Jun

2023

Ça plane pour moi

DIY Investor

28 June 2023

Some of the world’s biggest companies are doing just fine in Europe, yet investors shun the region. Time for a rethink…by Alan Ray

The investment trust sector of 2023 is awash with many different types of so-called alternative assets that share the common characteristic of regular and predictable cashflows. As a result, investors have become as accustomed to talking about ‘discount rates’ as they have ‘discounts’ (to net asset value).

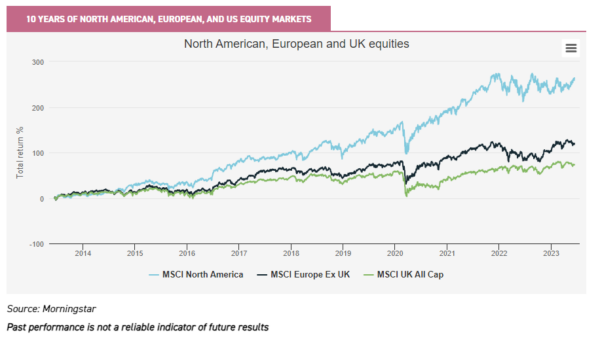

But discount rates matter when it comes to good old equities as well. Setting the stage to think about that for a moment, the chart below shows the last ten years of performance for US, European and UK equities, and serves as a reminder of the enduring power of the US equity market in particular.

As ever, when we see a chart like that, our interest is piqued more by the lines nearer the bottom than the top and asking why that might be.

The first reason in our view is that the US has long been exceptionally good at producing the types of companies that, given time and investment, can and do disrupt entire business models, or create entirely new ones. The US is just good at that kind of stuff, and its equity market often benefits as a result.

But this chart also coincides with an era of low interest rates. As a consequence, the stock market was able to place a higher value on future earnings, because low interest rates mean low discount rates for risk assets, and the lower the discount rate, the more value is placed on future earnings, which is what high-growth, or disruptive-growth, companies are all about. This can be an incredibly good thing for companies investing in the future, as they can get a higher value for their equity.

In the end, though, a very long run of benign conditions, where companies with impressive future growth plans as rewarded by the stock market, is bound to create the ‘rising tide floats all ships’ phenomenon.

This doesn’t for a moment mean we think that disruptive-growth businesses are no longer ‘a thing’. Far from it, we actually think if a stock market isn’t helping to fund such companies, it’s not really doing its job properly.

But perhaps the pendulum swung a little too far in the direction of over-confidence, and we all failed to see that low interest rates had played an important role in fuelling that confidence.

So if we are now entering an era where we can be a little less confident about earnings far into the future, perhaps we need to start placing a little more value on more predictable, steady earnings. European equities have been waiting in the wings for a little while for such conditions.

As a group, all of our European equities fund managers have pointed in recent months to the exceptionally low valuations that they see in their portfolios and wider European markets. To put some numbers on that, the MSCI Europe index is currently on 12x 12-month forward earnings, has a price-to-book value of 1.8x and yields 3.3%, compared to the MSCI US Index, which is on 18.6x 12-month forward earnings, a price-to-book of just over 4x and yields 1.6%.

In 2022, very large amounts of money flowed out of European equities, perhaps $100bn, in part seeking the safe haven of the US dollar and in part seeking the attractive returns now on offer from government and corporate bonds. These outflows were not a judgement on European companies specifically, but a flight to safe havens in the face of a war in Europe, with a consequent energy price spike.

But if all we were saying was that European equities look cheap, that wouldn’t be all that interesting, would it?

Europe makes ‘stuff’…

A strong and consistent message that comes from our European equity fund managers is that European companies are already well underway in reconfiguring their business models for a different kind of world, where globalisation and long and ‘just in time’ supply lines aren’t necessarily the default. The team of Tom O’Hara and John Bennett at Henderson European Focus Trust (HEFT) put it very succinctly “Europe is good at making stuff”. In a world where we worry about Taiwan’s relationship with China, it’s good to know that Europe has a semiconductor industry too.

The large-cap core European equity trust JPMorgan European Growth and Income (JEGI) recently took a holding in semiconductor company Infineon, which has exposure to the automotive industry, and in particular electric vehicles. Stablemate JPMorgan European Discovery (JEDT) has identified a smaller-cap European semiconductor play, Melexis, which is also a strong player in the automotive industry. These are just a couple of examples of a sector where Europe does well, but investors who haven’t thought about Europe for a while may have overlooked it.

It would be easy to think that this reconfiguration is mostly just talk at this stage, but a very recent conversation with pan-European property expert Marcus Phayre-Mudge from TR Property (TRY) confirms that many of his European industrial and logistics holdings are seeing very strong demand, which is being driven by this reconfiguration of supply lines. Staying with property for a moment, Schroder European Real Estate (SERE) is finding exciting opportunities to invest in the logistics and industrial sectors, making a recent acquisition in this space in the Netherlands at an attractive yield, SERE has a focus on the strongest economic centres of Europe, or ‘winning cities’ as the manager describes them. Both of these property trusts make for an interesting alternative way to play the theme of ‘making stuff’.

Logistics hubs are more than a steel box next to a major road though. Sam Cosh and Lucy Morris, managers of European Assets (EAT) share in the view that there are opportunities in this space and have made an investment into Kardex, which is a leading manufacturer of automated storage and retrieval systems, helping to automate logistics warehouses. Kardex is not competing with the incredibly complex Amazon-style warehouse solutions, instead providing a relatively standardised solution that is quite straightforward to install for less complex warehouses.

Globalisation may be in retreat, but many European companies are outward-looking…

European Opportunities’ (EOT) manager Alex Darwall has long advocated that many of Europe’s leading businesses are global in nature and not at all inward-looking. About 40% of revenues of EOT’s portfolio company revenues come from North America, about a third from Europe and a quarter from Emerging Markets.

One of EOT’s very long-term holdings is Novo Nordisk, the Danish-headquartered global pharmaceuticals business, which is most well-known for its diabetes treatments. Novo Nordisk’s products are sold in over 160 countries around the world. JEGI also owns this global business, together with LVMH, the global luxury brands company which recently became the first European company with a market cap of over $500m.

LVMH owns brands such as Louis Vuitton, Moet, and Hennessey, and again, demonstrates that many of Europe’s companies are not inward-looking and provide products that have a unique value to their customers. BlackRock Greater Europe (BRGE) also owns both of these leading companies.

Sustainability and the energy transition

Like the US, the EU has launched a very ambitious programme to increase its energy security through the use of renewable energy, and it is safe to say that while this is not a new topic for Europe, the Russian invasion of Ukraine has acted as a significant catalyst for rapid action, and although it will be a long time until Europe is not using fossil fuels, it’s very interesting how rapidly it has re-routed supplies and found alternatives, given a short-term motivation to do so.

The team at JEDT have moved to capture the momentum behind this theme by making an investment into Ariston Group in Italy, which manufactures domestic and industrial heat source pumps, which have become increasingly viable alternatives to traditional fossil fuel heating, with energy price spikes in 2022 helping to accelerate momentum.

HEFT’s Tom O’Hara and John Bennett have very strong and carefully thought out views on ESG, and see the energy transition as creating some significant opportunities. HEFT, like the rest of the peer group, is not positioned as an ESG strategy but we find it increasingly the case that fund managers like Tom and John nevertheless see many ESG factors as important for any investor.

One of their big themes is companies that are on a pathway to improvement. One of their investments, Holcim, is a good illustration of their thought process. Holcim is one of Europe’s leading cement companies.

Cement manufacturing is very carbon intensive, partly because of the chemistry of the cement-making process, and partly because of the energy used. As a result, Holcim and its sector may be overlooked by a rigid ESG strategy. The HEFT team see however that it has not only made significant progress in increasing its sources of renewable energy, but also in using recycled materials in some of its products and producing a new form of concrete that absorbs carbon over its lifetime.

The JEDT team have identified a similar opportunity in a different industry. Verallia is a French glass-making and recycling company. Like cement, glass-making is an energy-intensive business, and Verallia is undertaking a long-term programme to electrify its furnaces, moving away from gas.

This is, admittedly, a long-term process over several years, but it is on the right path and so scores well in ESG terms. Glass is, of course, a relatively straightforward material to recycle, which also helps with ESG factors. In these inflationary times, it’s also a strong positive that glass, like cement, is a heavy material and so local manufacturers tend to be at an advantage as transport costs are much lower. As a result, the company has managed to pass on costs.

Finally the team at BlackRock Greater Europe first initiated a position in 2017 in Sika AG, a Swiss-listed international leader in chemicals for the construction and automotive industries. Sika provides chemicals and systems that can improve the efficiency of building materials and key infrastructure, as well as adhesives aimed at environmentally-friendly vehicles. A key challenge of climate change is making existing and new buildings more efficient and making critical infrastructure more durable.

It’s not unlikely at the time of going to print that one or more of the stocks mentioned above will have been sold from a portfolio, but the main point of mentioning them is to show the diversity of opportunity in this very large market and to show how some big global themes play very well with leading European companies.

In conclusion

The big flows out of European equities in 2022 haven’t been reciprocated by inflows in 2023, and so valuations remain very attractive compared to US equities. One can carry on believing in the US’s exceptional ability to create disruptive industries, while at the same time acknowledging that ‘jam tomorrow’ might not have quite the same value today.

All of this would damn Europe with faint praise if it weren’t for the fact that Europe, which has some world-leading companies, is showing that it can transform itself in response to world events, and is leading the world in terms of its response to ESG matters. In the investment trust sector, we think we are lucky that we have a group of fund managers running very distinct strategies to pick from.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.