Jul

2021

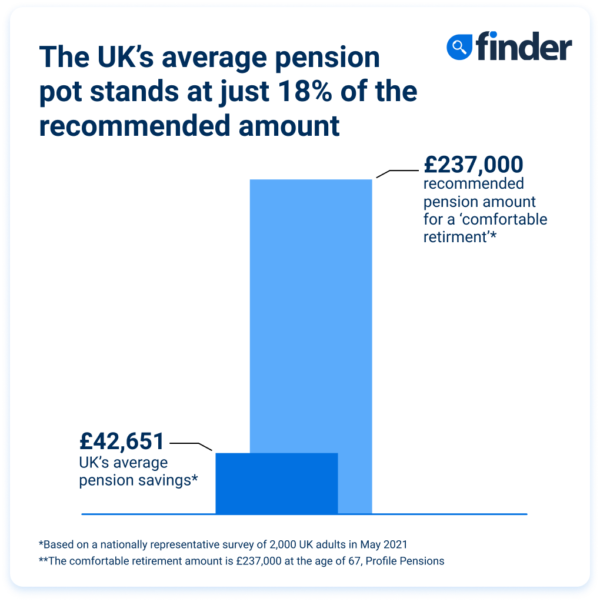

Average UK pension pot just £42.7k – 18% of the recommended total

DIY Investor

7 July 2021

A survey conducted by the personal finance comparison site, finder.com, has found that the average pension pot in the UK stands at just £42,651. This figure drops even further for non-retirees, who only have £33,809 saved on average

A survey conducted by the personal finance comparison site, finder.com, has found that the average pension pot in the UK stands at just £42,651. This figure drops even further for non-retirees, who only have £33,809 saved on average

Key findings:

- Non-retirees in the UK have £33,809 saved

- A fifth (19%) of the population have no private or workplace pensions

- Men have an average £62,336 saved in their pension, while women have just £22,735 in comparison – 64% less

With one pension specialist recommending that someone retiring at 67 should have at least £237,000 saved for a ‘comfortable’ retirement*, this means that the average Brit’s pension stands at just 18% of this figure.

Even more concerning was that a fifth of the population (19%) say they have no form of private or workplace pension. A further 18% have a workplace pension but no private pension.

Gender breakdowns

The survey revealed a very worrying discrepancy in pension amounts for men and females. On average, men have £62,336 saved in their pension, while women have just £22,735 in comparison – 64% less.

Age breakdowns

In terms of age breakdowns, Millennials have £17,175 saved on average, and, as you would expect, these totals rise along with the generations. Gen X’ers have £35,175 saved, while baby boomers have £61,546 in their pension pot. Despite many of them being retired, the average amount saved for the silent generation is only £111,855.

When it comes to not having a pension, it is actually the older generations who appear less likely to have a workplace or private pension – relying on just a state pension to live off. Despite many people within these demographics being retired, a staggering 22% of Baby Boomers and 30% of the Silent Generation said they did not have a workplace or private pension. These figures drop to 15% for Millennials and 19% for Gen X.

Zoe Stabler, Investment Writer at the personal finance comparison site, finder.com, said: “The pandemic has been extremely tough for Brits in many ways, with a lot of people having to take unprecedented steps in order to stay afloat financially. It is understandable that some Brits have reduced, or paused, payments in order to direct money to more immediate priorities.

“However, if you are someone who has had to do this, it is vital that you look at replacing this money or at least starting to pay into your pension again. The power of compound interest means that what you pay in now could be a life changing amount if you’re able to leave it for decades. As an example, £10,000 paid in now, earning an interest rate of 5% per year, would be worth £25,330 in 20 years, £41,259 in 30 years and £67,207 in 40 years**.

“Also, if you opted out of your workplace pension in order to save money during the pandemic, you should look to rejoin it as soon as you can. If you contribute 5% of your salary each month towards it, your employer is obliged to pay a minimum of 3% on top of this, which is effectively free money topping up your pension!”

To see the research in full visit: https://www.finder.com/uk/pension-statistics

Methodology:

Finder commissioned Censuswide to carry out a nationally representative sample of 2,000 people throughout Great Britain at the end of April 2021, with representative quotas for gender, age and region.

*The comfortable retirement amount of £237,000 for someone who owns their property at the beginning of retirement (aged 67) was taken from Profile Pensions pension calculator

**The future projections were calculated by taking the amount of £10,000 and applying 5% interest each year.

Leave a Reply

You must be logged in to post a comment.