Jul

2022

A new fund we’ve bought amid a red-hot summer

DIY Investor

19 July 2022

Saltydog deploys some of its vast cash reserves into a new sector, which is making a comeback after a tough year so far

So far, it has been a challenging year for trend investors, especially if you like to stick with conventional funds such as unit trusts and open-ended investment companies (OEICs).

There are various reasons why we favour funds. They invest in a range of different companies, which means that you are less exposed to fluctuations in the price of individual companies, and more likely to pick up on the underlying trend of the sector. You also take advantage of the fund managers who have the resources to investigate and monitor the businesses they invest in. There are lots of different funds, they are easy to buy and sell, and they are heavily regulated.

Contrary to what many people think, they are not expensive. The trail commission, which used to be built into the price, was banned years ago and if you use a fund supermarket, or discount broker, then you will not normally have initial charges or a bid/offer spread, and there is no stamp duty to pay.

From an investor’s point of view, it is also very easy to understand what you are invested in. For example, if a fund is in the UK Smaller Companies sector, then it has to invest in small UK companies. (The official definition is “funds which invest at least 80% of their assets in UK equities of companies which form the bottom 10% by market capitalisation.”)

The problem we have got currently is that stock markets have been falling this year and nearly all the sectors are trending down. We could try to find a way to “short” the markets, but that introduces a whole new level of risk and complexity, which we are trying to avoid.

Although it is not very exciting, our solution is to hold cash, and at the moment we have got lots of it. In our Tugboat portfolio, we have got only 6% invested in funds, and in the Ocean Liner 15%.

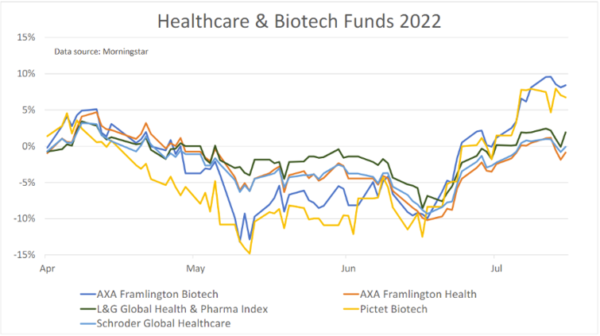

Even when most things are going down, there are usually some sectors going up. At the beginning of the year, it was natural resources and energy, and over the last couple of months it has been China. Since mid-June, we have seen healthcare and biotech funds moving up our tables.

When we reviewed the numbers last week, the Pictet-Biotech fund was showing a four-week return of 17.8% and AXA Framlington Biotech was not far behind, up 15.7%. There were three healthcare funds that had risen by more than 6%.

There are a couple of reasons why these funds are rising. During the Covid lockdowns, a lot of routine hospital work was put on hold, but it is now starting up again. There are massive backlogs, which need to be cleared, and that will drive demand for healthcare goods and services.

At the same time, many people believe we are heading into a recession and, if that is the case, governments may have to cut spending but they will try to maintain healthcare budgets. Only time will tell if this develops into a meaningful trend.

Last week, our Ocean Liner made a small investment into the Pictet-Biotech fund. Now we will just have to wait and see what happens.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.