Aug

2019

Cryptocurrency: Bitcoin & Ethereum – Blockchain Technologies To Adapt To A Better World

DIY Investor

8 August 2019

When we look back 10-20 years from now, we’ll realize the true magnitude of inventions the likes of Bitcoin or Ethereum as the manifestation of opportunities the visionaries transformed into a legacy to constantly adapt in a world that marches unstoppably towards its digitalization writes David Munday of Global Prime

When we look back 10-20 years from now, we’ll realize the true magnitude of inventions the likes of Bitcoin or Ethereum as the manifestation of opportunities the visionaries transformed into a legacy to constantly adapt in a world that marches unstoppably towards its digitalization writes David Munday of Global Prime

A Compatible Coexistence

Talking about Bitcoin vs Ethereum is referring to two of the most widely adopted blockchain-based technologies in the crypto space.

Both projects have successfully proliferated and inspired millions by introducing distinctive characteristics in perfect symphony with the digital era we live in.

Each one, as the article will explore, still proposes a use case that make them fully compatible in its own right as the purposes it serves for the end user are poles apart.

The Undisputable King Of Cryptos

Bitcoin (BTC) was designed as a medium of value exchange on a peer-to-peer (P2P) basis. To understand the inner works of the Bitcoin network, one could draw some parallels by thinking of it as a “digital notary”, achieved through a theoretically tamper-proof, verifiable public ledger system where transactions are executed and recorded in a string of blocks.

In the Bitcoin system, the ledger contains all the transactions that have ever existed and it is in constant auto-update mode as new blocks are created on what’s called the mining process.

Miners, through the use of computing power aimed at resolving complex mathematical formulas based on Hashcash PoW (Proof Of Work), keep the network alive by creating new blocks in exchange for an incentive in the form of Bitcoins (currently at 12.5 BTC but halving every 210,000 blocks formed).

In simple terms, PoW is a piece of data that is sufficiently costly and difficult to be produced and validated yet easily verifiable. Proof of work serves the purpose of preventing malicious use of the network such as spamming or denial of service attacks.

The mysterious person or group behind the Bitcoin project is called Satoshi Nakamoto, whose whitepaper was first introduced to the world back in October of 2008.

Audaciously, Satoshi published the revolutionary Bitcoin project idea right at the heart of the global financial crisis (GFC) as confidence towards the establishment was on shaky grounds. The project carried as the title for Bitcoin’s body philosophy “A Peer-to-Peer Electronic Cash System.”

As the article delves into the evolution of Bitcoin from its inception, it’s important that the reader is reminded of the grass-roots Bitcoin originates from, as over the years, the debate on Bitcoin’s purpose has shifted.

In light of the explosion in interest towards Bitcoin that led to huge transaction fees back in 2017, discourse ensued to perceive the crypto asset, not as a means to exchange cash digitally, but to see its real use as a store of value, a precious asset akin to digital gold, partly due to its limited supply (cap set to ever be in existence won’t exceed 21 million).

The Virtual Machine Of The Crypto Space

In the realm of cryptos, another blockchain-based project that has gained enough momentum to compete in reputation rather than functionalities with Bitcoin is the Ethereum network, invented by Vitaly Dmitriyevich “Vitalik” Buterin, a Russian-Canadian programmer prodigy. Over the years, Vitalik has emerged as a mouthpiece of the crypto community due to his innovative approach of the Ethereum network back in late 2013 when the whitepaper was published, even if it wasn’t until July 30th, 2015, that Ethereum would be officially launched.

Ethereum is described as a “blockchain-based decentralized mining network and software development platform rolled into one”, which unlike Bitcoin, aims to facilitate a whole ecosystem for open-ended decentralized application development and smart contracts that are built and run in a seamless manner, removing the risk of interference from a third party.

The Ethereum network runs on its own in-house cryptocurrency called Ether (ETH). Any application developer or user must own ETH to be granted permission to execute actions in the network or even monetize work done.

As an analogy, unlike Bitcoin, which is purely built upon the premise of becoming the most trusted value-based digital currency, Ether is the gas a vehicle needs to keep moving along the ‘Ethereum’ roads. The higher the computational resources behind transactions and operations in the network, the more gas needed. Note, the gas price is fixed, what changes is the price of Ether. No gas (ether), no honey.

Since I bring up honey, let’s touch on that sweet and gratifying taste as that’s what drives miners into the network. However, Ethereum mining, unlike Bitcoin’s Hashcash PoW, is currently on a transition from a PoW consensus algorithm to a Proof of Stake (PoS).

The main distinction is that to take ownership of a new minted block and participate on the reward, a miner will increase its chances proportionally to how large of a stake in Ether it holds.

A key component that has emerged as an advantage when using Ethereum over Bitcoin’s network resides on the promptness to validate and mint new blocks. Bitcoin’s average block time is around the 10m mark even if for a transaction to be confirmed, while Ethereum’s block time has proven overtime to be less constraining, averaging between 10 and 19 seconds.

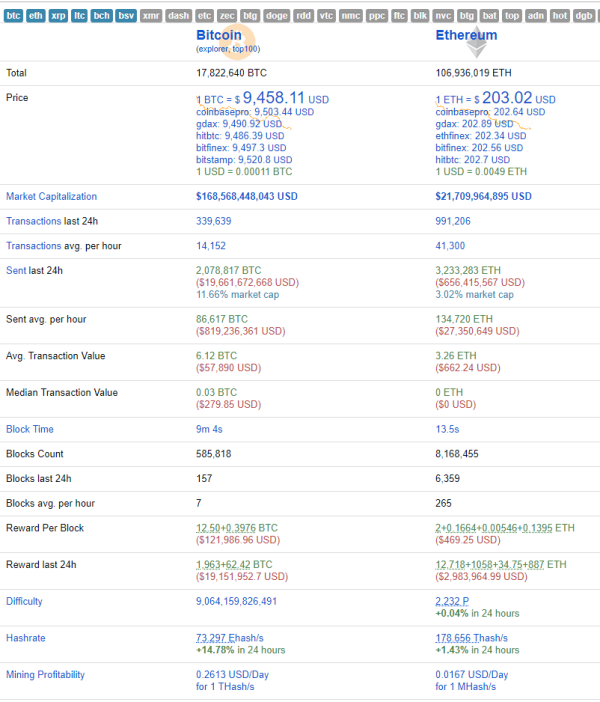

One can check all types of stats via BitInfoCharts. A snapshot can also be found below:

As part of the payout process, it also differs from Bitcoin in that miners, also known as block validators, rather than receiving a block reward, the reward comes in the form of network fees called gas (unit on the Ethereum network).

That’s why miners have the ability to adjust the ether to the gas exchange rate as they see fit since gas to broadcast the execution of operations remains constant while Ether value does not due to speculative reasons.

Ethereum’s grand vision has been dubbed Bitcoin 2.0, as it creates a hybrid version of Bitcoin’s existent blockchain-based technology by taking it one step further and make it more appealing for real day-to-day use cases as it facilitates the platform for distributed application developments via its innovative smart contract technology integrated as part of the network.

Need For Further Inroads Mounts

The awareness of blockchain-based technologies has gone ballistics over the years, with Bitcoin and Ethereum as the posterchild of the crypto boom. But it wasn’t until the Nov-Dec 2017 exuberant retail-driven bull run in crypto assets, which reached valuations completely out of whack with the stage the technology was at, that it truly exposed the limitations of both Bitcoin and Ethereum as vehicles prime-ready to accommodate a rising wave of users.

Bitcoin’s transaction processing average time was an absolute nightmare to efficiently use the network back in the days when the asset was in sizzling demand.

This led to insurmountable congestion in the network to perform efficiently, so miners had to prioritize incoming transfers that paid the highest fees.

In the latest Bitcoin boom of late 2017, the cost of broadcasting a transaction into the network reached an average of over $150, an outrageous amount that started to shift the debate from Bitcoin seen as digital cash to a store of value.

Let’s not forget, Bitcoin was originally created to process only a handful of transactions per second.

In the case of Ethereum, an analogous problem emerged, with peak transaction volume back in 2018 (over 15 tx/sec) far too little for the demand that was hitting the network.

What that meant at the time was that in its current design, Ethereum’s scalability was severely undermining the potential of the project to thrive and accommodate worldwide adoption.

The Trade-Off To Greater Usability

To put things into perspective, Facebook’s technology can process over 170,000 requests per second or 45,000 processed by Visa. To understand why the Bitcoin or Ethereum networks are so limiting in its transactional volume capacity, one needs to remember that the philosophy has always been to achieve the highest degree of verifiability, privacy, security, and decentralization.

All the machinery integrated into the inner works of the networks, from users broadcasting, executing, then nodes validating, recording and other technical tricks and incentives create roadblocks.

The more developers raise the size of each block to fit more transactions, the more risk exists that all the principles by which the Bitcoin or Ethereum networks were built upon will no longer serve the purpose it originally was created for.

For instance, if ‘nodes’ have to store all the transaction history and state of accounts, the pitfall is that only a few of these nodes may amass enough power to control and run this validation process, hence why this has been a thorny issue among academics and developers.

Bitcoin’s Scalability Via The Lighting Network

Fortunately, blockchain developers have managed to come up with innovative solutions that makes what in theory was an incompatible impasse between decentralization and scalability a viable one with the introduction of proposals such as the implementation of an upgrade called Segregated Witness (SegWit) in the case of Bitcoin back in July 2017, allowing a higher number of transactions per block without the need to increase the actual block size.

Segwit, however, was just a bridging solution until the next phase in Bitcoin’s scalability, via a process called the Lightning Network spearheaded by the blockchain development teams at Lightning Labs, ACINQ, or Blockstream to name a few, can be adopted by a wider user base.

With the Lightning Network, Bitcoin transactions between two parties take place off-chain, without the need to be confirmed by the entire network by creating public payment channels atop the bitcoin blockchain, in what’s been referred to as a second layer payment protocol.

Since the inception, the number of lightning payment channels, as well as lightning nodes, have steadily increased and we currently stand at more than 9,000 nodes (about half active) and 32,000 channels.

In terms of liquidity, LN has a capacity of just under 1,000 BTC with a maximum channel capacity of 0.168 BTC that can be lifted on a client-by-client basis.

This puts the average capacity per channel at circa 0.025 BTC, while the average node capacity sits over 0.21 BTC. What this means is that the network is barely capturing 0.005% of BTC in circulation.

However, let’s face it, for the lighting network to see the light in the form of day-to-day widespread adoption, in a world where ease of use is paramount, the amount of complexity for the less initiated still makes it a rather baffling experience.

So far, it serves the purpose of acting as a micropayment solution for the geek types out there willing to operate nodes and funding channels in what’s perceived as a bootstrapping job out of love for ideological reasons, but depending on one’s goodwill alone may come with an expiry date.

Therefore, a major challenge to overcome is to keep attracting Lighting nodes outside the group of enthusiasts, since the current low-fee environment makes one’s involvement an endeavor short on incentives.

The hope is that the Lighting Network, through the rise in awareness and popularity of Bitcoin core, increases the participation in the LN to a level where nodes find it justifiable to get involved as a profitable business where fees collected exceed the costs incurred.

Besides, critics of the Lightning Network argue that a few large nodes may dominate the payment hubs (the creeping centralization issue), which judging by the entrance of the unknown entity LNBIG.com nodes, which alone it controls a significant portion of the liquidity available, it ‘validates’ reluctance to support the project by some sectors of the BTC community.

If the project proves ultimately futile based on the vision the first pioneers had, it will only strengthen the case to take hold of Bitcoin as an asset where its main purpose orbits around the store of value vs digital cash.

Behind developing an engaged community that improves the lighting, by and large, boils down to change how payments are conducted in the future.

That’s why onboarding the largest number of merchants to accept bitcoins through the Lightning Network is yet another massive test to continually assess, even if the reality is that Bitcoins are still only accepted by a very small group of online merchants due to impracticality or regulation.

Regardless, it’s hard to imagine the total decay of the lighting network, and even if it does not succeed, projects ‘dead in the water’ tend to mutate into other living forms by inspiring a future tsunami of innovations to improve the layer-2 solutions built on Bitcoin.

The 1ML provides a handy tool to check LN stats in real-time via their website. Besides, find below a visualizer of all of the nodes and channels currently running under the LN software:

Source: https://explorer.acinq.co/

Ethereum Aims To Grow With ‘Serenity’

In the case of Ethereum, there is also hope that proposed solutions will manage to circumvent the hurdles of its limited scalability capacity. Ethereum is working on three pillars (Sharding, Plasma, Casper) as part of its grand vision to improve scalability under the ‘Serenity’ upgrade.

This whole transition into an improved version of the network has been dubbed Ethereum 2.0, with the Phase ‘zero’ set for launching on Jan, 3th, 2020.

The first technique is called ‘database sharding’, and is based on the partition of a database into pieces which get subsequently distributed to different servers, with the aim to bypass ‘full’ nodes validation to instead only store a subset of this data derived off limited transactions.

This model is built, therefore, upon synergies and reliance among nodes to crosscheck transactions or blocks that it doesn’t store with other nodes. The downside is that the process isn’t fully trustless, which is why other complementing solutions are on the works in parallel.

Plasma is another technique predicated on the idea that in order to reduce the processing requirements, the main Ethereum blockchain is only required to store a partial subset of verified data from ‘child’ blockchains.

Lastly, Casper constitutes the missing piece to primarily mitigate the problem of over-centralization of the most powerful miners. Did you know Ethereum’s four largest miners account for an eye-popping 70% of the Ethereum hash rate?

Casper will be achieved via a hard fork of Ethereum to improve the network on three fronts, including a risk reduction in centralization, enhanced scalability, and more energy-inefficient when mining.

But time is of the essence Ethereum co-founder Vitalik Buterin may have thought. Since the launch of phase ‘zero’ of Ethereum 2.0 won’t be production-ready until early 2020, the quirky leader of Ethereum caused quite a stir in the community on July 13th, by proposing to temporarily utilize the Bitcoin Cash blockchain to tap into its scalability capacity.

Vitalik, some believe, is starting to get into murky waters by suggesting the deployment of other blockchains as short-term options to Ethereum scalability.

While Bitcoin Cash would allow increasing Ethereum’s data throughput by over 6 times from 8 kilobytes (KB) to around 53 KB, as well as lower fees and a friendly community in Vitalik’s view, the proposal has been received with loud criticism, seen as a portrayal of Ethereum’s inability to scale through its own means.

Tuur Demeester, Founding Partner at Adamant Capital, tweeted: “Vitalik proposes to store Ethereum blockchain data on Bitcoin Cash. Terrible idea imo: nobody uses BCash and it has the same mining algo as Bitcoin, making it extremely vulnerable to 51% attacks.”

Source: https://twitter.com/TuurDemeester/status/1150741539384987648

Credible Alternatives To Bitcoin & Ethereum

It is no wonder why, over the years, with both Bitcoin and Ethereum projects having its fair share of controversy due to its limitations and hence detractors, other alternatives have emerged.

In the case of Bitcoin, the one cryptocurrency that has garnered the most market value and popularity is Bitcoin Cash (BCH), which has proliferated among those married to the philosophy of using Bitcoin as a medium of exchange for easy and fast payments.

BCH was born out of a hard fork (network split) from the Bitcoin core network on August 1st, 2017, after a group of members of the Bitcoin community decided it was time to address BTC scalability by increasing bitcoin’s block size.

The list, however, goes on. Other peer-to-peer digital currencies the likes of Litecion (LTC) have also gained a lot of attention, usually referred to as the Silver of cryptos whereas Bitcoin is the Gold.

LTC’s main purpose is to also facilitate instant and low-cost payments. Other cryptocurrencies catered for a more specific use case with special features on security, privacy, or traceability are too available as a substitute of Bitcoin to make payments all over the world.

When it comes to the replacements to Ethereum, the most popular projects out there also classified as a platform with the ability to enable the creation of decentralized apps include Ethereum Classic (ETC), which again, is the result of a hard fork which split the network in two.

Another platform that has made headway by leaps and bounds since its inception is the NEO blockchain, commonly referred to as the “Chinese Ethereum.” EOS is also hugely popular as is TRON. One can visit all the crypto projects by category in the website coincheckup.

Market Valuation A function Of Fundamentals & Buzz

The recent confusion originated since the proposal by Vitalik to temporarily move Ethereum’s data storage into the BCH network led to the collapse in ETH valuation by more than 40% from a peak of $360 back in late June ‘19 to around $200 a month after as confidence erodes.

But ETH is not an isolated episode. The valuation in Bitcoin, which experienced an explosion since early April ‘19 from the 4k mark, up to a peak of 14k on June 26th ‘19, has also seen its market capitalization plummet by more than 30% during July 2019.

The rise in Bitcoin, the indisputable king tantamount to the USD in fiat terms due to its world reserve currency status, was, by and large, fueled by sheer fuss due to the magnitude of the announcement by Facebook’s cryptocurrency Libra.

The buzz it created was predicated on the tremendous positive repercussions it may have for the awareness and adoption of digital assets in the future.

However, since Facebook’s Libra whitepaper was published, the scrutiny and pushback from government officials, central bankers, regulators and the likes has led to the anticipation that before Libra sees the light at the end of the tunnel, due to the immensity of FB reach, it will have to face many restrictions from regulators that may delay the launch significantly.

So, when trying to figure out which asset is more attractive to invest in, there are a couple of ways I’d personally endorse to go about. The first one is to monitor the exchange rate ETH/BTC chart via a popular platform like tradingview. You should then decide on a specific strategy that will act as your mechanism to determine the share of your allocation into ETH or BTC.

Source: www.Tradingview.com

In the chart above, as I’ve written at length about, a simple yet very effective system to use could be to deploy the 55 & 80 Hull MA applied to price action. If price breaks and closes above the latter, one goes long ETH, while a return below the 55-HMA triggers to be long BTC vs ETH. This setup allows for an objective, highly adaptive, and lag-limited approach.

Another alternative method to experiment and backtest with, which I’ve also written about, consists of selecting a single baseline as the cornerstone to trigger the right entry signals to ride a trend.

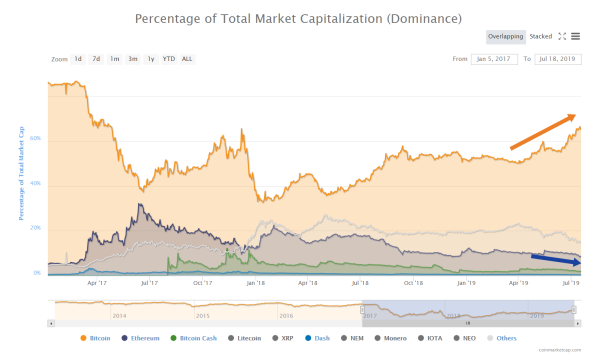

Bitcoin dominance has also become a must-follow metric in order to have a quick overview of the total share in market capitalization the king of cryptos has gathered in any point in time.

The chart is useful as a measure to understand how Bitcoin fares vs its most direct peers. The comparison against Ethereum is a fabulous and personal favorite of many crypto traders to also gauge the different crypto market cycles since Ethereum’s valuation is perceived as barometer or proxy of the overall attractiveness to gain exposure in the Altcoins complex.

As the chart below shows, BTC dominance has recently broken into a fresh 2-year high, which implies, as depicted by the ETH/BTC chart, that we are currently in a BTC-led market cycle, hence you want your investment to be overweight in Bitcoin vs Ethereum.

Source: https://coinmarketcap.com/charts/

Crypto Assets To Act As Portfolio Volatility Reducers

Let’s now touch briefly on a critical point that over time, once the standards in security, custodianship, and regulation are addressed, is likely to see a paradigm shift in how big institutions, hedge funds, money managers, family offices, go around diversifying their portfolios.

One of the subtleties of trading cryptos, either is to invest in Bitcoin or Ethereum, is the uncorrelated nature of this asset class against traditional financial instruments such as equities, commodities, currencies, real estate, etc.

This is incredibly unique, as the fact that an asset class has the ability to detach itself from well-known correlation dynamics (risk appetite or risk-averse mode) creates a huge opportunity for the ‘big boys’ with hundreds of billions under management to potentially reduce a portfolio’s volatility by gaining exposure to cryptos as a vehicle independent of the business cycle.

Therefore, allocations into Bitcoin, Ether, and other Altcoins, will in the not so distant future constitute an essential alternative for every portfolio manager out there.

Teeka Tiwari, Head of Research at Palm Beach Group, notes: “Institutions want to be in this market. They don’t have the ability to be in this market yet, because the roads haven’t been built.

But the roads are being built. By the end of this year, you will have the on-ramps and the off-ramps and the custody solutions that institutions need to get into this asset. And the prices that we will see as this money comes into the market will be unfathomable.”

It is happening before our very own eyes. The crypto revolution is well and alive, and the building of the roads the above-cited author refers to are currently being built, with billions of dollars committed into the space.

And while Bitcoin and Ethereum have obviously made it into the stardom of the most popular exchanges such as Binance, Bittrex, Coinbase, facilitating a much larger adoption entails providing the right infrastructure to guarantee the funds are properly secured under state of the art custody solutions to the most sophisticated investors.

Similarly, a tsunami of average Joes and less initiated retail types out there, are waiting on the sidelines, until the trading experience improves, in other words, trade Bitcoin, Ethereum and other cryptos at the click of a button with direct access and funds fully protected.

The vast majority of people with an interest in owning cryptos, don’t want to be bothered with the time-consuming and arduous task of understanding all the nuances when it comes to storing cryptos, registering a digital wallet, risk of hacks, etc.

That’s why the biggest names in the space the likes of Fidelity, Gemini, E-Trade, Coinbase, Bakkt, are on the final stages before launching products that will make trading Bitcoin, Ethereum and Alts a seamless and more secure process.

This experience of trading cryptos will only become easier, and here is where Bitcoin has a distinct advantage as the cryptocurrency of reference, once regulators give the green light by approving the first Bitcoin ETF (Exchange Traded Fund).

When this occurs, which judging by officials, could occur anytime once regulatory hurdles are addressed, it is widely accepted that it would lead to a windfall of capital coming into Bitcoin first as the involvement in trading the asset will skyrocket at the expense of Ethereum at first, even if the latter tends to catch up later.

The bullish connotations for BTC can be found on the benefits of an ETF as an investment vehicle designed to track the performance of the asset without the need to actually own it, which makes for a great alternative to diversify holdings.

Besides, an ETF includes the option to go long or short, which is something that is not permitted in traditional exchanges. So far, all petitions to launch a bitcoin ETF have been denied by the SEC as reluctance remains on the potential manipulation and fraud of prices via unregulated exchanges

Bitcoin & Ethereum Represent Progress To Adapt In A Changing World

Over the short span that the Ethereum project has existed, it is fair to state that the market has embraced the assumption that the technology, which is designed for different purposes, can coexist and is compatible with Bitcoin.

It’s not about leaning against the Bitcoin or Ethereum fence, that would be unfounded as both projects don’t compete for the same objective or for superiority in the same field, therefore rivalry per se falls devoid of logic.

Bitcoin is intended as a medium of exchange to purchase goods and services, act as an alternative to fiat via its ‘digital characteristic’, with a clear permutation into a store value of value too. There is a reason why Bitcoin has been asserted by the CFTC as a “commodity”.

On the flip side, Ethereum is intended with the vision of creating a virtual platform that transcends digital cash or the storage of value, by offering a full range of functionalities derived off a cloud-based decentralized computer, in which strings of code bring into existence “smart contracts” or “decentralized applications” with the Ethereum network as the ecosystem where these arrangements and/or interactions ensue.

Each project, on its own right, has made major inroads by creating a blockchain-based technology that caters the needs of a large range of profiles.

As a developer with the idea to build Dapps or as a businessman to tap into self-executing, self-enforcing contracts, you may consider Ethereum as your go-to venue, especially as scalability sees the light. Meanwhile, as a proponent of a cashless society, or as a speculator, Bitcoin could be an attractive proposition to diversify your holdings, as a store of value and hopefully over time, as a realistic prospect to gradually replace cash.

Just as it would have been unthinkable for the majority to see the awareness and valuation of Bitcoin 10y from its inception, the amount of constant innovation in the space makes a theoretically impossible vision (cashless society, digital gold) a prospect waves of innovators will continue to fight for, driven by the desire to continually permutate into new uncharted territory that can make life a more egalitarian and democratic affair.

“It is not the most intellectual of the species that survives; it is not the strongest that survives, but the species that survives is the one that is able to adapt to and to adjust best to the changing environment in which it finds itself,” said Charles Darwin in his “Origin of Species.”

When we look back 10-20 years from now, we’ll realize the true magnitude of inventions the likes of Bitcoin or Ethereum as the manifestation of opportunities the visionaries transformed into a legacy to constantly adapt in a world that marches unstoppably towards its digitalization.

Leave a Reply

You must be logged in to post a comment.