Nov

2023

Built to last

DIY Investor

28 November 2023

UK commercial property trusts have weathered a fierce storm, but our analysts think their fortunes may have already passed a nadir…by Alan Ray

In May, we looked at some of the uncertainties around property and property trusts and asked how uncertain some of those things really were. In summary, our argument was that some uncertainties, such as the difficulties that the office sector was facing, or the shift from traditional retail assets to hybrid logistics and retail were well-established trends and that most property trusts had anticipated these changes, and thus perhaps they were not really all that uncertain. We also concluded that discounts were, in fact, if not in scale, quite a rational response by the stock market to rising interest rates, and that property trusts would have to face higher debt costs, with implications for dividend cover. We also concluded that although discounts to net assets were very wide, dividend yields, and by extension the underlying property yields, when compared to interest rates, looked OK but didn’t jump out as being especially cheap. In other words, there’s more to a discount to net asset value than might at first meet the eye. Although May isn’t really all that long ago, there’s a good amount of data since then that might help us evolve that thought process. At the time of writing, a day or two after the UK reported very encouraging inflation figures, property trusts have seen quite significant share price rises in response, which if nothing else, serves to highlight that they are indeed rate sensitive and that share prices can respond positively in the right circumstances.

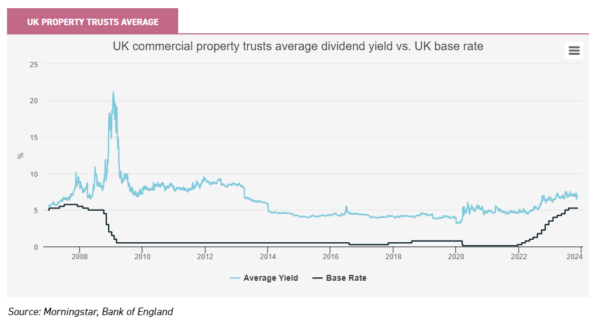

Before we get into some of the more recent data, the chart below is a version of the chart we used back in May. It shows average dividend yields for property trusts compared with UK base rates going back to the start of 2007, and thus neatly encapsulates the era of ‘free money’. Given the small sample size of trusts that go back this far, we would say it’s best to look at this chart as a way to see the direction things have moved, rather than focusing too closely on the absolute level. And the GFC provides us with some anomalies such as the very brief appearance of a 20% yield, which we think in all likelihood was so fleeting that very few investors actually dealt at that level. When we said in May that yields look “OK, but…” we were referring to the gap between interest rates and dividend yields. The gap between the two is the premium investors receive for taking the extra risk of owning property. As the chart shows, this gap has narrowed even though discounts have widened. What we went on to say was that the most likely way that gap would re-establish itself at a level that compensates investors for the extra risk was first, by rental growth feeding through to dividends, and second, for inflation, and then interest rates to fall.

The chart above hints at the relationship between property yields and interest rates, and this is a good reminder that there is downside risk. If one believes that interest rates will rise again, now probably isn’t the time to invest in property trusts. Even if one has a more positive view, it’s worth noting that in the years following the GFC, property dividend yields in the investment trust sector took a while to compress. This was a period when investors were still dusting themselves off, and the property trusts themselves were in a period of balance sheet repair. It took a while for confidence to return and for problems associated with too much debt to work their way through the system. In 2023, very few property trusts face the problem of having too much debt, but they will at some point have to refinance the debt that they currently have, and this is likely to be at a higher cost. In fact, many property trusts have begun this process in 2023, with a number of trusts refinancing or extending their debt terms.

What is clear from those so far is that while the cost of debt is higher, lenders still want to lend against property. The rising cost of debt was, from the start, quite predictable and thus one might say was one of the more certain factors in the stock market’s calculation of where discounts should end up. However, the availability of debt was less easy to predict, and plenty of investors who were around in the GFC will have bitter memories of when debt just wasn’t available. One might say this is one of the uncertainties that the stock market also factored into its discount calculation. As 2023 has progressed, this uncertainty seems to be fading away, and while property investors might not like the new cost of debt, it’s much less inconvenient than having to sell assets to repay debt.

So, while there is a strong contrast between the aftermath of the GFC and today, there are still issues to work through with the cost of debt, and we think investors should therefore prepare themselves for the fact that the journey back to full confidence might feature a few bumps along the road.

While the macro environment has not been helpful, one comment we’ve heard time and time again from property fund managers since the start of 2022 has been that they continue to see demand from tenants and that rents are still growing. One could perhaps be forgiven a year ago for wanting to see a few more data points, but here we are in Q4 2023 and property trusts continue to report the same thing.

That chart we opened with gives us a nice neat long-term perspective, but shorter term we have various trust-specific data and anecdote that doesn’t always line up perfectly on a chart. Instead of trying to shoe-horn different short-term data points into a single diagram, below we are picking out some key points relating to income from recent updates from property trusts under our coverage that serve to highlight that rental growth has continued into 2023. It should be said that all of these trusts have seen valuations weaken in 2023, with overall numbers for Q3 being quite weak, and that at a sector level industrials held up well or even firmed slightly, while retail and offices in particular have continued to fall.

Picton Property Income (PCTN)

Picton Property Income (PCTN) recently gave an update for the six months to 30/09/2023. The trust saw both its contracted rent and its estimated rental value (ERV) increase by 0.4% and 0.7% respectively in the six months to 30/09/2023. PCTN’s estimated rental value (ERV) is almost 23% higher than contracted rents and we think this is a good reminder of the opportunities that property management can present to an active manager (although it is worth noting that ERV is notional and may factors such as current tenants can prevent it being achieved).

As well as focusing on rental growth, PCTN is actively seeking a change of use for some of its assets, and as a result saw its office exposure fall from 31% to 26% as it has obtained planning permission to repurpose some assets to residential, which serves to highlight that active managers sometimes have more options than simply selling assets if they wish to change their sector exposure.

In its report, PCTN also showed some useful granular details of its benchmark, the MSCI All Property Index, which measures the performance of a very wide range of property funds and thus is a widely used proxy for the whole market. Overall, this index showed that ERV grew by 1.8%, with the strongest showing from industrial, plus 3.3%, offices 1.4%, and retail 0.5%. Industrials also showed a slightly positive capital growth of 1.2%, while office values fell by almost 8%. This helps to highlight that the correction in property is not really correlated to the underlying rental growth.

PCTN’s debt is 93% fixed until at least 2031, so it has very little exposure to rising debt costs, and its dividend cover is currently 105%. PCTN trades at a c.31% discount and yields c.5.1%.

Balanced Commercial Property (BCPT)

Like PCTN, Balanced Commercial Property (BCPT) has attractive reversionary potential, with an ERV 18% higher than current rentals, which the manager has the opportunity to gradually unlock as leases come up for renegotiation. BCPT’s industrial portfolio in particular has a strong reversionary potential of up to 40% and is on fairly short average lengths averaging 3.7 years.

At the interim stage on 30/06/2023, BCPT reported it had grown portfolio rent overall by 4.1% and it has recently increased its monthly dividend, having reported a dividend cover of c.118% in its interim results.

In BCPT’s trading update for the three months to the end of 30/09/2023, BCPT highlighted that its portfolio vacancy rate had fallen to 6.7% as the result of various lease initiatives, and pointed out that 4.4 percentage points of that was due to a lease that had been surrendered to allow the manager to reposition the building, again illustrating that active management is at play.

BCPT also recently extended the term of part of its fixed debt to the end of 2024, giving it greater certainty over interest costs. BCPT trades at a c.42% discount and yields c.7.0%.

Schroder Real Estate (SREI)

Schroder Real Estate (SREI) has just reported its half year results to 30/09/2023 in which it is noted that the portfolio has a reversionary yield of 8.1% compared to the MSCI benchmark’s 5.9%, and is a c.30% premium to current rents. SREI’s dividends at the half year stage are 102% covered and the trust has achieved 56 lettings, lease renewals, and rent reviews during the period achieving an average premium of 7% to the opening ERV. SREI also disposed of an office asset at a price in line with the valuation on 31/03/2023.

SREI’s gearing is c.37% LTV and it has no debt refinancing event until 2027, with an average debt maturity of over ten years at an average interest cost of 3.4%, so again isn’t exposed to any short-term rise in debt costs.

SREI trades at a c.34% discount and yields c.7.5%.

UK Commercial Property REIT (UKCM)

UK Commercial Property REIT (UKCM) is one of the most conservatively geared property trusts, with an LTV of c.17%, and while it does have a short-term credit facility that matures in 2024, this is largely unutilised, and the main debt maturities for UKCM are in 2027 and 2031, and so once again there is little exposure in the short term to rising debt costs. In the year to 30/06/2023, UKCM’s total rents grew by 19% and its ERV by 9%. In a recent trading update to 30/09/2023, UKCM had relatively low lease renewable activity, but reported three lease renewals at 24% above passing rent. Once again highlighting that active management can play a role, UKCM has invested in a hotel development project in Leeds which is expected to deliver a yield of 7.25% on cost once operational. UKCM also reported that its occupancy rate had risen from 96% to 97%, which is relatively high compared to the peer group and the MSCI property index. UKCM’s dividend in the first nine months of 2023 was 97% covered, and it trades at a c.21% discount and yields c.7.0%.

Readers may also be interested in a presentation hosted by Kepler on 15 November where Will Fulton and Dan Walsgrove, managers of UKCM and BCPT respectively, presented their current views and had a friendly debate about various aspects of the property market. Both reiterated our over-arching point, that rents are growing and they aren’t seeing any worrying trends for vacancy rates. The video and slides for the presentation can be found here.

Conclusion

Overall then, accepting that there are limitations from shorter-term data, different trusts express things in slightly different ways and there are timing differences between reporting, we think it’s fair to say that 2023 has generally seen rental growth, positive active management in response to a changing world and no worrying trends in vacancy rates. We think it’s unlikely that the chart we opened with, showing dividend yields against interest rates, will be anything other than a hindsight indicator that property trusts have reached their nadir and we think the fact that 2023 has seen very encouraging rental growth should be of interest to long-term investors.

Disclaimer

Disclosure – Non-substantive Research

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. With this commentary, Kepler Partners LLP does not intend to influence your investment firm’s behaviour.

Alternative investments Commentary » Brokers Commentary » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.