Feb

2024

Up 55% in 12 months, this fund has further to go

DIY Investor

13 February 2024

Saltydog Investor highlights star fund Jupiter India, which has continued its stellar run in 2024

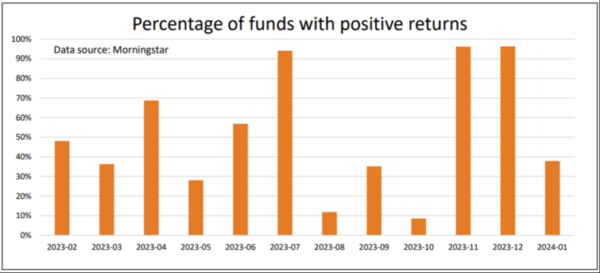

Finding funds doing consistently well has been a challenge over the past year. More than 90% of the funds we monitor rose in November and it was a similar story in December. Unfortunately, this year has not started particularly well with fewer than 40% of the funds making gains in January.

Only 2.5% of the funds have gone up in each of past four months.

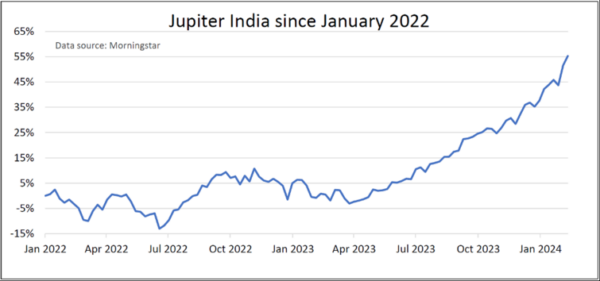

The best-performing sector in January was Technology & Technology Innovation, with a one-month return of 3.2%. However, the leading fund was Jupiter India, from the India/Indian Subcontinent sector. It rose 30% last year and has made a further 8.7% in January. Over the past 12 months, it has now risen 55%.

Saltydog’s top 10 funds in January 2024

| Fund Name | Investment Association (IA) sector | Monthly return |

| Jupiter India | India/Indian Subcontinent | 8.7% |

| Janus Henderson Glb Tech Leaders | Technology & Technology Innovation | 7.9% |

| Liontrust Global Technology | Technology & Technology Innovation | 6.4% |

| Polar Capital Global Tech | Technology & Technology Innovation | 5.7% |

| WS Blue Whale Growth | Global | 5.5% |

| Janus Henderson US Growth | North America | 5.5% |

| Pictet-Digital | Technology & Technology Innovation | 5.3% |

| VT Argonaut Absolute Return | Targeted Absolute Return | 5.1% |

| T. Rowe Price Global Tech Equity | Technology & Technology Innovation | 5.0% |

| FTF Martin Currie US Unconstrained | North America | 4.7% |

Data source: Morningstar. Past performance is not a guide to future performance.

India has a wealth of natural resources, along with a large and relatively young population and an expanding middle class with rising levels of wealth. Although it still gains a lot of its revenue from its exports, it also has a large domestic market.

Since 2014, Prime Minister Narendra Modi and the Indian government have put in place several policies to boost the economy and they seem to be working. They include the National Infrastructure Pipeline, the Make in India campaign, and the Startup India initiative.

Although historically India’s growth has lagged behind China’s, that might now be starting to change. China has not got a great track record when it comes to sticking to internationally agreed business standards, and the government has faced numerous allegations of human rights abuses over the years. Perhaps India now looks like a more attractive option for foreign investors.

In 2022, India overtook the UK as the world’s fifth-largest economy and this year it is expected to grow faster than China.

The Jupiter India fund has been going up pretty steadily since last April, rising 59%, and it is currently the best-performing fund in our demonstration portfolios.

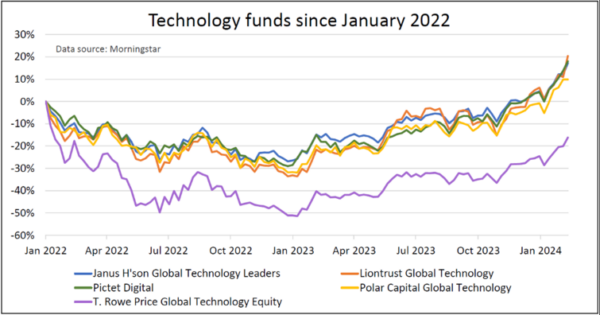

The next three funds in the table, Janus Henderson Global Technology Leaders, Liontrust Global Technology, and Polar Capital Global Technology, are all from the Technology & Technology Innovations sector, as are Pictet-Digital and T. Rowe Price Global Tech Equity, which have returned a bit less.

The Technology sector had a difficult 2022, with an overall loss of 27%, but recovered in 2023, finishing strongly with a 9.6% gain in November and making a further 5.5% in December. In January, the sector as a whole went up by 3.2%, but some funds did much better than others.

We currently hold the Pictet-Digital fund in our Ocean Liner portfolio. We bought it last December, and it has already gone up by more than 15%.

There are also two funds from the North America sector and one from the Global sector in our top 10. They also invest in the large US technology stocks. For example, WS Blue Whale Growth’s largest holding is in NVIDIA Corp, NVDA, 0.78% and its next largest is in Microsoft Corp, MSFT, 1.38%: between them they account for more than 15% of the fund’s assets. As long as the technology funds keep doing well, I would also expect these funds to maintain their upward momentum.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.