Oct

2021

Bargains galore: Discounted Investment Trusts

DIY Investor

26 October 2021

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

We review our discounted opportunities portfolio, with one constituent rallying more than 30% in just two months…

We review our discounted opportunities portfolio, with one constituent rallying more than 30% in just two months…

We last updated our discounted opportunities portfolio in July. Since then markets have been grinding higher but discounts have not moved – and perhaps slightly widened. We think readers will largely agree that it is hard to have conviction about the direction of markets and leadership at the moment, which may explain the static picture regarding discounts.

At a directional level, the easy gains in the recovery have been made, and government support schemes have still to be wound down, creating uncertainty about the real health of companies and economies.

At the market leadership level, the growth/value distinction was the main driver of markets from the start of the pandemic to the end of the reflationary rally in the first quarter of 2021. Since then, the degree of divergence of the relative returns of the two styles has fallen, and we would argue it is not clear it will drive markets to the same extent over the coming months.

One possibility we have been alluding to over the past year is that after the initial recovery, it will be quality that is the most attractive characteristic, as economies are likely to be struggling with the impact of the pandemic for some time to come, despite the optimism of the relief rally. Supply chain issues, wage inflation and declining macro data from the US and China are all possible indications of a more troubled period to come.

We think this is more than a summer lull, therefore. One weight on sentiment is likely to be concerns about the impact of the delta wave, which was only really picking up steam at the start of the period. If this is the case, the current ‘back to school’ period could be key.

If the UK and Europe manage to open schools and return to the office without kicking off a new wave that needs to be controlled via lockdowns, this could be the catalyst for a fresh wave of optimism. Yet with support schemes in the UK winding down at the same time, it is hard to call how everything will play out.

Market review

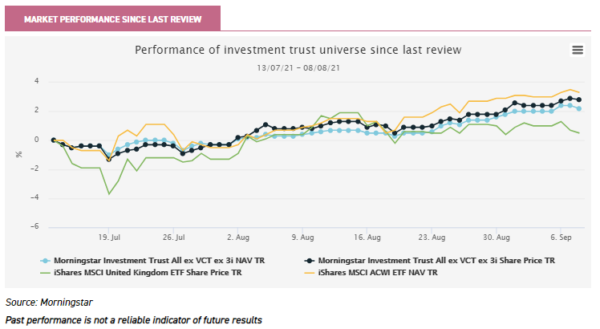

Since our last review on 14 July, the UK’s recovery rally has slowed, and the FTSE All-Share’s total return of 1.9% is below the 3.5% of the MSCI ACWI. Morningstar’s universe of investment companies has enjoyed NAV total returns of 2.2% over the period and share price total returns of 2.8%. The discount has narrowed slightly over the period.

JPMorgan Cazenove’s more restricted universe of investment trusts has seen slightly lower numbers for both return series, with discounts ending up roughly where they started at around 3.6% on a weighted average basis compared to 3.5% on the 14 July.

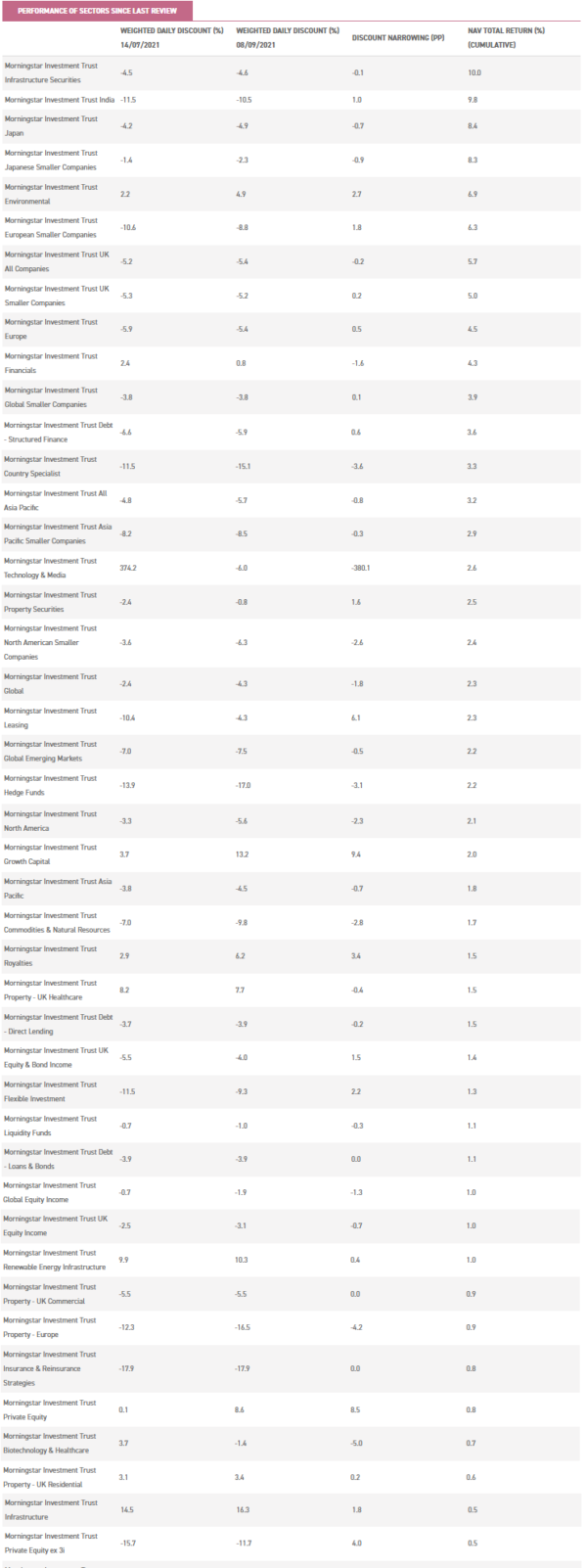

On a sector level, the best NAV returns have come from the two infrastructure securities trusts . They have slightly outperformed the India sector, while the Japanese sectors are close behind. There has also been something of a revival for the environmental sector.

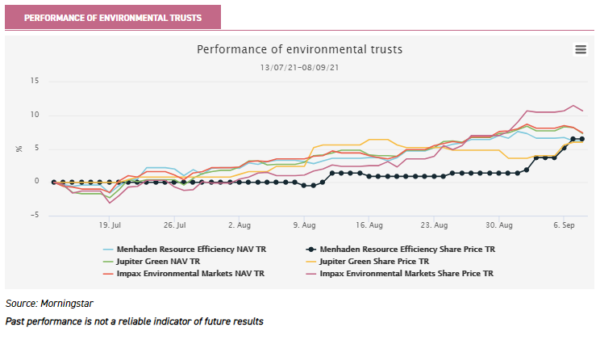

After performing well in late 2020 on the expectation of green stimulus measures, the sector traded sideways for the first half of 2021. Since the start of July, it has enjoyed a decent rally. Our portfolio constituent Menhaden Resource Efficiency has seen its share price keep up with NAV, although the absolute discount remains attractive at 27%.

The daddy of the sector, Impax Environmental Markets has seen its share price exceed its gains and the premium rise to 6.7%. Jupiter Green, however, has seen its discount widen as its shares have not kept up. Since 14 July, NAV is up 7.5% on a total-return basis, but the shares are up just 6%. The discount has widened to 8%. While this is not wide enough for the trust to make it into our portfolio, we do view it as attractively priced and would certainly add it to the list should it widen significantly further. JGC is one of a limited number of trusts investing entirely in the environmental space.

Another similar situation has emerged in the two-strong US Smaller Companies sector. Brown Advisory US Smaller Companies (BASC) has seen its discount drift out to 9%, while its peer JPMorgan US Smaller Companies is trading just 3.7% below par. BASC has a new manager, which may explain the weakness, although the Brown team have actually outperformed their competitor since 1 April when the manager took over. With both trusts having a quality growth style, we see no good reason for this disparity, but the BASC discount is not quite wide enough for our discounted opportunities portfolio.

Excluding the sectors with many stale NAVs, the environmental sector overall has seen the greatest discount narrowing over the period, making JGC stand out even further as an anomaly. It may be to do with investors taking stock after the recent promotion of Jon Wallace to lead manager and the departure of Charlie Thomas. The other sectors to see their discounts widen are an eclectic bunch, encompassing the flexible infrastructure and European smaller companies sectors. We show the list of sectors below, ordered by the NAV total return during the period.

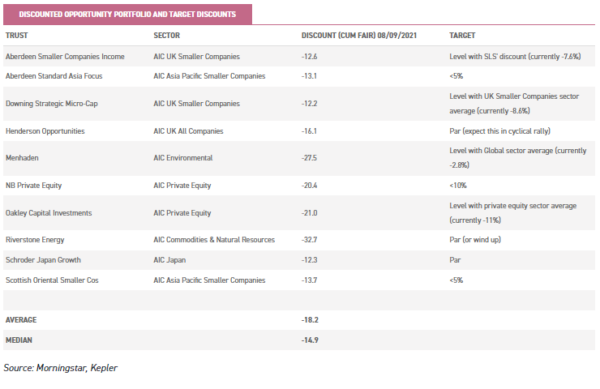

Portfolio review

As a reminder, our discounted opportunities portfolio contains a series of trusts we think trade on wide discounts, which represent an opportunity. First and foremost, however, they are trusts which we think have strong NAV potential. Investing in trusts on the basis of the discount potential alone is a risky business, given the potential for non-investment events to drive discounts – corporate action, illiquid shareholder registers etc.

As a result, our portfolio contains trusts where we think strong NAV gains could be accompanied by a discount narrowing, creating excellent return potential. Investors should be aware, however, that there is no guarantee that our instincts will be proven correct!

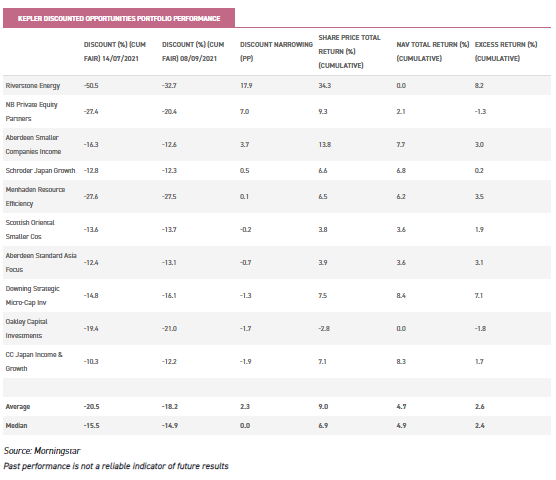

That said, it is pleasing to report that the portfolio has performed extremely well on a NAV total return basis, the average being 4.7% since our last report. This is substantially higher than both UK and global indices have managed during the period. Share price returns were even better, with an average gain of 9% over the period. The median was 6.9%, indicating that these gains have not been equally shared.

The standout performer in share price terms was Riverstone Energy (RSE). The discount has come in from 50.5% to 34% over the period. RSE’s NAV has not been revalued during the period, but the shares have rallied over 30%. While there was no new NAV inspiring this move, the company did publish semi-annual results for the period ending 30 June, which included some details and commentary which may have increased demand for the shares.

These included the announcement of new investment in battery assets, increasing the exposure to the energy transition which is at the core of our long thesis on the discount. RSE now has 28% of its portfolio in clean energy investments, with 44% in the legacy energy and petroleum investments. In our view, the decarbonisation theme is so important, and investment opportunities are so sought after that there is a good chance of a significant re-rating close to par. In the meantime, there is a potential realisation opportunity by the end of 2022 if investors are not satisfied with the new strategy.

The second strongest discount narrowing seen was by NB Private Equity Partners, another not to have reported a NAV. However, its share price appreciation of 9% was well ahead of the 4.3% growth in the S&P500 (it has a US-focussed portfolio). Yet it still trades on a discount wider than 20% – and using Numis’ estimate of the current NAV, the discount is slightly wider than that in the table, at 22.4%. Aberdeen Smaller Companies Income also saw significant discount narrowing, to 12.6% from 16.3%. While the NAV performed very strongly, share price gains exceeded it.

Both ASCI and its stablemate Standard Life UK Smaller Companies have been amongst the best performing UK smaller companies trusts over the past three months as growth has recovered against value.

Aside from these three, discount moves have been fairly muted, averaging 2.3% with a median of essentially no move (0.1%). This is in line with the general picture on the market as a whole discussed above where discounts haven’t moved much.

While NBPE saw high demand for its shares, the other private equity trust on our list, Oakley Capital Investments, has seen its discount widen by 1.7 percentage points. On a discount of 21%, one of the widest in our portfolio, the shares look particularly good value to us. OCI’s portfolio is full of digital disruptors in the education, consumer and technology sectors.

CC Japan Income & Growth saw slightly more discount widening: 2.9 percentage points. Japanese equities have generally been out of favour in the past few months, with the country struggling to shake off the pandemic and the prime minister announcing his resignation. This has reversed at the start of September, as the leading candidate to replace Suga promises more fiscal stimulus and low-interest rates for longer. It has been growth strategies that have benefitted the most in this bounce, but CCJI is still well-positioned to benefit from the improving corporate governance culture in Japan, which includes a growing dividend culture.

Conclusions and event preview

The summer period has represented a lull after a healthy recovery period for markets since the nadir of the pandemic. As a result, discounts look full overall, with investors having to look hard for opportunities in specific trusts. With that search in mind, our autumn conference on 30 September ‘Now that’s what I call a discount!’ , will these the managers of six investment trusts trading on significant discounts discussing the opportunity which they see and the potential for a narrower discount that might accompany it. Please sign up using the above link.

We see no reason to make any changes to our portfolio. No new trusts have hit our target levels (see table below), while there have been no outstanding opportunities emerge. We do think both Jupiter Green and Brown Advisory US Smaller Companies look attractively cheap compared to similar peers, but neither discounts are quite wide enough for this portfolio.

Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.