Sep

2021

A better class of travel*

DIY Investor

29 September 2021

Sharing many features of a traditional family office, investment trusts offer ordinary investors a cost-effective solution to managing family wealth…

Sharing many features of a traditional family office, investment trusts offer ordinary investors a cost-effective solution to managing family wealth…

*Gulfstream G700 not included

A family office, particularly after the year we have just had, means different things to different people. For the less fortunate, it’s the kitchen – where mum and dad spent a large part of last year at the same table, each trying to block out the noise of the other’s zoom meeting while the children smeared peanut butter on the dog.

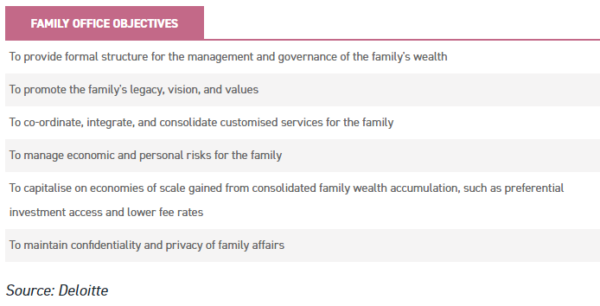

In the more traditional – and entirely more desirable – sense, the term family office covers a range of multi-faceted organisations which, at their core, provide professional assistance with wealth management, and a very high level of personal service. Deloitte has come up with six broad objectives or functions that a family office should have.

FAMILY OFFICE OBJECTIVES

Traditionally, family offices have been seen as the hub which governs the family affairs of ‘old money’, and in many cases covered all aspects of life such as HR (paying staff), facilities management (ensuring the yacht is berthed at Cannes in time for the festival), but also sophisticated and holistic investment advice.

Aside from administration, the emphasis on family office investment tends to be on the provision of sound professional advice from a dedicated team with a deep understanding of the ‘whole picture’ (including tax), but arguably more importantly, with a long-term view and an ability to consider ‘non-standard’ avenues for investment.

Sound like the sort of thing everyone should have? The drawback is that it only really makes sense from a cost perspective if you have more than $100m to play with (Source: FT).

Archegos, the ‘family office’ of Bill Hwang, perhaps over-stretches the definition, having employed huge leverage in highly speculative investments, thereby achieving the exact opposite of what family offices might be set up to achieve.

However, Archegos does illustrate the rapid proliferation of the number of family offices, with wealth inequality in major developed economies continuing to widen. Iconiq Capital is an example of the ‘new guard’ style of family office, being a secretive multi-family office, apparently, founded to look after the Facebook / Zuckerberg family wealth, with a host of other technology-related founding families amongst its clients.

However, aside from offering investment advice, Iconiq offers secrecy and the network benefits of the founding families’ involvement in the technology sector. It also has an aim to “channel capital, talent, and ideas to initiatives that advance society”.

Fundamentally, family offices are only answerable to their clients (and their unique objectives), and so performance is not comparable, nor is it typically made public. However, from an observer’s standpoint, the investment functions of a family office seem attractive.

Back to the future

In our view, many (or all) of the above characteristics and attributes are shared by investment trusts. And so it is therefore no surprise that many families have chosen investment trusts as their ‘family office’ vehicle. Investment trusts provide a structure to consolidate many members of a single family’s wealth under one roof.

They are infinitely divisible, enabling individuals to pass on or sell assets without compromising the unity that binds the family. Governance is overseen by an independent board, and economies of scale are harnessed, enabling lower costs than would otherwise be the case.

Additionally, the closed-ended nature of a trust can enable ‘non-standard’ assets to be held alongside more usual investments, and a long-term view on investment to be taken. Finally, a defining advantage over traditional family offices is that capital gains tax is rolled up over time, and only paid when an individual makes a sale of shares.

In terms of cost, Investment Trusts on average look fairly priced when compared to the costs of family offices. The UBS Global Family Office Report 2019 shows that of 360 family offices surveyed, the average “all-in” cost averaged 1.17%. By comparison, the average OCF for the entire investment trust universe is currently 1.12% (Source: JPMorgan Cazenove).

Investors in investment trusts that have ‘a family office’ feel are pinning their flag to the mast of a founding family. In this way, they will share in the benefits of having the long-term perspective of the founding family, and perhaps a different attitude to investment – focusing on the long-term ability for capital to compound.

In many cases, portfolios will be diversified across different asset classes – both private and public, and occasionally have unique legacy assets – e.g. Hansa Trust’s holding in Ocean Wilsons, or RIT Capital’s lease on Spencer House.

On the other hand, there appears to be a fairly persistent discount attached to trusts which are influenced by one or a handful of shareholders. Some might see this as an opportunity, but it is worth noting that few ‘family office’ trusts have managed to break the discount spell – the notable exception being RIT Capital.

Early adopters

Examples of families which have followed the investment trust route for their ‘family office’ investment function include the Brunner Investment Trust, which was formed from the Brunner family’s interest in the sale of Brunner Mond & Co, the largest of the four companies which came to form Imperial Chemical Industries (ICI) in 1926.

The Brunner family still own 22.66% of Brunner Investment Trust and has one member of the family on the board. Management of the trust, which has a global equity income mandate, has been assigned to Allianz Global Investors since 2002 when its previous manager, Dresdner RCM Global Investors, was merged with the latter.

Over time, as the decades have progressed, the mandate has remained broadly the same, with the most substantial change being was as far back as 1980 when BUT started to invest in overseas equities.

At the same time, the management personnel have changed over the years BUT having seen five different lead managers come and go under Allianz. BUT has traded at a persistently wider discount than peers over the years, currently 10%.

Caledonia is another investment trust, which incorporates the Cayzer family’s wish to “build wealth for generations”, with an in-house capability to invest in private as well as public market investments. The team also invest in funds to access local expertise around the world. Caledonia has net assets of £2.2bn and sits on a wide discount to NAV of 23%. The Cayzer family owns 48.5% of the company and has several seats on the board.

Over the years, several families have utilised the innovative multi-share class structure of Invesco Select, to enable long term changes in asset allocation without the need to crystalise a gain for tax purposes.

Invesco Select has four share classes, including a Global Equity Incomeand a UK share class (which recently bolstered its assets by merging with Invesco Income Growth – the combination of which we covered here). Investors in any share class can periodically convert – on a NAV for NAV basis – between share classes without a taxable event occurring. This structure proved attractive for several families selling their businesses over the years, most latterly those of Mercury Asset Management when sold to Merrill Lynch in 1997.

Perhaps the purest expression of the investment trust family office is presented by RIT Capital Partners, which has its origins as the Rothschild Investment Trust. With a significant (c. 21% currently) and continuous shareholding by Lord Rothschild’s family since listing on the LSE in 1988, it epitomises the long-term approach and ability to invest across multiple asset classes that a traditional family office usually epitomises.

The in-house management team have the freedom to invest the portfolio across multiple asset classes, geographies, industries and currencies, be it public or private, all overlaid with a macro-overview. As we discuss in our March update note, the trust has achieved its aims through several cycles, aiming to deliver long-term capital growth while preserving shareholders’ capital by participating in market upturns and aiming for reasonable capital protection on the downside.

Several investment trusts with less of a family office feel to them still have dominant family shareholdings. Perhaps, as a result, discounts on these trusts are generally wider than they might otherwise be.

This can present an opportunity, with any future dilution of the family control, potentially acting as a catalyst for the discount to narrow. Mid Wynd International and Witan both serve as examples of discounts having normalised, now that the ‘founding family’ is of less influence. Both had their roots as family investment vehicles of the Scott and the Henderson families, respectively. In both cases, the trusts have evolved, and the family shareholding has been diluted down to an insignificant percentage. Both offer differentiated approaches to global equities and have seen their historic discounts narrow.

Majedie Investments represents the historic investment vehicle of the Barlow family. The Trust offers exposure to a significant stake in the privately held Majedie Asset Management (MAM, manager of Edinburgh Investment Trust), of which the trust was a founder investor in the management company. Since then, significant shareholder value has been generated.

Alongside the MAM stake, the portfolio is allocated to various Majedie funds, many of which have been beneficiaries of a revival in the fortunes of managers who have a value tilt. The discount to NAV of 15.6% is very wide when compared to the peer group which currently trade in line with NAV on average.

New Star Investment Trust, Hansa Trust and Manchester & London also have significant family interests behind them and have founding families that still hold sway in the investment activities of each trust. The three trusts diverge in their investment objectives, with New Star employing a more conservative multi-manager and multi-asset approach and trades on a persistent discount to NAV.

Hansa has a large ‘strategic’ stake in another family-related business (Ocean Wilsons) and a diversified portfolio of funds. Both trusts trade on very wide and persistent discounts. On the other hand, Manchester and London have more of a risk-taking profile, with a concentrated portfolio of technology stocks. It saw its discount narrow over the three years to 2020. However, more recently, the discount has widened once again to c. 11%, significantly wider than the peer group average of 3.7%.

New kids on the block

Other trusts, rather than ostensibly starting as a family office, have ended up resembling one. Each of the trusts below represents very different investment propositions. Yet underlying each are highly talented individuals directing investment activities, with significant “skin in the game”, and taking a unique approach to investment.

With so much of their own capital at risk, the management teams are highly incentivised to protect and grow capital. And within the closed-ended structure, they have incredible flexibility to do so by taking a longer-term view or enable them to hold their nerve when things are going against them. At the same time, each trade on a wide discount, which – if it narrows (by no means certain) – will give an additional tailwind to NAV returns.

Tetragon Financial Group (TFG) a de-facto family office of the founding managers, who together with employees own c. 35% of the company. TFG originally launched as a listed CLO fund. TFG now invests in a diversified set of alternative assets, including bank loans, real estate, convertible bonds and event-driven equities via hedge funds.

It also invests (or is a founder investor) in the equity of alternative asset managers representing c. 33% of the portfolio. NAV returns over the long term have been consistently good, but the discount, wide before the pandemic hit markets, widened yet further and currently stands at an eye-popping 62% discount.

In our view, contributing factors to this discount is the non-voting status of the shares, dilutive share issuance and the high fees.

The lead manager of Pershing Square Holdings (PSH), Bill Ackman launched this closed-ended vehicle with $75m worth of management shares, but since launch has bought and been issued further shares so that in aggregate, Pershing Square Capital Management affiliates (including Mr Ackman) now own c. 25% of the company.

With a significant majority of his wealth tied up in PSH shares, the alignment of interest is clear for all to see but evidenced in the PSH (rather than the manager) benefitting from the warrants issued by Pershing Square’s SPAC.

Whilst not exactly well-diversified (the portfolio consists of 10 companies currently), the manager has shown an impressive ability to protect capital at market inflection points through the use of hedges. That said, this is a higher risk strategy aiming for higher returns. It currently trades on a discount to NAV of 28%.

In our view, perhaps the most interesting of the three at the current time is Third Point Investors (TPOU), which is a London listed feeder fund investing in Third Point’s Master Fund, itself run by a team led by Daniel Loeb.

The team/s investment accounts for c. 12% of the Master Fund’s assets (representing an investment worth c. $1.8bn, Source: Third Point). Their multi-asset approach across equities and credit enables Third Point to optimise risk and reward through a market cycle, towards their aim of providing consistent long-term capital appreciation.

Over the long term, the strategy has a strong track record, although in recent years TPOU has experienced periods where it has lagged equity markets. Daniel stepped back into the sole-CIO role at Third Point in Q2 2020 and is responsible for overall capital allocation across the teams.

He has described four pillars of the strategy, centring around activism, fundamental and event-driven equities, credit, and venture. Venture (or private) investments have been a strong contributor to returns this year, helped by several successful IPOs.

At 17%, TPOU’s discount remains wide and the board have a significant buyback programme that they could deploy. Additionally, the board has stated that it intends to implement two tender offers for 25% of NAV, at a discount of 2% to NAV, if in the six-month periods ending 31 March 2024 and 31 March 2027, the average discount to NAV is more than 10% and 7.5%, respectively.

With the remaining buyback facility and the conditional tenders in 2024 and 2027, there is a credible long-term route towards seeing the TPOU discount narrow towards the board’s target of 7.5%. As such, the current Discount of 17% – when combined with the measured, risk-aware approach to investing that the manager has demonstrated over the years – offers some very interesting investment properties for long term investors.

Conclusion

Investors wanting a family office of their own, but without the requisite $100m, might well consider the investment trust universe to satisfy their needs. As evidenced by the examples of wealthy families which have spotted the similarities, investment trusts seem to offer investors many of the benefits.

That said, for those families invested in them, they seem to be blighted by a derivation of the winner’s curse – that their very presence (or control) seems to mean a wider discount than might otherwise be the case.

For those who share the same broad investment objectives, these trusts, therefore, offer the opportunity to invest on a wide discount and benefit from long term compounding. The evidence suggests that if the family’s influence wanes, then the discount might narrow. However, it is probably safest to assume that it will not and be content with the progress of the NAV and dividends earned over future years.

RIT Capital is the only trust in the group that we have identified that seems to have cracked the discount problem, having at times traded on a significant premium to NAV. In our view, this proves that a ‘family office in a share’ is indeed something that investors are attracted to. Discount attractions aside, several trusts offer investors the potential to invest at a low cost alongside families who are looking for the generational preservation of wealth. Investment trust’s structural advantages provide all the tools to do just this.

Click to visit:

Past performance is not a reliable indicator of future results. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. In particular, this website is exclusively for non-US Persons. Persons who access this information are required to inform themselves and to comply with any such restrictions.

The information contained in this website is not intended to constitute, and should not be construed as, investment advice. No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not a recommendation, offer or solicitation to buy or sell or take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm’s internal rules. A copy of the firm’s Conflict of Interest policy is available on request.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority (FRN 480590), registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Commentary » Investment trusts Commentary » Investment trusts Latest » Mutual funds Commentary » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.