Apr

2024

Apple & Tesla: The Non-Magnificent of the Seven

DIY Investor

10 April 2024

The Non-Magnificent of the Seven – by Nikos Tzabouras

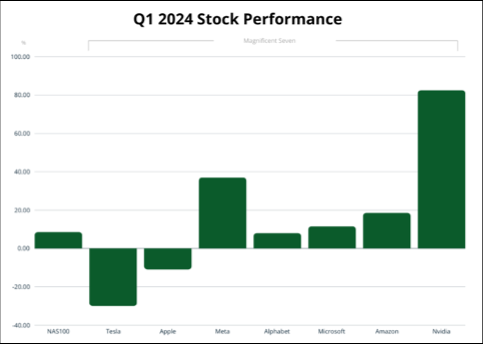

The so-called Magnificent Seven have been in the spotlight for the past year or so, with their push on artificial intelligence (AI) and their stock performance. The enabler of this AI boom, chip designer NVIDIA, is the leader of the pack, with eye-watering gains in excess of 80% in the first quarter of the current year.

Despite being relatively new, this acronym has already come under question, as two of its constituents have underperformed. Tesla Motors Inc. shed around 30% in Q1, and Apple lost more than 10%, along with the title of the world’s most valuable company. Their stock declines are largely a reflection of the difficult external environment they are facing, the advance of competitors and lacklustre results.

Tesla

Demand for electric vehicles has been dented due to high-interest rates, elevated inflation, price premiums, range anxiety and other factors. At the same time, Tesla faces increasing competition, with China’s BYD selling more electrified vehicles last year.

Tesla tried to address these issues with a series of price cuts, but that hurt its profitability and the firm’s operating margin fell below 10% in 2023. Furthermore, executives warned of a slowdown in volumes in 2024, while Q1 deliveries plunged around 20% over the previous quarter and below the 400K threshold for the first time in over a year.

On the other hand, Tesla has been refreshing its line-up, with the updated Model 3 and the futuristic Cybertruck. An upgraded version of the Model Y also appears to be in the works, which was the best-selling car globally last year. More importantly, the company plans a cheap EV at the 25K price point, which will be crucial for mass adoption. However, this will need some time, as CEO Elon Musk expects production to begin “sometime in the second half” of 2025.

Its autonomous driving and AI progress are also going to be critical for its future, as they can unlock tremendous value. Elon Musk has made bold claims and also wants to license the technology to other companies. However, true self-driving and relevant regulatory approvals are not here yet.

Apple

The tech giant lacks growth at a period when its lucrative walled garden business model is under siege from regulators on both sides of the Atlantic. Revenues rose by a feeble 2% in the December quarter (Q1 FY24), but that came after four consecutive quarters of contraction and there is risk of another drop in the next reported quarter.

Worryingly enough, Apple appears to be losing its grip in China, amidst a resurgence of domestic makers and strained Sino-Western relations. Data from Counterpoint Research showed that iPhone unit sales dropped 24% y/y in the first six weeks of 2024.

Apple’s problems are partly a result of the lack of innovation, which prevents it from finding a new growth market. A good example is its failure to crack the electric vehicle market, as Bloomberg reported that the firm abandoned its EV project. The revelation came as rival smartphone maker Xiaomi made its foray into electric cars, aspiring to become a top-5 global auto manufacturer.

What is most concerning though is that Apple lags on the AI arms race, as competitors like Samsung have already enabled AI-enabled smartphones. Although it plans to provide an update later this year, any delays on this transformative technology can create a substantial handicap.

On the other hand, Apple was last year’s top smartphone maker according to Canalys and the market appears to be bottoming out after a tough couple of years. It is unwilling to let China slip away, as indicated by yet another visit from Mr Cook to the country, but also looks towards India. Moreover, it launched its first major new product since the first smartwatch, with the Vision Pro AR headset aiming to gain an early foothold in a still niche market.

Reasons for Optimism

Tesla Motors and Apple are approaching the new earnings season from a weak position and the situation looks grim at this stage. External headwinds, heightened competition, regulatory scrutiny, lacklustre financials and cautionary guidance are among the concerns.

Despite these setbacks, there are reasons for optimism. Both these companies are market leaders with large and committed user bases, while investors are not likely to simply give up on them. Tesla is already working on a next-gen mass-produced car while pushing on autonomous driving and AI. Despite its lack of innovation, Apple launched a new product this year and says it is working on AI, while the smartphone market looks poised for a comeback.

Nikos Tzabouras is Senior Financial Editorial Writer at multi-asset trading platform, Tradu,

Leave a Reply

You must be logged in to post a comment.