Oct

2020

China Investment Trusts Come Of Age

DIY Investor

5 October 2020

The Chinese stock market has been one of 2020’s top performers; up 19%, it’s well ahead of the US’s 10% gain and the UK’s sickly 19% drop.

But in the past, investing in China has been both difficult and disappointing; MSCI China index is up just 2.5% a year since 1993, miles behind the 8% a year posted by global markets.

Chinese stocks fell throughout the 1990s, while the rest of the world boomed; they were then flat before soaring just before the financial crisis. Up 83% in 2006 and 66% in 2007, they crashed the next year and trailed the rest of the world in the early 2010s as financial companies dominated the Chinese index.

The rise of Chinese tech

But much has changed; financials account for under 14% of MSCI China and both Alibaba (20%) and Tencent (14%) are now larger than the entire Chinese financial sector.

Other large tech stocks in the top 10 include Meituan Dianping (a local food shopping platform), JD.com (online retail), NetEase (computer games), and Baidu (search engine).

Over five years, the Chinese stock market is up 14% a year versus the world’s 11% and the US 15%; 16 Chinese companies are valued at more than $100 billion – the UK has four (Unilever, AstraZeneca, BHP and GlaxoSmithKline).

May you invest in interesting times

China’s poor stock market returns occurred when its economy was growing rapidly. In Y2K China’s GDP was 25% of Japan’s and 10% of the US; by 2010 China’s exceeded Japan’s, becoming the world’s second-largest economy with 40% of US GDP.

In 2019, China’s GDP was 66% of the US and it looks set to overtake it by 2030.

Where China fits into world markets

There are complications for investors wanting to invest in China; developed world global trackers typically have no significant exposure to Chinese stocks as it is not classed as a developed market.

Whole world trackers, like Vanguard’s All-World ETF, do include China but the country’s weighting is 5%, far below the 15% or so of world GDP that the country represents; ‘Greater China’ (including Hong Kong and Taiwan) still only takes it to around 7.5%.

Investors seeking exposure can include an emerging market tracker as China makes up around 45% of most emerging market indices, dominating emerging markets in the way the US dominates developed markets.

Presumably, China will one day be classed as a developed market; MSCI has no precise definition of what constitutes a developed market and moves between emerging and developed are relatively rare

Getting China exposure via trusts

There are various ways to invest in China using an investment trust.

Mainstream global trusts typically have 5-10% in Greater China, similar to whole world trackers; Scottish Mortgage is the outlier with 20%.

Emerging market trusts have mixed exposure, with Fundsmith Emerging Equities at the low end (20%) and JPMorgan Emerging at the high end (50%).

Various Asia Pacific trusts with additional focus on income or smaller companies, have a similarly wide range of exposure to Greater China; Tech and biotech/healthcare trusts, two popular growth themes, are light on Chinese stocks, holding just a few per cent.

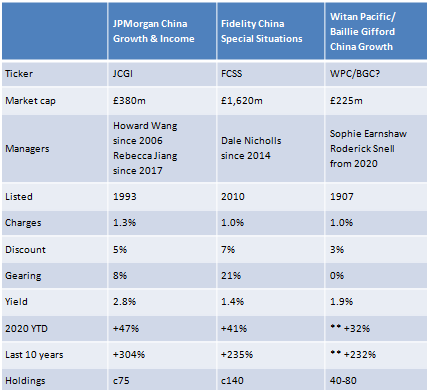

The two purely Chinese focused trusts are large; Fidelity China Special Situations (FCSS) has a market cap of £1.6 billion while JPMorgan China Growth & Income (JCGI) is nearly £400m.

Shareholders of Witan Pacific Investment Trust are due to vote to rename the trust as Baillie Gifford China Growth Trust, targeting 40-80 listed and unlisted Chinese companies, sharing two of the three managers that run the successful Baillie Gifford China open-ended fund.

Chinese trusts compared

At first glance, the top ten holdings in the three Chinese trusts look very similar to the Chinese index, thanks to the heavy weighting of all three portfolios towards Alibaba and Tencent, although all are underweight the 35% level these two companies are within the MSCI China index.

Ping An Insurance is the only other company to make all three top tens; other big China tech stocks feature, but none are held in all three top tens.

The smallest of the big five China banks appears in one top ten, and there is no Petrochina, China Mobile, or Baidu; these aren’t closet trackers.

Similar strategies

FCSS can hold up to 10% of its portfolio in unlisted companies, past successes include Alibaba and Meituan Dianping; it had 6% of its assets in unlisted as of March 2020, including a small position in ByteDance, the owner of TikTok.

According to FCSS’s manager, Dale Nicholls: ‘Tensions between China and the US will be with us for decades to come’; and ‘the impact of the virus is likely to accelerate several of the structural shifts already underway, such as the shift to e-commerce and various online services. A significant weighting in such holdings should see the Trust benefit from such trends.’

According to the managers of JCGI: ‘the portfolio continues to seek out higher-quality businesses in sectors where we see structural growth opportunities, namely in the Consumer, Health Care and IT sectors; we remain confident that secular growth trends here will not be derailed by the Covid-19 pandemic.’

Baillie Gifford follows a similar strategy so all three China investment trusts follow a quality/growth approach, even if the make-up of their portfolios is a little different.

Have we seen the best gains already?

Alibaba and Tencent have been a big factor in the recent growth of the Chinese market; Alibaba is up 200% since listing in 2014, while Tencent is up 1,650% over the last decade and an incredible 65,000% since 2004.

They are both worth several hundred billion dollars, and their future growth rates are likely to be lower; most of their revenues come from China so they are far less ‘global’ than the big US tech stocks, but as China is growing more quickly than the rest of the world, you could argue that their medium-term growth prospects are fairly similar.

Side by side

** These are the figures for the Baillie Gifford China fund rather than Witan Pacific.

JCGI has the longest China-specific history; Earnshaw and Snell have several years of experience at other Chinese and Asia Pacific funds but appear to be the youngest managers from this group.

Charges are similar, JCGI and FCSS have a 0.9% basic management fee; the latter also has a performance element meaning it can vary up or down by 0.2%.

Baillie Gifford China Growth will have a tiered management fee starting from 0.75% and 0.55% over £250m; if it grows in size, trades at a premium and can issue new shares, it could become the cheapest of the three.

Discount levels are similar although they have narrowed considerably in recent years.

The curse of the star manager, part 489

FCSS traded at a premium for its first year after launch, thanks to the appeal of star manager Anthony Bolton, following his success as manager of the UK-focused Fidelity Special Situations.

It was big news, raising £460m when it floated in 2010 and a further £166m the following year; however with the shares down 30% eighteen months after they listed, Bolton handed over the reins in April 2014.

Gearing and dividends

FCSS carries a much higher level of gearing; BGCG can gear up to 20%, so its figure is likely to rise.

JCGI is one of a few JPMorgan trusts that set a dividend at 4% of net asset value.

Dividends for BGCG may fall over time, given the fund manager’s preference for growth stocks; its open-ended fund only pays out 0.6%, but the trust has pledged to maintain a 7.15p dividend for the years ending Jan 2021 and Jan 2022 and has three years’ worth of revenue reserves.

Long-term returns

JCGI has the edge in 2020 and over the last 10 years, but its prior performance reinforces how difficult the China market was for a long time; those investing at launch in Oct 1993 were down 50% ten years later and still flat in Mar 2009, nearly sixteen years later.

However, all three trusts have managed to beat both the MSCI China and MSCI Golden Dragon (China, Hong Kong, and Taiwan) over the last 10 years, which is up around 160-170%.

They also compare favourably with 21 open-ended China funds, which range from +40% to +255% with an average of around +150%.

Summary

There aren’t a lot of China-focused investment trusts to choose from but all of them look pretty promising.

Baillie Gifford is betting big on China, across many of its existing funds and trusts, so it will be interesting to see how this new trust carves its niche; increased focus on unlisted investments may well provide that, although it could take a few years for it to build up to 20%.

I’d expect all three of these trusts to be quite volatile, as Chinese markets have been in the past; although I’ve moved away from regional and country-focused investment trusts in recent years, there seems to a decent case for making an exception when it comes to China.

Click to visit:

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.