Aug

2020

445 LSE Listed Companies Have Cancelled, Cut or Postponed Dividend Payments

DIY Investor

12 August 2020

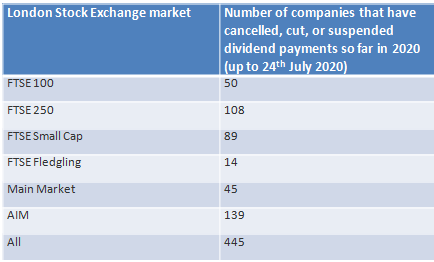

New analysis (1) from ETF provider GraniteShares, reveals that between 1st January 2020 and 24th July 2020, a staggering 445 companies listed on London Stock Exchange cancelled, cut, or suspended dividend payments.

The majority of these were AIM stocks – 139 companies – but the findings reveal 50 FTSE 100 companies have done this so far in 2020, as have 108 FTSE 250 companies.

Will Rhind, Founder and CEO at GraniteShares said: ‘Last year, dividends paid by British companies hit an all-time high or £110 billion – an increase of 10.7% on 2018.

‘The payment of dividends and reinvesting them provides a huge boost to returns over time. Indeed, £1,000 invested in an ISA at the end of 1999 would have delivered growth of £204 by November 2017, but by reinvesting all dividends and with the benefits of compounding, you would have seen growth of £1,193. (2)

‘Given the current economic crisis and the likely rise in job losses, it will be some time before we see a return to the level of dividends paid before the Coronavirus crisis started. We therefore expect to see a rise in sophisticated investors and professional investors making greater use of shorting and leveraged investment strategies to boost returns.

‘At the same time, those companies that are able to maintain or increase dividends, like Rio Tinto, are likely to be well-backed by income-seeking investors. Interestingly, our ETPs track total return indices that incorporate the dividend, multiplied by the leverage factor, into the index return.’

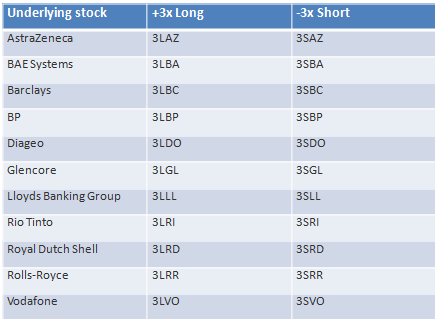

GraniteShares offers daily ETPs providing long and short exposure to a selection of major companies listed on London Stock Exchange. The list includes companies that have cut or cancelled dividends including Royal Dutch Shell, Lloyds Bank, Barclays, and Rolls Royce.

It also includes Rio Tinto, which on 29 July, announced that it was increasing its interim dividend to 155 cents, an increase of 3% over its 2019 first half dividend, and BAE Systems, which on 30 July, announced it was declaring an interim dividend of 13.8p per share in respect of the year ended 31 December 2019, payable in September, representing the value of the dividend deferred earlier in the year, as well as an interim dividend of 9.4p per share for the half year ended 30 June 2020.

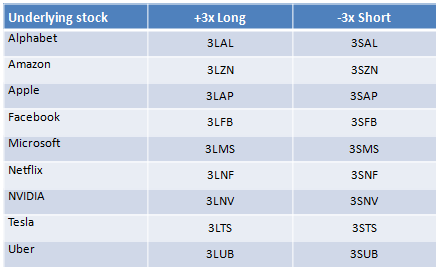

At the beginning of July, GraniteShares listed on London Stock Exchange long and short daily ETPs on popular U.S. technology stocks – see: ‘Short and leveraged exposure to US tech giants for sophisticated investors’

GraniteShares Short and Leveraged Single Stock Daily ETPs on UK companies

GraniteShares Short and Leveraged Single Stock Daily ETPs on US technology companies

Notes:

- GraniteShares analysis of data from dividenddata.co.uk

- Schroders, 7th March 2018. https://www.schroders.com/en/uk/adviser/insights/markets/how-reinvesting-dividends-has-affected-isa-returns-since-1999/

Click to visit:

Leave a Reply

You must be logged in to post a comment.