Dec

2019

Beta clockers

DIY Investor

17 December 2019

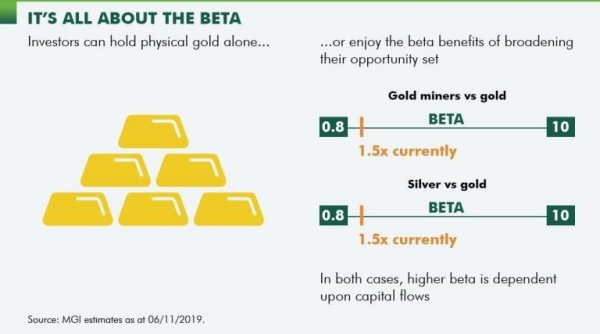

Investors can hold physical gold alone, or enjoy the beta benefits of broadening their reach.

At the very basic level, gold is a currency; a foreign exchange instrument.

It plays the role of defence against the loss of purchasing power and the idea of the ‘golden constant’ – the first statistical proof, published in 1977, of gold’s inflation hedging qualities, which explains how the same quantity of gold can buy the same basket of goods at different points in time.

‘At the very basic level, gold is a currency; a foreign exchange instrument’

An inflation hedge is an investment that is considered to protect the decreased purchasing power of a currency that results from the loss of its value due to rising prices (inflation).

The evidence of the past 20 years – with the exception of short periods in which silver has performed well – would suggest that gold miners and silver do not merit the attentions of investors.

But it is equally true that in periods of falling real rates – interest rates adjusted to remove the effects of inflation – they have both been only mildly negative (2001-2008) or mildly positive (2012-2019).

A matter of timing

When real rates fall quickly, either through rate cuts, rising inflation or substantial central bank balance sheet expansion, investment flows into gold accelerate markedly.

And it is at these moments that the additional beta of gold miners and silver can help boost investment returns otherwise lacking in a pure physical gold allocation.

Indeed, silver’s eclipsing of gold is very typical when both metals are rallying, as they both move inversely to real interest rates, but the magnitude of silver’s price moves in percentage terms are often greater.

‘silver’s eclipsing of gold is very typical when both metals are rallying’

The precious metal is consumed in a number of ways in industry, such as in electronics, solar and medical instruments and this means that its return profile has the potential to be roughly double that of gold.

However, given its absence from most benchmarks, it can take a little longer for capital to flow to the asset class.

We are currently seeing some gentle investor participation in the gold sector but flows are muted and the beta of gold miners to gold and silver to gold are both around the 1.5 to 1 mark.

Historically, the beta ranges from 0.8 to 10 to 1. Back in August 2019, when real rates fell to their 12-month lows, investment flows increased and the beta of both jumped to 3 to 1: broader participation has a very real effect.

The last time the beta of silver versus gold hit its mid-to-upper range was in 2011, when it hit 5. It was the final year of outright central bank support and stimulus, and real rates were still dropping. Between August 2010 and May 2011, the gold price rose by 32%; silver soared by 165% (Bloomberg as at 14 November 2019).

Going with the flow

The beta of gold miners versus gold and silver versus gold are driven almost entirely by participation and capital flows. With investor participation in monetary metals at historic lows and investor behaviour ever more driven by market momentum, there is plenty of room for flows to appear and drive both forms of beta higher.

This is particularly pertinent in the current environment of diminishing real rates, rate cuts, fiscal expansion and central bank balance sheet growth.

Merian Gold and Silver Fund >

Alternative investments Commentary » Alternative investments Latest » Commentary » Latest » Mutual funds Commentary » Mutual funds Latest

Leave a Reply

You must be logged in to post a comment.