Oct

2023

AI revolution: who’s profiting now from generative AI?

DIY Investor

3 October 2023

Our AI revolution series explores the views of our experts on the fast-evolving topic of AI. In this Q&A, members of our public and private equities teams consider which types of tech companies may be best placed to reap the rewards.

What is AI and why has interest in it taken off now?

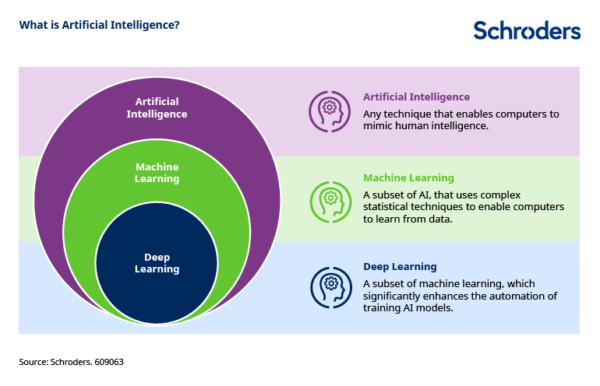

Jonathan McMullan, Global Sector Specialist, Public Equities: “Artificial intelligence (AI) essentially means any technique that enables computers to complete tasks that typically require human intelligence. The concept of AI has been around for a long time; we could date it back to 1950 when Alan Turing introduced the Turing Test for machine intelligence. Like many conceptual technologies, its progress has ebbed and flowed over the years. The journey has been marked by alternating periods of heightened excitement and subsequent disillusionment.”

“We already encounter AI a lot in our daily lives, often without knowing it – think of voice or image recognition on your smartphone, or the TV shows which Netflix recommends to you. But generative AI – and particularly the unveiling of ChatGPT at the end of last year – has sparked peoples’ imaginations.”

“What really distinguishes generative AI from other hyped technologies of recent years, like cryptocurrency or the metaverse, is its tangible, practical nature. It’s not just an abstract idea. Generative AI is already finding its way into everyday workflows, and we don’t need to stretch our imaginations too far to see its transformative potential.”

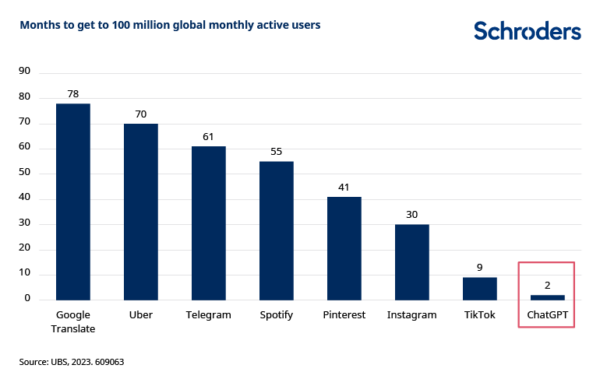

Michael White, Global Sector Specialist, Public Equities: “The success of ChatGPT has been astonishing. It was the fastest platform in history to reach 100 million users, and is now at around 170 million. The speed with which this milestone has been reached suggests that societal habits are forming around the use of text-based generative AI, and that this practise is here to stay.”

What’s behind the new wave of generative AI apps?

Paddy Flood, Global Sector Specialist, Public Equities: “There are multiple factors contributing to the emergence of generative AI, these include:

- New(ish) architecture: There are many different architectural approaches to AI, but in 2017 Google introduced a new architecture based on transformers. This architecture is an essential building block for the large language models (LLMs) we see today as it, amongst other things, means that models can contextualise whole questions (as opposed to words or phrases in isolation) and be trained faster.

- Enhanced computing power: Semiconductors have become both smaller and more powerful which means that tasks can be done faster and more efficiently. In addition to this, cloud computing has taken off, and this has enabled companies to outsource their IT infrastructure to third parties. Without this, companies around the world would have had to invest in expensive AI related infrastructure, potentially slowing generative AI’s adoption.

- Data: The increased availability and usability of data, a key part of LLMs, is another reason. The world continues to generate a lot of data and advances like cloud computing mean it is easier to access and store it.

- AI at the edge: Finally there are also now techniques for deploying AI at the edge. This means the AI computations are done on the device where the data is created, rather than on a distant data centre. This is crucial for applications like autonomous driving where data instructions have to be acted on immediately with no latency or delay.

What kinds of companies operate in the generative AI segment?

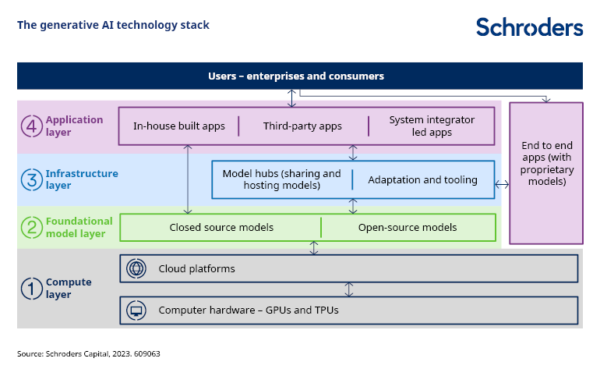

Ankur Dubey, Investment Director, Private Equity: “We need to understand the ‘technology stack’, i.e. the set of technologies needed to build a generative AI application. There are four layers to the stack:

- The compute layer is the base of the stack. Generative AI systems require large amounts of computing power and storage capacity to train and run the models. Hardware (semiconductor chips) provides the computing power and cloud platforms like Amazon Web Services, Microsoft Azure or Google Cloud Platform provide services like virtual machines and storage.

- Next comes the foundational model layer. Foundation models are systems with broad capabilities that can then be adapted to a range of different, more specific purposes. Arguably this is the most important layer of the generative AI stack. These foundation models are large statistical models built using sophisticated machine learning algorithms that generate human-like responses derived from large volumes of data they’re trained upon. Foundation models are split into closed source and open source models. Closed source software is proprietary – only the company that owns it can modify it – whereas open source means the source code is publicly available and programmers can change it.

- Infrastructure layer. These are the tooling/infrastructure companies for apps that don’t use proprietary foundational models. Such apps need the infrastructure companies to help them fully utilise the technology available at the foundational level. Apps with proprietary models (like ChatGPT) don’t need to rely on third parties in the infrastructure or foundational models layers.

- Finally, top of the stack is the application layer, which is the software via which users interact with the underlying AI technology. This can include OpenAI’s ChatGPT product or an internally built solution like Schroders’ in-house AI product, named “Genie”.

What kinds of companies will make the most money from generative AI?

Ankur Dubey: “The jury is still out on which of these layers will accrue the most value. It is still early days for the technology after all. However, we can agree that so far the ‘compute’ layer has emerged as a winner and the example of NVIDIA – with its share price up c.190% year-to-date (FactSet, as at 30 June) – shows the market agrees.

“That said, there is a question over whether the cutting edge technology being designed by NVIDIA today could be commoditised over time.”

Michael White: “For now, the ‘picks and shovels companies’ in the compute layer look like winners thanks to their existing dominant positions. As generative AI use cases grow, the demand for chips will grow too and NVIDIA is an expert with a dominant market share in the GPUs (graphic processing units) that are essential for AI processing.

“On the cloud side, the cloud computing market is an oligopoly. At least for now, the big players like Amazon Web Services, Microsoft Azure and Google Cloud Platform will likely retain their advantage having invested significantly in infrastructure and established customer relationships in recent years.

“But, we must remember that new tech enables new ways of doing things and creating entirely new businesses. For example, Netflix was enabled by the internet and was allowed to flourish because it offered a superior product to traditional pay TV in a way that threatened existing media companies.

“Similarly, Uber is a company whose business model can only exist because of smartphones and the mobile internet. It certainly seems as though this exciting new technology will provide new ways of doing things, but it is perhaps too early for those businesses to have emerged yet – this is what we are looking for”.

Mike McLean, Senior Investment Director, Private Equity: “Looking outside the tech industry itself, one possibility is that companies that are data-rich, for example those that own a large amount of proprietary user-generated content, could become valuable simply because of the value of that data in training AI models.

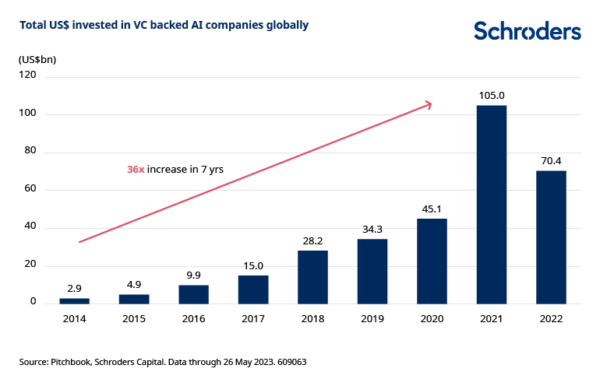

“From a venture capital side, flows into AI companies have surged in recent years, as the chart below shows. And the flows into AI companies are growing many multiples faster than the venture capital market overall. There was a drop off last year in dollars invested into the AI space, but that reflects a dip in the venture market more generally.

“The key point is that AI is an increasingly important element of the types of companies being created in the market today”.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Alternative investments Commentary » Alternative investments Latest » Brokers Latest » Commentary » Equities Commentary » Investment trusts Commentary » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.