Oct

2019

Cloud computing: A business necessity…

DIY Investor

21 October 2019

In just a decade, cloud computing has become the default computing platform, with 88% of organisations now adopting a cloud-first strategy.

What began as a way of increasing flexibility and reducing IT costs has morphed into a strategic necessity for companies to become more agile and access infrastructure capabilities that they do not have themselves.

Cloud computing allows companies to access virtually limitless computing power and storage on a pay-as-you-go basis. Any organisation – from a start-up to a government – can have access to world-class computing resources cheaply and quickly.

‘access to world-class computing resources cheaply and quickly’

The computing infrastructure itself is owned and operated by the ‘hyperscale’ cloud companies Amazon, Microsoft and Google. When individuals stream videos, play games, use social networks and bank online they are often using physical computing resources sitting in the cloud.

Instagram is an example of an application that uses cloud computing to store photographs. More importantly for us, it also allows businesses to save the cost of having to own, maintain and manage their own hard drives or servers while still having the ability to provide full computing capabilities.

Cloud computing is a key part of businesses’ digital transformations as they modernise not just to evolve but to survive.

Where are we now?

The cloud computing industry is dominated by three big players. Amazon Web Services (AWS) is Amazon’s cloud platform that was launched in 2006 and is the market leader. To give an idea of the scale of the business, in Q4 2018 alone it generated $6.7bn in revenues, up 45% on the previous year, with a profit margin just shy of 30%.

Azure, launched in 2010, is Microsoft’s equivalent that recorded $3.1bn in revenue over the same timeframe (76% y/y). Google’s GCP (Google Cloud Platform, which includes G Suite/Google Apps) produced $2.7bn (102% y/y).

Three main categories of cloud computing service have developed: Infrastructure as a Service (IaaS), the significantly larger Software as a Service (SaaS) and the intermediate Platform as a Service (PaaS), where the consumer provides the software and the provider provides the network, server and operating system.

IaaS is essentially the storage and network building blocks of any cloud service. It has quadrupled in value over the past three years to be worth more than $42bn.

As often happens with disruptive technologies, we appear to have hit an adoption sweet spot – having taken 10 years to reach the first $10bn in revenue (2006-2016), IaaS is now adding $10bn revenue every 1-2 years.

While growth must invariably slow at some point, the market is expected to sustain growth rates of around 30-35% which (at the higher end of forecasts) means the IaaS market could be worth as much as $150bn by 2023. SaaS has also continued to deliver strong growth over the past year and is forecast to expand by more than 20% annually to c$235bn by 2023.

Survival of the biggest and brightest

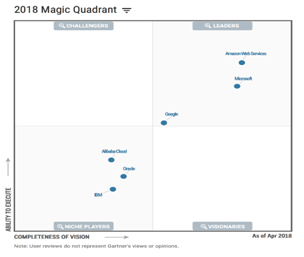

The IaaS market is rapidly forming around a handful of companies. A year ago, research firm Gartner produced an IaaS ‘magic quadrant’ of 15 leading cloud companies; this year there are just six.

Gone are the telcos and managed service providers leaving three vendors who – thanks to their massive scale – deliver high levels of performance, fault tolerance and availability. Of these, AWS has an estimated 61% market share and Azure 23%.

The three largest providers are also using technology to improve their own operations. Google applies machine learning to improve the energy efficiency of its data centres; AWS uses it to forecast capacity demand and how to best meet it.

Enormous and technologically sophisticated IT companies including IBM and Oracle have been unable to make much of a dent in the cloud computing market, which points to formidable barriers to entry.

Where next?

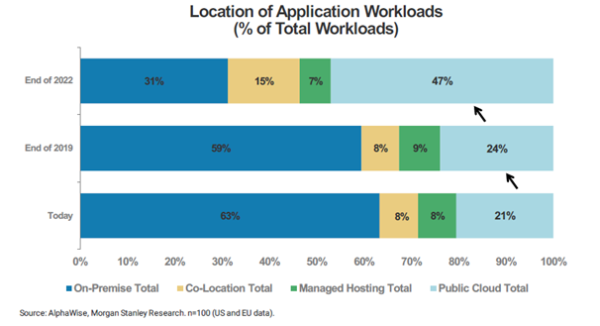

This time last year, we suggested that the public cloud accounted for c21% of workloads, and a year on the process of ascertaining cloud penetration remains highly uncertain. CIO surveys suggest that it remains at or around 22% headed to 29% next year and 50% by the end of 2022.

However, other measures put it at less than 20% today growing to 28% by 2022. A further complication is that as cloud offerings continue to broaden and deepen so more uses are found for the cloud and the total addressable market expands again.

This leave a lot of room for conjecture. For example, Gartner sees the opportunity at more than $1trn while KeyBanc believes nearer $1.8trn is up for grabs. Fortunately, either scenario should provide plenty of runway to sustain cloud growth well into the next decade.

This leave a lot of room for conjecture. For example, Gartner sees the opportunity at more than $1trn while KeyBanc believes nearer $1.8trn is up for grabs. Fortunately, either scenario should provide plenty of runway to sustain cloud growth well into the next decade.

IT budgets continue to be reallocated away from legacy areas such as hardware and infrastructure software in favour of cloud, cybersecurity and workflow automation. This will continue to weigh on and work against incumbents such as Dell, Oracle and HP and in favour of cloud vendors such as Amazon, Microsoft and Google.

‘Like electricity before it, the cloud has become both the source of and saviour from disruption’

Overall device growth is just 1.6% this year following a flattish 2018. Having peaked in 2011, the PC market has been declining ever since with units falling a further 1.3% last year. Tablets peaked in 2014 when 250 million units were shipped but sales have since declined for 16 consecutive quarters – units declined 6% in 2018. The smartphone market continues to falter amid high penetration and a slowing pace of innovation with units declining 1% last year with growth of 1.4% expected between 2017-2022.

At an IaaS level, storage spending is expected to decline by 1.8% per annum through 2022 despite expectations of a 10x increase in data creation between 2017-2025. This is because the cost of data storage is declining at a commensurate rate: $100 next year will buy you 20-40% more gigabytes of storage than $100 will this year.

The outlook for mainframes also looks problematic with more than half of CIOs using mainframes today expecting to move off them within the next five years. While servers remain a bright spot, this largely reflects hyperscale demand and pass-through of higher server component prices (which are currently reversing). Even within software, budgets continue to be reallocated away from legacy areas such as infrastructure.

Like electricity before it, the cloud has become both the source of and saviour from disruption, with cloud computing now providing the infrastructure to help businesses drive their digital transformation.

Click on the link to visit:

Disclaimer

The information provided is not a financial promotion and does not constitute an offer or solicitation of an offer to make an investment into any fund or company managed by Polar Capital. It is not designed to contain information material to an investor’s decision to invest in Polar Capital Technology Trust plc, an Alternative Investment Fund under the Alternative Investment Fund Managers Directive 2011/61/EU (“AIFMD”) managed by Polar Capital LLP the appointed Alternative Investment Manager. Polar Capital is not rendering legal or accounting advice through this material; viewers should contact their legal and accounting professionals for such information. All opinions and estimates in this report constitute the best judgement of Polar Capital as of the date hereof, but are subject to change without notice, and do not necessarily represent the views of Polar Capital. It should not be assumed that recommendations made in future will be profitable or will equal performance of the securities in this document.

Polar Capital LLP is a limited liability partnership number OC314700. It is authorised and regulated by the UK Financial Conduct Authority (“FCA”) and is registered as an investment advisor with the US Securities & Exchange Commission (“SEC”). A list of members is open to inspection at the registered office, 16 Palace Street, London, SW1E 5JD

Software Development Trends to Watch out for in 2020

Leave a Reply

You must be logged in to post a comment.