May

2022

Investing Basics: An introduction to government bond ETFs

DIY Investor

23 May 2022

Government bonds are debt – IOUs -issued by sovereign governments such as the UK, the US, and Japan; where there are governments, there are usually government bonds, because governments love spending money, especially money they haven’t got – a nuclear power station here, a social programme there – by Dominique Riedl.

Essentially governments can make themselves popular by popping life’s little extras on credit now and leaving others to worry about it in 10, 20 or 50 years time when the loan comes due.

Those loans often come in the shape of government bonds which promise to pay you back interest every year (the coupon) and the full amount borrowed at maturity.

That makes sense for government and investors alike; during a recession, demand from private individuals and corporations drops, as does government income from tax, but the government can plug the gap and keep people in work by issuing bonds that raise funds to, for example, renew the national infrastructure, or keep paying for the NHS.

Investors are happy to lend to stable governments like the UK because they have faith that the country will still be standing and paying them a reliable source of income many years into the future.

The global bond market is huge – far bigger than equities – and government bonds are the largest, most important and liquid part.

Unsurprisingly the world’s superpower and biggest debtor nation, the US, is the major issuer of government bonds and although no asset can ever be truly risk free (see below), the strength and stability of the US is such that its bonds are often thought of as the safest asset available.

A testament to its economic strength aging population and 25-year struggle with low growth Japan is the second largest government bond issuer followed by China and then a clutch of large European nations – UK, Italy, France and Germany – who were forced to ramp up their debt levels to maintain growth in the aftermath of the financial crisis.

What are the benefits of government bonds?

Investors value high-grade government bonds because they are the best available complement to equities; they tend to be more stable than equities and often perform better during recessions which can reduce portfolio losses in a crisis and prevent investors from panicking when equities plunge.

Having a government bonds in your portfolio is the essence of diversification; they can deliver a reliable source of income when bills need to be paid and equities are down, and they can also be used to buy more equities when prices are cheap.

The reason that high-grade government bonds bear up well in turbulent times is because they are backed by strong nations; the US and UK have never defaulted on their debts. Companies can go bust but a developed nation that has survived World War, rampant inflation and the financial crisis is a good bet. Investors believe these countries will manage their finances prudently in the future and so flock to them as safe havens when the global economy is threatened.

Developed nations are likely to keep paying income to investors for the foreseeable future and if interest rates fall then you can even make a capital gain as bond prices rise

What are the risks of government bonds?

In the current low interest rate environment, many assume that rates must rise which will cause bond prices to fall; this will inflict capital losses on bond investors although they are only temporary for bond ETFs, because ETFs automatically buy new higher-yielding bonds that eventually make good the loss by reinvesting more income into cheaper bonds.

However, interest rates are not guaranteed to rise just because they’ve hit historical lows, Japan’s rates have not recovered in over a quarter of a century. If you don’t believe that can happen here then you can minimise the risk of rising rates by investing in a short-term government bond ETF.

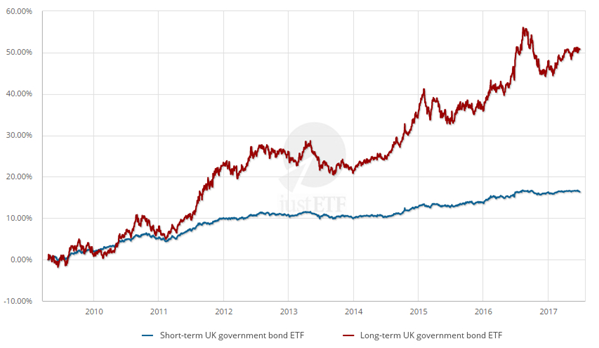

Short-term vs. long-term government bond ETFs

Source: justETF.com; 17/04/2009 – 26/06/2017

A rise in interest rates would at least solve the rock bottom coupon payments currently offered by government bonds; bonds yield more as rates rise, and this would enable them to return to their traditional role as a decent source of income.

Inflation risk is another issue for government bonds – the chance that your bond returns don’t keep pace with inflation. Low yielding bonds are particularly vulnerable to rapid and unexpected increases in inflation. Solutions include diversifying into:

- Inflation-linked bonds that match inflation hikes.

- Commodities that have historically done well in high-inflation environments.

- Short-term bond ETFs that rapidly replace low coupon bonds with higher yielding versions as interest rates rise.

- Relying on equities and property holdings to outpace inflation as they have done over time.

Credit risk is another trap for the unwary. This is the risk that a government defaults on its debt and fails to pay you back as promised.

You can minimise this by investing in government bonds of high quality: look on your bond ETF’s factsheet for average credit ratings of AA- and above.

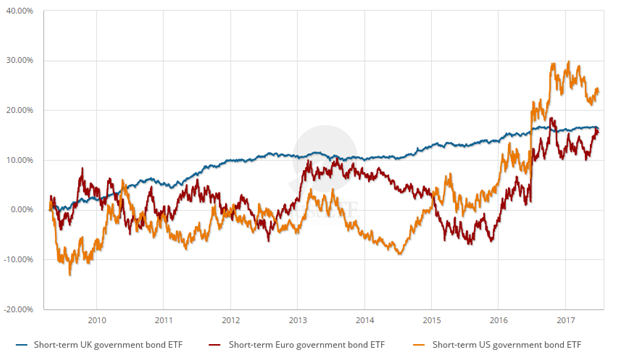

The final thing to think about is currency risk. Government bonds are meant to be a source of stability but foreign bonds add currency market volatility into the mix.

This can swing both ways. If the pound drops 5% against the dollar then a US Government bond fund will appreciate by 5% regardless of the performance of its underlying asset.

Equally, a strengthening pound will detract from the performance of overseas assets.

Short-term UK vs. short-term foreign currency government bond ETFs

Source: justETF.com; 17/04/2009 – 26/06/2017

Currency risk adds an extra dimension of diversification for a global equity portfolio that’s volatile, but it’s best avoided in the minimal risk portion of your portfolio. You can solve this part of the puzzle by investing in government bonds valued in your home currency or ETFs that hedge overseas assets back to the pound

Government bond diversification

The flipside is that you can maximise diversification by investing in government bonds that offer larger yields in different currencies and across a range of maturities. Emerging market government bonds are particularly useful here and can be valued in their local currency or the US dollar.

How does this tally with minimising currency risk? You square the circle by allocating government bonds that are exposed to currency risk to the growth / equity portion of your portfolio. Their job is to diversify your sources of return and not to protect your portfolio from volatility.

Although you can buy individual bonds directly from your broker or even from the government’s Debt Management Office, it’s a time-consuming and often expensive process as the bond market is geared towards major financial players that normally buy bonds in massive quantities.

As ever, small investors, can cheaply and conveniently diversify their portfolio by sticking to ETFs.

Leave a Reply

You must be logged in to post a comment.