Sep

2024

After years of underperformance, high street fashion brands stage a revival, outperforming luxury stocks

DIY Investor

12 September 2024

- Basket of high street fashion stocks have significantly outperformed luxury brands in the past year (11% vs -8%)

- This is a major reversal, with luxury stocks such as LVMH and Hermès having comfortably beaten ‘fast fashion’ in the preceding years

- High street comeback is being fuelled by falling inflation, easing cost of living pressures and strong performance of Next and Inditex

With just days to go until European catwalk season kicks off again with London Fashion Week, new research from trading and investing platform eToro reveals that high street fashion brands appear to be staging a comeback versus their luxury counterparts after several years in the doldrums.

eToro looked at the performance of ten of the largest UK and European luxury and high street fashion retailers by market capitalisation to build two equal-weighted baskets of stocks – one for high street stocks, one for luxury stocks.

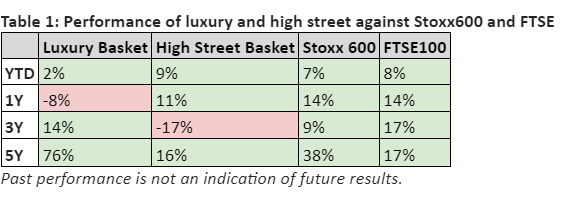

The data shows that luxury stocks have significantly outperformed high street names over the last five years, generating more than quadruple the returns (76% vs 16%). The luxury basket also comfortably beats the performance of key global indices, generating double the returns of the Stoxx 600 over the last five years and four times the FTSE 100 (See table 1).

In the last year however the trend has started to reverse. The high street basket is up 11% from 12 months ago, whilst the luxury basket is down 8% – both have underperformed the Stoxx 600 (+14%) and FTSE 100 (+14%) in this time.

Leading the high street recovery is UK stalwart, Next, with its share price up 44% over the last year thanks to consistent earnings growth and shrewd acquisitions (see table 2). The world’s biggest fashion retailer and owner of Zara, Inditex, has also rewarded shareholders (up 36% in a year), with the firm recently delivering record profits. Other strong performers include Primark owner ABF (+27% in the last year) and Italian retailer OVS (+17%).

Commenting on the data, eToro UK Analyst Sam North said: “Make no mistake, investing is a long-term endeavour and over the last five years, those invested in luxury brands will be far happier than their peers holding shares in high street names. The luxury fashion sector was better equipped to deal with the cost-of-living crisis, with its customers less sensitive to economic uncertainty in comparison to price-sensitive high street shoppers, and LVMH and Hermès and others really capitalised on this.

“However, easing inflation and cost pressures appears to be sparking a revival amongst some of the high street’s biggest names such as Inditex, Zalando, and OVS. The picture isn’t black and white though. Brands such ASOS, Superdry, JD Sports, and SMCP have continued to struggle since the pandemic, with changes in shopping habits and fashion playing their part. Some of these struggling companies could look across the pond for inspiration from firms like Abercrombie, which have turned things around by going back to basics, cost saving, and understanding their customer better.”

In the luxury basket, there have been some strong recent performers, with France’s Hermès up 14% over the year and Italian brand Brunello Cucinelli up 18% over the same period. However, the luxury fashion basket has been weighed down recently by the poor share price performance of leading names such as Kering (-48%), Hugo Boss (-45%) and Burberry (-69%), with slowing demand in China proving a major dampener on earnings and sentiment.

North adds: “Luxury brands have been on the ropes somewhat this year, but this could all change if China’s economy begins to gather steam again. However, while a rebound in demand could offer a lifeline, it’s crucial for these brands to deeply understand their evolving customer base. Without a clear insight into shifting preferences and the nuances of the Chinese market, there’s no guarantee that recovery will be straightforward.”

- eToro’s Fashion Week basket was constructed with two equal weight indices of ten of the largest UK and European luxury and mass market fashion retailers by market capitalisation. Share price performance data rounded up to the nearest whole number. Data source: Refinitiv. Data from w/c 19/08/2024

Alternative investments Commentary » Alternative investments Latest » Equities » Equities Latest » Latest

Leave a Reply

You must be logged in to post a comment.