Oct

2020

A Glimmer of Hope for UK Income Investors as Some Dividends Return

DIY Investor

29 October 2020

UK income investors have had a pretty torrid six months as companies rushing to shore up their balance sheets variously cut, cancelled of postponed their dividend payments during the second quarter earnings season – ‘Why are Companies Cutting Dividends?’ – writes Hannah Barnaby.

When BP halved its dividend – ‘Another Savage Blow to Income Investors and Pension Funds’ it came as a real blow because one of the most reliable sources of income had been cut in two; however, elsewhere companies such as ITV and Glencore cancelled their dividend payments completely.

However, it hasn’t been entirely with hope and DividendMax recently reported that packaging firm Smurfit Kappa is the second FTSE 100 company to reinstate its dividend, while diversified miner Rio and silver producer Centamin are increasing their payouts, by up to 50%.

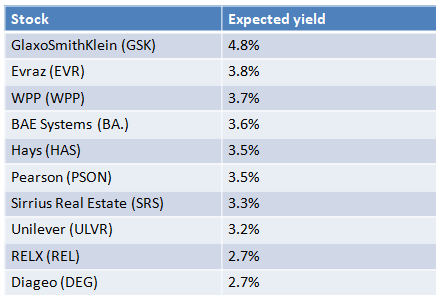

Morningstar has GlaxoSmithKline at the top of its list of companies offering decent returns with an expected payout of 4.8%.

Morningstar screens companies and filters out those without a wide or narrow ‘economic moat’ and those with a dividend cover of less than 1.25 – i.e. where payouts are only just covered by their annual profit.

The term economic moat, popularized by Warren Buffett, refers to a business’ ability to maintain competitive advantages over its competitors in order to protect its long-term profits and market share from competing firms; just 20 companies make it through this screening process.

Glaxo has benefited from the healthcare and vaccine boom in the Covid-19 crisis, and is one of a handful of notable FTSE 100 companies not to have cut payouts; however, according to Morningstar’s analysts, its stock remains undervalued.

As just one of seven companies on its list with a wide economic moat, analysts Damien Conover believes the fair value for GSK is £18, rather than the £15 it currently trades at: ‘GlaxoSmithKline has used its vast resources to create the next generation of healthcare treatments … Patents, economies of scale, consumer brands, and a powerful distribution network support GlaxoSmithKline’s wide moat,’ he said.

Why is Dividend Cover Important?

Dividend cover matters because it shows how much of a company’s profit is used to pay dividend; a ratio of 1 means that all of a company’s annual earning. A ratio of 2 is generally considered comfortable – Evraz which comes second in the table has an exceptional ratio of 6.

By contrast, WPP which was next on the list has the lowest dividend cover of 1.3 as the advertising and events giant has been hit hard by recent changes to the global economy and its shares are trading down 43% year to date; Morningstar assigns its shares a fair value of £13, compared with the current price of £6.

London Stock Exchange just made Morningstar’s list with the lowest expected yield at 0.5% but one of the highest dividend covers, at over 3; this is a pattern that is repeated across the list – companies with the highest yields have the lowest margin of safety in terms of dividend affordability.

With the country having plunged into its deepest ever recession due to the pandemic and ongoing uncertainty over Brexit, many companies are understandably choosing to prioritise cash preservation over shareholder payouts.

The Investment Association (IA) reports that the UK All Companies Sector was the worst performing in June as income investors shopped elsewhere – Focus on Funds: Income Investors Ditch UK Equity Funds.

Morningstar index strategist Dan Lefkovitz has taken a global approach to search out the companies that are maintaining and even growing their dividends, ruling out those that have cut or cancelled their pay outs; travel and hotel stocks have been kicked out of Morningstar US indices in favour of financial and healthcare companies like JPMorgan and Visa.

Explaining why growth is so important he said: ‘Dividend growth not only helps investors keep pace with inflation, but it signals strengthening corporate fundamentals. Companies that increase payouts to shareholders also tend to be competitively well-positioned.’

Commentary » Equities » Equities Commentary » Equities Latest » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.