Oct

2022

Active vs passive investing: Use active to your advantage

DIY Investor

8 October 2022

Much has been written about the demise of active management at the hands of passive investing. Certainly, some market environments can favour passive over active but the opposite is also true, and the current backdrop may well be one in which active management can thrive – by JP Morgan Asset Management

Is passive investing better than active?

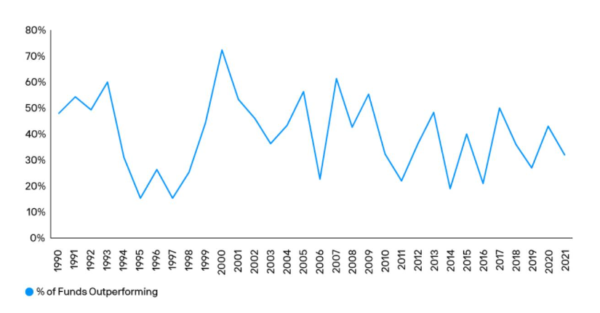

Over the last decade, the number of actively managed funds outperforming their index benchmarks has dipped. If we look from 1990 through 2009, over 40% of active funds outperformed, a high hit rate, but since 2010 that rate has declined to 34%.

US Large Cap, actively managed excess return vs. prospectus benchmark

Source: J.P. Morgan Asset Management, Morningstar. Data most recent through 31 December 2021. Analysis includes Actively Managed US domiciled US Large cap funds (Value, Growth, Core) net of fee returns versus their respective prospectus benchmarks. Historical data includes funds that are no longer active. © 2022 Morningstar. All Rights Reserved. Past performance is not a reliable indicator of current and future results.

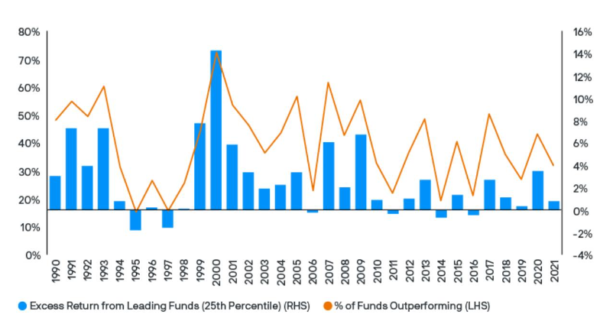

Many investors may give up the search given those odds, yet by doing so they may be foregoing a lot of capital appreciation. When we overlay the previous chart with the best performing fund managers and their alpha generation, on average these fund managers have outperformed their index by 2.6% per annum net of fees.

‘Due to the effects of compounding over time, this additional 2.6% a year can make a significant difference to portfolio returns’

Due to the effects of compounding over time, this additional 2.6% a year can make a significant difference to portfolio returns. For example, $1,000 invested in the S&P 500 at the start of 1990 would be worth $26,318 today, but $1,000 invested in the S&P 500 over the same period with the extra 2.6% a year would be worth nearly double at $55,903.

US Large Cap, actively managed excess return vs. prospectus benchmark

- Source: J.P. Morgan Asset Management, Morningstar. Data most recent through 31 December 2021. Analysis includes Actively Managed US domiciled US Large cap funds (Value, Growth, Core) net of fee returns versus their respective prospectus benchmarks. Historical data includes funds that are no longer active. Leading Funds comprise all funds that rank in the 25th percentile based on excess returns in any calendar year. © 2021 Morningstar. All Rights Reserved. Past performance is not a reliable indicator of current and future results.

Should you take a more active investment approach?

Is now the time to consider looking for an active manager in the US with a proven track record? So far this year, the trend has been much better, with 62% of active managers in the large cap blend category outperforming the S&P 500 (source: FactSet; Lipper Analytical Services; FTSE Russell; Jefferies, as of 30 June 2022).

From our perspective, it’s not a question of active versus passive, but the balancing act of active and passive. We believe the ability to take an active approach to managing individual asset classes can reap many benefits over the long-term. Investors can add significant value by:

- Selecting active managers with a track record of long-term success

- Investing in active strategies that have been able to add value across market cycles

- Taking a long-term view and compounding the benefit of active outperformance over time

![]()

Sign up to receive our investment trust emails here >

Take the long view

This is a marketing communication and as such the views contained herein do not form part of an offer, nor are they to be taken as advice or a recommendation, to buy or sell any investment or interest thereto. Reliance upon information in this material is at the sole discretion of the reader. Any research in this document has been obtained and may have been acted upon by J.P. Morgan Asset Management for its own purpose. The results of such research are being made available as additional information and do not necessarily reflect the views of J.P. Morgan Asset Management. Any forecasts, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are unless otherwise stated, J.P. Morgan Asset Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all inclusive and are not guaranteed as to accuracy. They may be subject to change without reference or notification to you. It should be noted that the value of investments and the income from them may fluctuate in accordance with market conditions and taxation agreements and investors may not get back the full amount invested. Changes in exchange rates may have an adverse effect on the value, price or income of the products or underlying overseas investments. Past performance and yield are not reliable indicators of current and future results. There is no guarantee that any forecast made will come to pass. Furthermore, whilst it is the intention to achieve the investment objective of the investment products, there can be no assurance that those objectives will be met.

J.P. Morgan Asset Management is the brand name for the asset management business of JPMorgan Chase & Co. and its affiliates worldwide. To the extent permitted by applicable law, we may record telephone calls and monitor electronic communications to comply with our legal and regulatory obligations and internal policies. Personal data will be collected, stored and processed by J.P. Morgan Asset Management in accordance with our EMEA Privacy Policy www.jpmorgan.com/emea-privacy-policy. Investment is subject to documentation. The Annual Reports and Financial Statements, AIFMD art. 23 Investor Disclosure Document and PRIIPs Key Information Document can be obtained free of charge from JPMorgan Funds Limited or www.jpmam.co.uk/investmenttrust.

This communication is issued by JPMorgan Asset Management (UK) Limited, which is authorised and regulated in the UK by the Financial Conduct Authority. Registered in England No: 01161446. Registered address: 25 Bank Street, Canary Wharf, London E14 5JP.

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.