Feb

2024

Chinese New Year – History tells us the Year of the Dragon could lift Chinese market out of slump

DIY Investor

6 February 2024

Ahead of Chinese New Year this weekend, Ben Laidler comments, on the performance of China’s stock market and the prospects of a rebound

“Chinese stocks are the worst performers of any major market this year and have now fallen for over three years. This is driving calls on the authorities for greater measures to support the economy and stock market and comes before the weekend’s start of the new year holiday. And has global implications for those economies and stock markets, from Australia to Germany and luxury goods and autos, dependent on the world’s second largest economy.

“February 10th starts the Year of the Dragon, the fifth in the twelve-year cycle of the Chinese zodiac, and a symbol of power and strength. It’s also historically been auspicious for the stock market. Of the four ‘Years of Dragon’ in recent history in 1976, 1988, 2000, and 2012, Hong Kong’s Hang Seng index has risen in three of them with an average 17% return.

“China’s falling stock market has made it among the world’s cheapest markets at an estimated 8x price/earnings ratio, less than half the level of the S&P 500. Whilst local and foreign investor sentiment has fallen sharply, that is often a contrarian positive. And the government vowed to ‘stabilize’ the market whilst maintaining the momentum of economic growth around 5%.

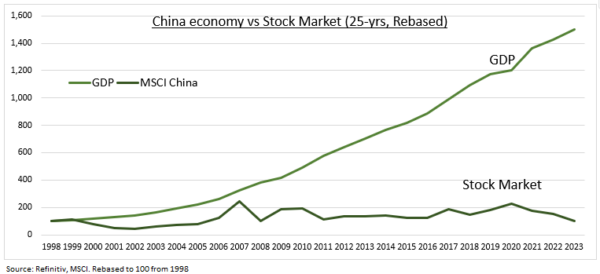

“Yet a long-term view has shown that China, for all its economic dynamism, has not rewarded stock investors. The economy has surged 14-fold to over 18 trillion dollars in the past twenty-five years even as its stock market, per the MSCI China index, has only been flat.”

Ben Laidler is Global Markets Strategist at eToro

Leave a Reply

You must be logged in to post a comment.