominates the excess return from both stocks and bonds. Non-American investors enjoyed an even more favorable relative return from futures than their American counterparts.”

See the Credit Suisse Global Investment Returns Yearbook 2023 to dig into the full DMS report.

If commodities’ post-2008 slump is a blip then the extended historical record suggests that the asset class is a serious contender for a role in every investor’s portfolio.

Commodities diversification potential

The case for commodities only builds when you examine its suitability as a portfolio diversifier and inflation hedge. The following table hints at the asset class’s potential.

Asset class correlations: annual returns 1877-2022 (inflation adjusted)

| Commodities | US stocks | US Treasury bonds | US inflation | |

|---|---|---|---|---|

| Commodities | 1.00 | 0.15 | -0.20 | 0.15 |

| US stocks | 0.15 | 1.00 | 0.22 | -0.31 |

| US Treasury bonds | -0.20 | 0.22 | 1.00 | -0.53 |

| US inflation | 0.15 | -0.31 | -0.53 | 1.00 |

- The dream diversifier has low correlations with both stocks and bonds. It also has a higher correlation with inflation than either of those conventional portfolio mainstays.

- Commodities negative correlation with bonds implies they’re liable to perform when US Treasuries suffer. This is an excellent result.

- Meanwhile, commodities’ low but positive correlation with stocks suggests that the pair are complementary assets which can amplify or offset each other, depending on the prevailing conditions.

How to read this table

That’s the story we see play out in the table above and it means that commodities have the potential to play a supporting role in a three-legged portfolio that includes stocks and bonds.

Notice also that broad commodities have the strongest correlation with inflation of the main asset classes. This is a clue to their role as an inflation hedge. They have a tendency to thrive during inflationary times and dive during disinflationary periods.

At the very least, commodities are more likely to respond positively to inflation than stocks and bonds which both have a negative relationship with rocketing consumer prices.

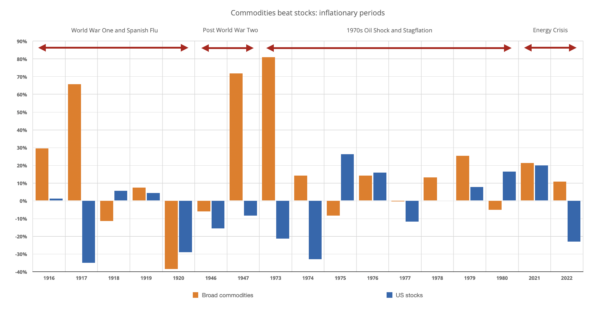

Commodities and inflation

The next chart shows how commodities and stocks performed during the four major inflationary outbreaks of the past 150 years.

- Commodities beat stocks in 12 out of 17 years when the inflation threat was high and escalating.

- The inflation protection offered by commodities was significantly better than stocks during these episodes, although you would still have to live with some negative years. Nothing is guaranteed.

It’s worth noting that inflation in many European countries was much worse than the American experience. Additionally, USD-priced commodities appreciate more for investors living in countries experiencing high levels of inflation, when their currency loses ground to the dollar.

Dimson, Marsh, and Staunton examined the inflation-hedge question using multiple metrics and concluded that:

“Excess returns [of commodities] were thus high when inflation was high, unexpected inflation was high, and when inflation rose.”

What do excess returns mean?

DMS further theorise that the central role of broad commodities within the global economy makes them an effective inflation defence because:

“Commodity futures portfolios provide the instruments needed to hedge against different types of inflation. Energy futures perform well during energy-driven cost-push inflation; industrial metals during demand-pull inflation; and precious metals, especially gold, perform well when central bank credibility is questioned.”

Anti-inflation protection is the strongest argument for including commodities in your portfolio given that both bonds and stocks are highly vulnerable to the pressure of fast-rising prices.

When do commodities underperform?

Commodity returns are likely to deteriorate during recessions and disinflationary periods i.e. when inflation is weak and falling.

Indeed, Dimson, Marsh, and Staunton identify the disinflation of the post-Global Financial Crisis period as a major contributory factor to the atrocious returns of commodities from 2008 to 2020. They think it unlikely that commodities are broken as an asset class, especially as similarly long slumps are a perfectly normal occurrence during the past century and a half for all of the major asset classes.

The possibility of lost decades is an unavoidable truth of investing life that makes diversification across the asset classes so important.

The lesson is: never pin all your hopes on a single source of return.

The equal-weighted index problem

Sadly, as mentioned earlier, question marks remain and there’s no simple answer to this particular issue beyond compromise. At this point, the story takes a complicated twist.

The researchers who’ve painstakingly unearthed the long-term returns of commodities have restored it in the form of equal-weighted indexes. In other words, their reconstructed indexes are composed of even proportions of every commodity type captured in their data.

This is a standard academic convention but in the real world very few broad commodity future indexes are equally weighted. Fewer still are tracked by the available commodity ETFs. The major investable commodity indexes are weighted by world production quantities and / or liquidity.

This matters because the historical returns from the reconstructed equal-weighted indexes are typically higher than the major investable indexes.

The best long-run data we can get that corresponds to an available investable index comes from the research team of Bhardwaj, Janardanan, and Rouwenhorst of Summerhaven Investment Management and Yale.

We can link their reconstruction of the Dow Jones Commodity Index to contemporary investable indexes. That enables us to calculate a 3.7% annualised return for broad commodities from 1934 to 2022.

The historical equal weighted index we used in the charts above delivers a 5.4% annualised return during the same period.

It appears that equal weighting confers a structural advantage that would be well worth having if it’s maintained in the future.

The only choice is compromise

All told, the academic findings and our own calculations indicate that the ideal commodity ETF would track an equally weighted index.

But currently, the only ETF in our database that does so is the Amundi Bloomberg Equal-weight Commodity ex-Agriculture UCITS ETF Acc.

However, that ETF’s index excludes agricultural commodity futures. Now that’s not necessarily a flaw, but it doesn’t make the product the perfect investable fit for the research community’s work either – because their equal-weighted indexes invariably do include an agricultural component.

Some sources suggest that risk-weighted (also known as volatility weighted) indexes bestow similar benefits to their equal-weighted counterparts. However, those ETF products are similarly thin on the ground.

But do not despair!

- Firstly, the properties that make broad commodities attractive – positive long-term returns, diversification, and inflation-hedging potential – remain intact when the research teams consider non-equal-weighted indexes.

- Secondly, do not let perfect be the enemy of good. 3.7% annualised is still an excellent historical return for a diversifying asset class. It’s much stronger than bonds or cash and the bulk of your portfolio’s growth potential should still be bound up in stocks anyway.

- Thirdly, most of the main commodity indexes do cap their weights to ensure no single futures type dominates, although this isn’t the same as equal weighting.

We’ve collated your commodity ETF options here if you’d like to assess the available products.

Commodities asset allocation

If you’re intrigued by the potential of commodities then the next obvious question is what’s the correct asset allocation?

Inevitably, there’s no right answer as it depends on unique and personal factors such as your objectives, risk tolerance, and the composition of your particular portfolio. Moreover, no-one can determine the optimal blend of assets in advance as the future dispersion of returns cannot be accurately forecast. Yet the consensus built on the back of the latest research does allow us to form some reasonable conclusions.

- For instance, commodities should only be viewed as a potential supplement to stocks and bonds. They are not a replacement for either.

- Nor are commodities a vital portfolio building block in the way that stocks and bonds are. You should feel no compunction about leaving this extra asset class complexity on the sidelines for now if you remain unsure or unconvinced.

- But if you are excited about the potential, then it may be best to carve out your commodities allocation from both the growth and defensive side of your portfolio.

This is because:

- The lower expected returns of commodities versus stocks implies lowering your portfolio’s overall return if the allocation is taken solely from your growth allocation.

- However, commodities’ tendency to decline during recessions means you could expose yourself to deeper drawdowns during an economic slump if the entire allocation is taken from bonds.

Thus a balanced and cautious approach is probably the way forward. With that in mind, any strategic asset allocation decision should be considered in terms of broad guidelines rather than ‘optimised’ quantities.

- For example, a minimum asset allocation of 5% makes sense because anything less will barely move the needle.

- Bear in mind that 20%+ allocations for strategic diversifiers can be tough to maintain when the asset slumps.

- Inevitably, the broader cultural conversation will invite you to compare your atypical allocation to the market portfolio. That’s fine when the comparison works in your favour but psychologically wearing when the investing fates conspire against you.

- The middle ground, of course, is a 10% allocation. That’s enough to make a noticeable difference to your outcomes without being too painful should commodity returns not bear fruit in the years ahead.

Our conclusion

Finally, we’d caution that, after an explosive 2021 to 2022, the main commodity ETFs are down year to date in 2023. If that troubles you then this volatile asset class is probably not right for you.

As we’ve seen, commodities have delivered good long-run returns, and have historically added value as an inflation hedge and diversifier but, without doubt, they are a wild ride.

Alternative investments Commentary » Brokers Commentary » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.