Aug

2020

Automated Solution for Millennials Seeking Ethical Investment Opportunities

DIY Investor

16 August 2020

Ethical, responsible, sustainable, eco-friendly, green; The last few years has seen a dramatic rise of these buzzwords across all products and sectors – writes Rich Mayor.

Ethical, responsible, sustainable, eco-friendly, green; The last few years has seen a dramatic rise of these buzzwords across all products and sectors – writes Rich Mayor.

The public is far more conscious about its impact on the world. As a result, companies are keen to be, or at least perceived to be, as responsible and doing their part to improve the environment and society at large.

Until now, most of the pro-environmental noise has been voiced by millennials; retail companies are keen to be perceived positively by millennials which has resulted in a plethora of ethical purchasing options in just about every aspect of life.

As a millennial myself (just) I’ve noticed that it’s now a natural reflex now for me to choose the eco-friendly option among similar products. I’m also far more sceptical, barely buying anything online without first corroborating my opinions against independent reviews.

When encouraging millennials to invest, it’s no surprise that the same principles apply. Having an ethical option and being transparent are critical success factors.

‘Having an ethical option and being transparent are critical success factors’

Traditional barriers such as price aren’t necessarily a barrier, because, according to Nielsen, nearly three quarters of millennials are willing to pay more for ethical products.

But it’s important to acknowledge that those who grew up during the banking crisis understandably have hang-ups about the financial services world, and trust – or the lack of it – is one of the biggest challenges to getting them to invest.

GREEN-WASHING

The idea of investing your money to help improve the world and earning money while you do so, is popular with investors.

‘the UK ethical investing market is predicted to grow to a whopping £48bn by 2027’

It’s the sweet spot many companies are trying to hit, and the market is expanding like a (biodegradable) balloon. Estimated to be worth around £15bn in 2016, the UK ethical investing market is predicted to grow to a whopping £48bn by 2027.

But because it’s growing so quickly, there’s a lack of consistency among the options, and the spectrum of what qualifies as ethical is a wide as the forests some are trying to help protect.

The growth has been as rapid as it is inconsistent and there’s a considerable amount of green-washing going on – so much so that some commentators believe ethical investing is the next PPI scandal waiting to happen.

Until there’s a more consistent, reliable approach, investors need some help wading through the myriad of options; enter Tickr.

TICKR TAPE

This fresh-faced robo only started life at the beginning of 2019 and focuses on impact investing.

While it’s yet another term in the investment lexicon, it more accurately describes what Tickr is about — investing money to make a positive impact in the world.

This means the options aren’t restricted to just one issue, such as climate change, but a broader range of environmental and social needs such as gender equality.

‘investing money to make a positive impact in the world’

Tickr does a lot of what other robos do. It offers access to ETFs through ISAs and General Investment Accounts (GIAs) and investors can make one-off contributions and invest through a direct debit.

Its app is easy to use. What Tickr does differently is it brings investors closer to the underlying investments and the impact they have.

It’s aimed primarily at millennials and in an industry that’s often perceived as murky and unclear, Tickr puts a lot of effort into demystifying how their investment portfolios work, whether it’s in Tickr’s favour or not. It’s a refreshingly open approach.

TICK ‘N’ MIX

Tickr’s aim is to get millennials investing for the first time with investment options that resonate with them. There are three investment themes to choose from: Climate Change, Disruptive Technology and Equality. Investors can choose a theme or a mix of all three in the Combo theme.

Within each theme, there’s a short list of sub-themes. For example, the Climate change sub-themes are Global Water and Clean Energy.

There’s a lot of additional info available that’s not normally provided by robo-advisers (or indeed any investment company) which helps to see what’s under the bonnet. It’s a good move that will appeal to sceptical millennials.

Tickr lists the main companies invested in its themes and sub-themes. If there’s an unknown or perhaps contentious company, it has videos outlining what the company does, the positive impact it has and why it’s being included in the theme.

This helps to bring companies to life, giving them a platform to tell their story and connecting investors to their investments – something we think should be adopted more widely across financial services.

Co-founder (and owner of fun-to-say surname) Tom McGillycuddy noted that after years of being in the investment management industry one of the most important events was meeting someone who had benefited from a company he was investing in – and that was the light-bulb moment for marketing Tickr.

‘One day, I was speaking to an Indian family that was being helped by one of the companies I was investing in, and I thought this is exactly the sort of story that would get my friends investing.’

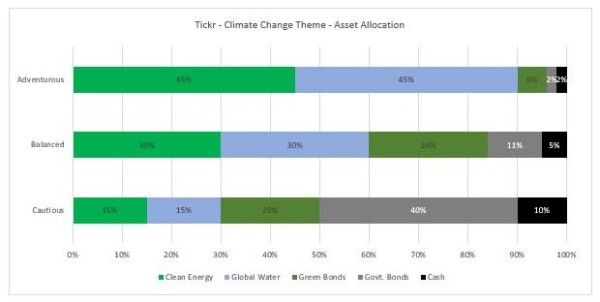

The sub-themes and government and green bonds make up the overall theme. The amount invested into bonds or sub-themes depends on the risk rating chosen, (cautious, balanced or adventurous). The more risk you take, the more of your investment goes into the themes and less into bonds.

The above graph shows the difference in asset allocations for Tickr’s Climate Change theme; cautious portfolios have a much higher weighting of green and government bonds.

Government bonds, while providing the balance of risk in the portfolios, could be perceived as controversial; for example, companies that benefit from tobacco are excluded by Tickr, but the UK Government earns around £9bn a year in tax on tobacco.

Though perhaps a more extreme example, it highlights the challenges Tickr faces when choosing fixed income ETFs. Co-founder Matt Latham said “We don’t analyse the proceeds of government debt to that level. I am not aware of any funds (active or passive) that do. If more sophisticated fixed income ETFs became available, we would happily look at them.”

The underlying investments are all iShare ETFs (Tickr says this is by coincidence rather than choice) and Tickr’s responsibility is to make sure the underlying investments reflect their values and switch ETFs if they don’t. Tickr has a small investment committee that monitors and reviews investments to make sure they remain suitable for the overarching themes. It has already replaced ETFs where that proved not to be the case.

The current number of themes could expand in the future, with Matt Latham telling us that Tickr was always on the lookout for new ideas that may be suitable. He also mentioned that Tickr will be adding a Sipp and Jisa in 2020. The Sipp, in particular, could prove popular with younger investors as research from Franklin Templeton found that millennials would contribute more to their pension if responsible investing was incorporated into it*.

THE EXPERIENCE

Tickr is an app-based robo-adviser with high production values. Signing up and opening an account is as smooth as silk and there is plenty of information to draw on to allow investors to make informed decisions.

Tickr charges a flat 0.7% for all its customers regardless of how much they invest, and portfolios generally cost 0.3%. The charges are a bit higher than others, but eco options generally cost more and the difference isn’t significant.

It encourages users to refer friends with refer-a-friend rewards of £5 and the promise to plant two trees for every referral. It runs regular live and informal events where investors can meet the Tickr team to discuss impact investing and future developments over pizza and beer.

CONCLUSION

Tickr’s aim is to get millennials investing for the first time and it’s working. Not all millennials are avocado-eating, top-knot sporting, eco-warriors. Over 90% of its users are under 40 years old, 70% of them are first-time investors and 40% are female.

The backdrop to millennials’ lives has made them more conscious and aware of the environmental impact of everyday decisions.

They’ve experienced bank bailouts and a decade of austerity, distrust financial services and are pessimistic about their countries’ economic situations — according to Deloitte, only 26% of millennials expect their countries’ economic outlooks to improve in the coming year.

But millennials are also the largest section of the population and need to save and invest just like everyone else.

They also stand to inherit a phenomenal £1.2trn over the next 30 years — financial services providers with transparent and ethical investment solutions will benefit the most.

Everyone will be fighting for those assets — Tickr is better placed than most to benefit.

*The power of emotions – Franklin Templeton

This article was first published by Fundscape. Established in October 2010, Fundscape is a research house specialising in the end-to-end research and analysis of the UK fund industry. It is the publisher of the quarterly Fundscape Platform Report, widely regarded as the industry benchmark for platform data and statistics in the UK. With many years’ industry experience, its team is well placed to provide unique insight into asset management and distribution trends, including product development, distribution and marketing. Visit Fundscape.

Alternative investments Commentary » Alternative investments Latest » Commentary » Exchange traded products Commentary » Exchange traded products Latest » Latest » Robo-advice commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.