Mar

2021

Why I Opened Junior ISAs for My Children

DIY Investor

21 March 2021

I’ve just listened to an FT podcast about the idea of a Financial Room 101; the redoubtable Justin Urquhart-Stewart suggested we banish Junior ISAs from existence – ‘they’ll either snort the proceeds or drink them’ he said. Or words to that effect.

I have some sympathy with that view, and it’s not the first time I have heard it; nevertheless, a few years back, I opened Junior ISAs for both our young children.

It’s more than a decade until they get their sticky hands on the cash when we’ll know whether Justin was right, but one of the main reasons I did so was to force myself to teach them about finances and investing – if they end up on a spending spree on their 18th birthday, that will be my failing.

The quick and dirty on Junior ISAs

Junior ISAs (JISA) are essentially shrunken adult ISAs, introduced in 2011 to replace Child Trust Funds; when your child turns 18 their JISA automatically converts into an adult ISA, although they can take control when they are 16.

You can put in £4,368 for each child for the 2019/20 tax year and this limit generally rises at the rate of inflation each year.

Like the adult version, JISAs can be either cash or stocks & shares. You can have one cash and one stocks & shares if you wish, up to the annual limit each tax year; permitted investments are in line with ‘regular’ ISAs with the exception of P2P loans facilitated by the IFISA.

There isn’t a massive amount of information available on Junior ISAs but in summary:

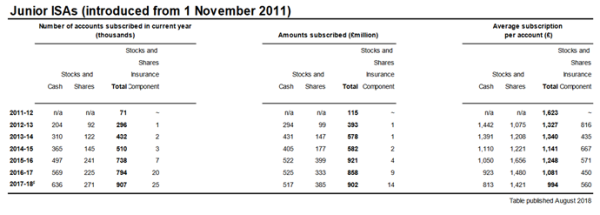

In 2017/18, fresh money was added to nearly 1m JISA accounts, with an average subscription of around £1,000. Three times the number of accounts were subscribed to in the year compared to five years earlier.

With around 14m children in the UK, nearly 1m contributing in a single year is significant; less encouraging is that the amount of new money invested has remained at £0.9bn for the last three tax years.

As of April 2018, JISAs were worth a collective £4.15bn – £1.85bn in stocks & shares and £2.3bn in cash; half a dozen Cash JISAs currently offer 3% or more, but I think more parents should be investing – keeping too much money in cash is far riskier than investing in the stock market over the timeframes we are looking at here.

Choosing a provider

You can open stocks & shares JISAs with most major brokers these days, and there are a few specialist providers as well.

Charges are generally the same as adult ISAs and because smaller sums are involved, percentage fees usually work out cheaper than fixed monthly charges; annual fees typically range from 0.15% to 0.45%. Minimum monthly and lump-sum amounts vary quite a lot, too.

What to invest in

I am happy to take some active risk with my own investments, but tend to be more cautious when making decisions for others, so I’m sticking to passive investing for now. I may switch to investment trusts later, especially if my children show some interest.

I wanted an investment that can continue on its merry way without any monitoring, should something happen to me, which means a fairly narrow choice of the larger fund providers and their global tracker offerings – mixing things up a bit, I went for Fidelity Index World which charges just 0.12% a year.

Admin fees take the effective annual charge up to nearly 0.6%, but I can live with that for now, although I’m not averse to moving providers (away from Bristol!) if the sums add up; now that exit fees seem to be on the way out, that’s becoming easier to do.

Playing fair

I put equal amounts in for both children at the same early age; it’s been a good few years for global equities so the eldest is up nearly 60% and the youngest about 25%.

I contribute a couple of lump sums rather than regular monthly contributions – I didn’t want to invest too much and I want the amount the amount they receive to be meaningful but not too tempting andlump sums give me a bit more control.

If global equities return 5-6% above inflation over the full 18 years then the spending power of our initial contributions could increase by up to 3 times.

I’m going to encourage them to keep as much invested as possible, and I might even add a bit more if they do; I expect at least some of it will go towards funding a house deposit or getting them through university.

If they do spend it, my plan involves lots of sulking and a few beers (for me, not them), but it is their money and I do want them to be responsible for what they do with it.

Alternatives to Junior ISAs

JISAs aren’t the only way to go of course – you can open taxable accounts in a child’s name or even Junior SIPPs.

I plumped for JISAs rather than SIPPs as I wanted to see them benefit from the money while I still had a few marbles left; plus, I suspect the ISA regime is marginally less likely to be fiddled with by the government.

You get more control with a taxable account but I’ve learned from my own investments how valuable ISAs can be as tax shelters; even though you might not think you’ll benefit when you first set them up, it’s amazing how investments can compound over the sort of timeframe we’re looking at here.

When to tell them

It occurred to me that the one thing I haven’t really worked out is when to tell them about their accounts; I guess you could hide the post from them, given how late most teenagers tend to sleep, but that doesn’t seem right.

We’re introducing pocket money for the eldest now, as the first step in this process; they both have savings accounts as well, which they don’t know about either. That will probably be stage two.

And I guess once we are happy that’s not been an unmitigated disaster then the grand unveiling of the Junior ISAs can take place!

To subscribe visit:

Please note that I may own some of the investments mentioned above and that you can see my current holdings on my portfolio page. Nothing in this article or on this website should be regarded as a buy or sell recommendation as this site is not authorised to give financial advice and I’m just a random person writing a blog in his spare time. Always do your own research and seek financial advice if necessary!

Commentary » Investment trusts Commentary » Isas commentary » Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.