May

2023

Alt-right or alt-wrong?

DIY Investor

6 May 2023

Infrastructure and renewables have moved from alternative to mainstream assets – what could be next? By Ryan Lightfoot Aminoff

As recently as ten years or so ago, most investors may have been happy with a portfolio of equities and bonds, typified by the 60:40 portfolio. After 2008 though, a decade plus of near zero interest rates led to a significant rally in bonds, a reduction in their yield and questions over whether they still offered the same level of return and diversification they once did.

As such, many investors turned to alternative investments including the likes of infrastructure and renewable energy to improve yield and provide diversification to their portfolios. At the time, these were a nascent but growing asset classes, but their proliferation has since exploded, with a wide selection of trusts now available, offering a range of renewables including solar, wind and hydro, and infrastructure spanning from hospitals to data centres to laboratories.

With these alternatives arguably now mainstream assets, we decided to consider a selection of the next generation of fledgling alts to see whether they have the credentials to become the next portfolio staple.

Alt+N

The first alternative to discuss is battery storage. It is probably the most logical next step, following on from the huge investment in renewable energy coming online in the next few years, something we discussed in an article a few months ago .

Wind energy has been particularly prominent for the UK, but questions remain over intermittency and how to support the grid when the wind is not blowing. This is where large-scale battery storage comes in. The sector is being built out to be able to sustain electricity demand when generation is weak, and then be recharged when either demand drops or generation recovers.

There are three trusts currently focussed purely on this area at present: Gresham House Energy Storage (GRID), Harmony Energy Income (HEIT) and Gore Street Energy Storage (GSF). GRID was launched in 2018 and has grown to a market cap of c. £895m.

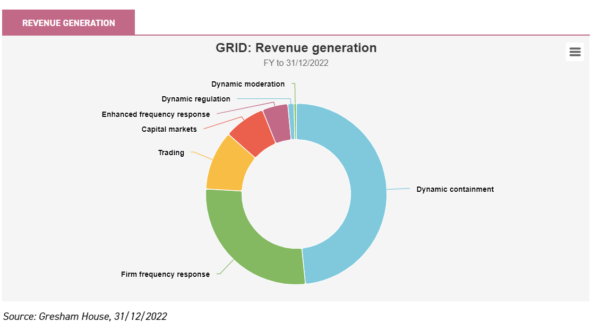

The trust includes 20 operational projects from across Great Britain, with a strong pipeline of new assets planned to come online soon. In their last financial year to 31/12/2022, the trust’s NAV per share grew by 33% and 7p was paid in dividends, which means that the trust offers a yield of just over 4.2%, based on the current price.

GSF was also launched in 2018 and its market cap stands at £486m. The portfolio has more geographic diversification, with assets in the UK and Ireland, as well as Germany and Texas. The managers have a target yield of 7% on NAV, although we note the trust is currently trading on a near-record 11% discount, despite robust NAV performance. HEIT, launched in October 2021, currently operates a portfolio of two operational battery projects, with another six under construction and one soon to begin. They have discussed their desire to expand into other renewable energy projects, also.

What arguably supports the future of these trusts is the big imbalance between the capacity of battery storage at present and the amount required to provide large-scale grid support. More of these assets are required to support the move to renewable energy, providing a strong growth runway for the trusts.

Also, there are multiple revenue generation sources for the sector other than simply charging and discharging on supply and demand. This includes frequency response, which responds to small imbalances in the grid’s frequency, energy trading, i.e. selling electricity when it’s expensive and buying when it is cheap and capacity markets, which ensures security of supply by guaranteeing minimal back up supplies.

These slightly different drivers allow battery trusts to take advantage of energy imbalances across a variety of time frames and generate cash from different sources, as we have shown in the chart below. However, questions remain over the defensiveness of these assets. Physically, many of these sites are very simple – large, container-sized units containing batteries.

There are arguably few barriers to entry for replicating these sites and the increasing demand could well entice bigger players, such as the domestic energy generators themselves. Even the large traditional energy names, such as BP and Shell, may become involved, looking to diversify their exposures. As a result, we think the energy storage sector is likely to grow significantly. However, we think it is possible it will become an allocation within the portfolios of the existing renewables trusts, and therefore the stand-alone energy storage trusts may look to diversify their income streams for fear of being too easy to replicate.

Another asset that has been touted as contributing to the fight against climate change is timber, in particular, forestry. Foresight Sustainable Forestry (FSF) is currently the only investment trust operating in this sector and offers investors access to an asset class which, the managers argue, is not correlated to equities or bonds.

The trust generates returns by purchasing land and converting it to forestry, and through the sale of the timber produced on the land. On top of this, the asset class has a potential income avenue through carbon credits, allowing investors to offset their carbon emissions. The managers of FSF believe there are strong supply and demand characteristics in the timber market which should support prices into the future.

However, these prices remain difficult to predict. There is a considerable lead time between planting and harvesting, during which there can be many factors that impact prices. Even in the last two weeks, packaging firms across the board saw considerable falls following concerns about slowing demand for paper products. That being said, considering the drivers behind the asset class and the lack of correlation, it may offer a compelling alternative investment, albeit the market size may be too limited for it to become a mainstream portfolio asset.

A potential energy source to replace fossil fuels is hydrogen, which has been touted as an alternative across power, heating and transport. It potentially fills the gap where electrical or battery power cannot replace fossil fuels, such as heavy transport, e.g. trucking, or weight-sensitive areas, such as flying.

Whilst the investment journey is early, there is one dedicated trust in the space, HydrogenOne Capital (HGEN). Launched in 2021, the management team behind the trust invest in a range of mostly private companies across the hydrogen supply chain, including the production and supply of clean hydrogen, distribution infrastructures and electrolysers and fuel cells.

They want to tap into a market where they believe demand could increase 200-fold by the end of this decade, with production of green hydrogen increasing from 4.5m tonnes per annum (mtpa) in 2019, to over 200mtpa by 2050, resulting in potential sales of $2.5tr. HGEN certainly has the first-mover advantage in this space and has done well to consolidate this opportunity, with a diversified range of companies from across Europe and different themes.

However, the industry is clearly very much in the nascent stage and there is no one clear direction as to how the hydrogen market will evolve and which technology will be the clear winner. As such, many of the current companies operating in the market will have business models that will, ultimately, prove unsuccessful and result in losses. Whilst the future opportunity for hydrogen may prove profitable, it may be too soon in the journey to be considered the next alternative asset, as of today.

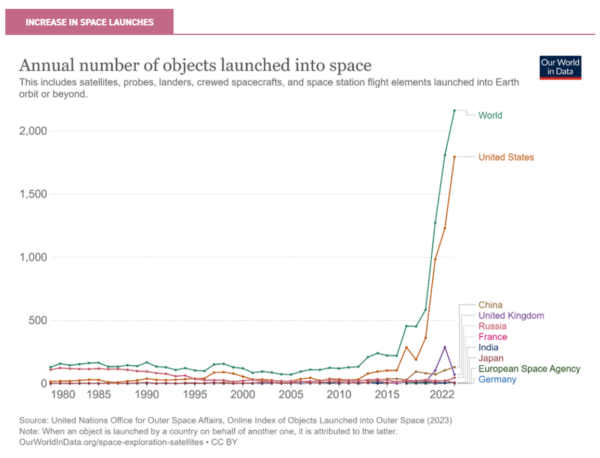

Expanding the horizons even further, one area attracting increasing attention is the opportunity of investing in space-related industries. The sector has long captured the imagination, but has gone through a recent resurgence as the costs for achieving space travel have fallen and a number of countries, and the world’s richest individuals, have joined a new space race.

This has led to an uptick in the number of companies operating in the sector. But this opportunity is far more than just investing in rockets. There are a number of supplementary industries, such as commercial satellites, robotics and data connectivity.

The cost of getting to space has dropped substantially in the last few years, having been stable for decades. In 1980, the space shuttle programme cost $85k per kg to reach space, whereas the cost in 2020 was around $951/kg, a fall of 99%, thanks to the likes of Elon Musk’s SpaceX. This has revolutionised the economics of getting to space and substantially increased the potential for digital infrastructure with satellites, with the results shown in the chart below.

There are a number of trusts that have some investments in this theme. Edinburgh Worldwide (EWI) is one example. The managers’ second-largest holding is the aforementioned Space X, a private company which makes up 4% of the trust. There is also one pure play investment trust – Seraphim Space (SSIT).

The trust owns a portfolio of predominantly private companies from around the globe from subsectors including satellite communications, navigation systems and drones and unmanned aerial vehicles. The shares performed well initially after launch in July 2022, but subsequently have fallen to a significant discount, as risk appetites have collapsed. The managers believe that as these are long-term themes which will dominate our lives in the next few decades, this could offer an attractive entry point for long-term investors.

However, the asset class is quite esoteric. While there are many more applications from the sector than investors may initially realise, it is unlikely to be an asset class that will move from being an interesting alternative to a mainstream allocation.

One final area to consider is music royalties. The digitalisation of the music industry has revolutionised music royalties and this has led to two investment trusts being launched in the past few years.

They have bought up an enviable catalogue of tracks with the intention of benefitting from the expansion of streaming, live performances and covers. Hipgnosis Songs (SONG) is one of these trusts and has a huge number of songs from a range of artists, from Otis Redding and Amy Winehouse to Britney Spears. The ownership of these rights not only entitles SONG to the income generated, but also provides the managers with the opportunity to increase their value, through encouraging their use in media or advertising campaigns. For example, the most recent Christmas advert for John Lewis used a cover of a track from the SONG catalogue.

The asset class also meets the criteria for being considered alternative, too. The revenue streams are, arguably, uncorrelated to either equities or bonds and could prove relatively economically defensive. SONG itself stands at a c. 48% discount, at the time of writing, which we believe is largely reflective of concerns over the impact of a higher interest rate environment on valuations and debt.

Whether the asset class is large enough to become a mainstream holding is a question that remains unanswered, but we believe the valuation of this trust looks interesting at present, as a potential portfolio alternative.

Conclusion

Whilst all the alternatives we have discussed have merit, there are hurdles for each of them to overcome before being considered truly mainstream portfolio assets to sit alongside the likes of infrastructure and renewable energy. One factor to keep in mind is what helped drive the proliferation of the previous cohort, which was the considerable level of government support, as we discussed last week.

In some cases this was explicit, such as co-investing in infrastructure projects such as in PFI programmes in which HICL Infrastructure (HICL) invests. In other cases, it was the government ensuring a minimum price for electricity for the renewable energy providers that helped create a financial floor for producers willing to build out. Generally, it is difficult to see similar government support for the latest set of alternatives above. If we had to guess which sector would see such support, it would likely be battery storage, given how plugged in it is to the government’s strategic goals on net zero.

As for the other sectors, there are structural factors supporting all of them, but some seem likely to face a challenging path to profitability. Should any of them manage to prove themselves in this tough environment, we believe it will truly show the ability of the management teams to navigate their asset class. Ultimately, only time will tell if they are the right alternative, or if they get radically left behind.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Alternative investments Commentary » Alternative investments Latest » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.