Jan

2026

Can stock markets deliver a fourth year of gains?

DIY Investor

18 January 2026

Lower interest rates, higher government spending and strong earnings are powerful tailwinds for shares. But there are risks of overheating, whether in stock market exuberance around AI or resurgent inflation. Our diversified, active approach stands us in good stead, whatever 2026 brings – by Caspar Rock

Key takeaways |

|---|

|

A supportive backdrop for 2026. US consumer spending remains resilient, while fiscal and monetary policy are a tailwind in many major markets. |

|

Rising earnings underpin equities. Higher corporate profits drove the rally in US equities in 2025. We expect further earnings growth in 2026. |

|

Tech bubble? There are some signs of excess, but valuations for the biggest technology companies still look justifiable. |

|

Inflation is easing, but not gone. Companies may pass on more of the cost of tariffs to consumers, raising prices. |

|

Bond markets remain a risk to watch. High debt levels make developed economies more vulnerable. |

Investment professionals make forecasts about how the world might evolve, but also have to react to what actually happens. In today’s uncertain political and geopolitical environment, the first task has become more challenging, placing greater emphasis on our ability to adapt to changing circumstances. This proved invaluable in 2025: as the shock of Trump’s “Liberation Day” tariffs gave way to resurgent markets, those who clung to fixed views struggled, while the more open-minded thrived. We expect this flexibility to be just as valuable in 2026.

As things stand, markets and the global economy approach the new year with positive momentum. During 2025, corporate earnings bucked the usual trend of drifting lower over the course of the year. Forecasts were cut in March, amid concern over the impact of tariffs. But they were revised back up as companies reported rising profits in the second and third quarters, with technology a major, but not the sole, driver.

Earnings have been supported by corporate investment, especially in AI-related infrastructure, but also the continued strength of the US consumer. Employment has softened at the margin, in both the US and UK, but labour markets remain broadly healthy. Crucially, wages are still rising even after adjusting for inflation, underpinning demand.

Policy decisions should keep the momentum going. Governments are spending more, whether through the One Big Beautiful Bill Act in the US, Germany’s defence spending or UK welfare commitments. Just taking the US as an example, tax exemptions and deductions, and greater scope to offset federal and state taxes, are expected to save households around $350 billion (£263 billion) over the next four years. To put that into context, the Covid stimulus packages totaled a far larger $850 billion – but it was delivered when much of the economy was in freefall, which is not the case today.

Consumers and companies will also benefit from falling interest rates, though this will take time to feed through into the real economy and we don’t expect rates to fall much further from current levels. In the eurozone, they may already be as low as they get.

Expensive … but worth it?

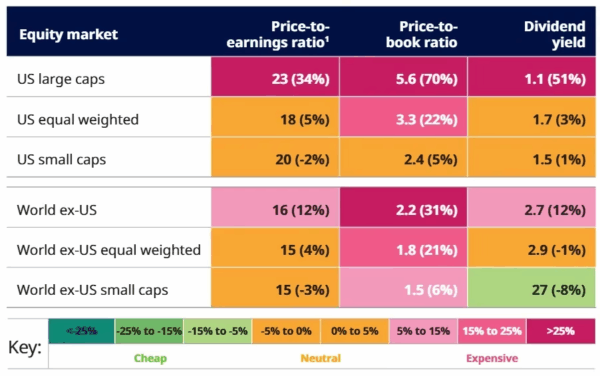

These positive developments have not been lost on markets, which performed very strongly in 2025. The MSCI All Countries World Index delivered a third consecutive year of gains close to 20%. As a result, valuations now look expensive compared to long-term averages across a range of metrics, as the table (below) shows.

This suggests that markets are pricing in favourable outcomes – on the economy, the impact of US tariffs and the impact of AI. But that doesn’t mean they can’t continue to rally if earnings continue to rise. This is exactly what happened in the US in 2025. Gains in the S&P500 index were driven by earnings growth rather than a rise in valuations. In some areas – small and mid-caps, healthcare – valuations remain relatively attractive and could still rise.

High valuations for the largest stocks make equities look more expensive

The latest valuation ratios – and how they compare to the long-term average (% above / below long-term median)

Source: LSEG Datastream, MSCI and Schroders. Data to 31 October 2025. 1) Based on consensus forecast earnings over the next 12 months. Assessment of cheap/expensive is relative to median since April 2012. This is the longest time period for which data is available on all six markets.

Of course, we aren’t oblivious to concerns of a bubble in parts of the market. Some of the best performing stocks of 2025 are loss-making or even pre-revenue technology firms, bringing back memories of the dotcom era. However, these companies still account for a relatively small part of the US market. The largest technology companies – such as Nvidia, Microsoft and Alphabet – are solidly profitable and still growing earnings quickly. The valuation of these companies is high, but perhaps not unreasonable given their exceptional performance. The reason for caution is not so much valuation in itself; it’s whether these companies will make a reasonable return on their huge bets on AI to justify their current share prices. We could well see volatility ahead as investors grapple with this question.

One key consideration is corporate adoption of AI: how soon, and how much, will companies pay for additional AI services? There is also the question of competition. Almost a year ago, markets were rattled by the launch of DeepSeek, a Chinese AI model. Today, Gemini 3, Google’s latest AI model, has sparked talk of a “code red” situation within OpenAI, creator of ChatGPT. As I wrote last February, the “winner-takes-all” pattern seen in social media, search and e-commerce may not be replicated in AI. This would have implications for the industry’s economics – and forecasts for individual companies. As ever, we will actively manage portfolios to ensure our exposure remains appropriate.

Bond markets are another key risk

Given that today’s technology champions now rival major economies in scale, their fortunes will have a big impact on the direction of markets. But this isn’t the only issue we are debating heading into 2026.

I mentioned before that government spending was supporting economic activity. This is not cost free. Government debt levels are already very high in many major markets – and set to rise further. We are also concerned about the inflationary impact of higher government spending, and lower interest rates. It’s a worrying combination for bond markets.

This is not of immediate concern in the US. Markets appear to be pricing in a “goldilocks” economy: not too hot to prevent rate cuts, not too cool to raise recession fears. Meanwhile, revenue from Trump’s tariffs have made the debt burden look more manageable.

Bond markets outside the US are slightly less relaxed. In Japan, yields have risen quickly as the central bank talks about raising rates. UK bond yields have also risen this year and are higher than in other developed markets. The recent Budget provided some breathing space, but investors continue to scrutinise the UK’s tax and spending plans. Other economies may not be far behind.

Staying agile in 2026

The question for 2026 isn’t whether risks exist – they clearly do. Solid economic growth, with support from government spending and lower interest rates, should keep earnings growing – and may allow stretched valuations to persist. But disappointment over AI or a bond market upset could bring the market’s run to a halt. We’re positioned for the former while prepared for the latter – and remain open-minded about what 2026 will bring.

![]()

This article is issued by Cazenove Capital which is part of the Schroders Group and a trading name of Schroder & Co. Limited, 1 London Wall Place, London EC2Y 5AU. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

Nothing in this document should be deemed to constitute the provision of financial, investment or other professional advice in any way. Past performance is not a guide to future performance. The value of an investment and the income from it may go down as well as up and investors may not get back the amount originally invested.

This document may include forward-looking statements that are based upon our current opinions, expectations and projections. We undertake no obligation to update or revise any forward-looking statements. Actual results could differ materially from those anticipated in the forward-looking statements.

All data contained within this document is sourced from Cazenove Capital unless otherwise stated.

Leave a Reply

You must be logged in to post a comment.