Nov

2020

Big Tech: A Trader’s Take on What Biden Means for Market Giants

DIY Investor

22 November 2020

After months of the most raucous election cycle in U.S. history, the victory of President-Elect Joe Biden poises a new market regime of opportunity, and risk, for investors – writes Will Rhind.

After months of the most raucous election cycle in U.S. history, the victory of President-Elect Joe Biden poises a new market regime of opportunity, and risk, for investors – writes Will Rhind.

The future Biden Administration’s economic policies are mixed bag, but on net are broadly supportive of asset prices. While higher taxation at the corporate level, and on capital gains, weighs on U.S. stocks, ample government stimulus spending can be expected to more than offset this burden.

Indeed, it is this certainty of government largess that will likely soothe stocks irrespective of developments on the COVID front.

Despite this overall rosy outlook, the prognosis for U.S. tech stocks is far more complicated and will emerge as an area of focus for traders.

The Democratic Party and the Biden campaign in particular have been critical of the growing concentration of economic power in the mega cap technology names.

The threat of regulatory action is now an unavoidable reality for not only the Trillionaires Club of stocks— Microsoft, Apple, Amazon and Google—but also for other platform companies such as Facebook and Twitter; even Snapchat could become ensnared.

Three distinct problems arise for tech companies: first their raw size, second their potential anticompetitive behavior, and third their responsibilities as communications platforms.

In addressing these challenges, the Biden administration may respond from industry regulation up to anti-trust enforcement actions. Let’s address each of these contentions in turn.

Matters of Size

Foremost, the absolute size of these companies, and their proportion of the overall stock market, is impossible to deny. For many in government there is no question regarding the unequal accumulation of wealth—it is simply an article of faith that corporate size matters and it causes object harm to society; no PowerPoint deck or DCF model would dissuade them of this assumption.

This issue is particularly dangerous for the tech giants, as really there is no remediation short of breaking up companies. Furthermore, the potential for a Warren or Sander cabinet position underscores this reality.

Severability becomes a trader’s paradise as each company is its own test case without much in the way of modern precedent. For instance, Amazon presents the best case for a velvet divorce: its retailing and cloud services business could be separated fairly seamlessly.

A Biden administration backed by a Democrat Senate could conceivably force Google and Facebook to spinoff their YouTube and Instagram acquisitions. This outcome would be loathsome for shareholders, especially after years of painstaking user monetization, and yet the risk cannot be denied.

Apple and Microsoft, however, do not present any clear breakup opportunities. Perhaps Apple could concentrate on smartphones by divesting its hardware business, but it is hard to see how such an arrangement would be feasible on any but a theoretical basis.

As for Microsoft, perhaps it could sell its overseas business, being given the same treatment as American Tobacco. While corporate breakups are never easy, it’s a risk companies smaller than Facebooks are unlikely to face.

Not Anti-Competitive, Just Hyper Competitive…

As if size concerns were not enough, the tech mega caps should treat anti-trust action as a base case scenario during the Biden Administration. At the heart of the matter is how government responds to the natural monopolies created by the platform effect, where each additional user creates exponential value for all other users.

Furthermore, it is not clear that simply creating more platforms by administrative fiat resolves this core dilemma: at what point do these online platforms become so powerful that competition becomes nigh impossible?

What makes the example of Tik Tok so remarkable is it demonstrates how seldom a true competitor can emerge to one of the established digital platforms.

Even under the Trump Presidency, the Department of Justice pursued anti-trust action against Apple and Google for intra-industry collusion—the appetite to reign in tech giants is not strictly a Democratic impulse.

Nonetheless it is extremely difficult to make the case that platform monopoly has materially harmed consumers; the tech giants have heralded unprecedented innovation over the past decade, giving rise to the “tech deflation” phenomenon.

To make this case abundantly clear, imagine living through the pandemic without any of the goods or services of our monopolistic benefactors.

It is almost a certainty that new regulation will flow from the Biden White House to remind the tech platforms of their responsibilities under shareholder capitalism.

In fact, we will likely see the creation of a digital Dodd-Frank regulation regime. If regulation is inevitable, the tech firms will likely emerge as willing participants to not only stave off the worst excesses, but also to create barriers to entry for would-be competitors.

This is the supreme irony of regulation—it often enshrines the very monopolies it was seeking to rein in by creating regulatory capture, whereby only existing players can navigate the onerous regulations.

The Minefield of Speech

In addition to these first two challenges, the most politically explosive dilemma for big tech will be how it enforces community speech standards, especially political speech.

Even before the 2020 election cycle began, it was clear the next administration would likely need to revisit Section 230 of the Communications Decency Act (CDA), a key provision protecting free speech on the internet.

In essence, the law maintains that internet platforms should not be held responsible for the content they provide access to—it is a legal equivalent of a don’t shoot the messenger standard.

However, since this law was passed 24 years ago, internet companies have transformed from newfound curiosities to economic hegemons, the likes of which hardly deserve extraordinary legal protections.

Furthermore, Facebook, Google and Twitter have long since progressed from simple service pipelines to active content moderators with profound consequences for free speech; even the most laissez faire acknowledge some public utility characteristics.

The recent entanglement between the New York Post and Twitter serves as a detonating moment in censorship/speech enforcement divide; almost any path forward is inherently political.

Faced with hostility from both the left and right over shadow-banning and alleged political inconsistency, the “section 230 risk” in all likelihood has escalated beyond what private companies can manage.

In fact, if the tech platforms could off-load this responsibility to the government in a way that does not impair their monetization strategies, it is a bargain tech would readily accept.

In layman terms, even Jack Dorsey must realize there is far more money to be made in being an alleged monopolist than an alleged Super PAC….

Tech Diplomacy: The New Normal

From a stock market perspective, the Biden administration is a welcome respite from the ravages of 2020 thus far. The promise of massive economic stimulus is too good an offer for the market to refuse.

Yet the inescapable irony is that for the stocks most central to the market, the economic picture is far more complicated. While big tech has largely survived the pandemic unscathed, managing their new business partners at 1600 Pennsylvania Avenue may prove a far more trying dilemma.

From outright breakup to anti-competitive action, and even addressing their latent political power, the next challenge for big tech more so resembles inter-state diplomacy than business as usual.

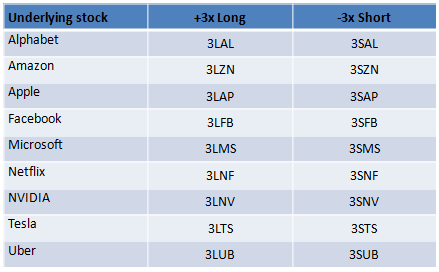

GraniteShares Short and Leveraged Single Stock Daily ETPs on US technology companies

Click to visit:

Commentary » Equities » Equities Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest

Leave a Reply

You must be logged in to post a comment.