Apr

2024

25 years of ISAs – how much could an investor have made tax free?

DIY Investor

5 April 2024

It’s a happy 25th anniversary for ISA investors on the 5th April! – by Rob Morgan

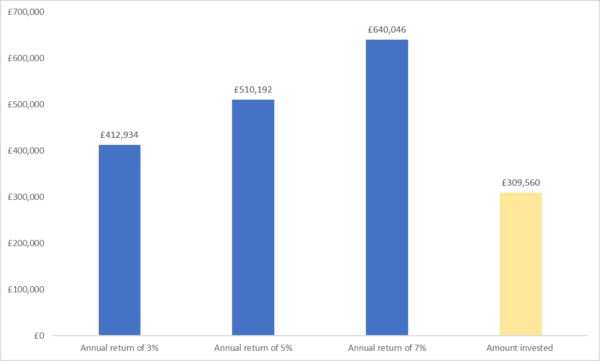

Since their introduction, an investor could have contributed over £300,000 to these valuable tax efficient allowances by utilising the maximum available each tax year.

If someone were able to do so, they would have needed a growth rate of about 10.6% a year to reach the magic £1m today. This would only have been achievable through taking a high, and possibly unrealistic, level of risk. The average annual return from global equities over that period is 7.3%.

While joining millionaires’ row from ISAs alone hasn’t quite been possible, some older investors have managed it, generally through utilising the forerunners to ISAs, PEPs, which began in 1987. PEPs were later merged into ISAs.

Yet building a substantial tax-free pot has still been achievable through patiently staying the course and consistently contributing as much as possible. Here’s how much could have been accumulated in this tax-free wrapper by investing the full allowance each year since they were introduced.

Why are ISAs an investor’s friend?

Simple, flexible and tax efficient, Stocks & Shares ISAs stand out as a home for investments, offering you freedom to invest how you choose.

A Stocks & Shares ISA is an investment account that allows you to shelter money from tax (up to £20,000 per year) and invest in shares, funds, investment trusts and more. Vitally, any returns you make on your investments are completely tax-free.

As high inflation risks eroding the value of cash in the UK, investment ISAs serve as a popular alternative to the more commonly known Cash ISAs. Simply put, a Stocks & Shares ISA will give your money the chance to grow faster than inflation through returns or gains on your investments. Think of them as a wrapper around your investments that prevents bites being taken out by tax, so you get to keep more of your returns.

Remember, the ISA is a ‘use it or lose it’ annual allowance that can’t be carried over to the next tax year. If you don’t utilise it before the end of the tax year on 5th April, it will be lost, resetting on 6th April.

How do you maximise the potential of ISAs?

The size of any portfolio is a function of two things: how much is put in and the return generated. With many demands on our money, it may not be realistic for many people to use their full ISA allowance each year, but the more you save and the earlier you do so the better.

To maximise the potential of ISAs it’s usually best to stick out tough times, stay invested and keep adding. As a patient investor with a long-term horizon, time is on your side. Leaving money untouched and reinvesting returns is crucial to allowing the magic of compound interest – earning interest on your interest – to take effect.

Being too reactionary and trading in and out of the stock market over the short term can be unwise – even if political or economic reasons seem compelling. Not only are outcomes unpredictable, but so are their effects on financial markets.

How has the ISA allowance changed?

ISAs have changed a lot over the years. When they were introduced in 1999 the limit for a Stocks & Shares ISA was £7,000. Alternatively, you could have two ‘mini’ ISAs, one for shares and one for cash, of £3,000 each. Today you can split a larger allowance of £20,000 in the proportion you want between the ISA types. The allowance has been £20,000 since 2017/18.

ISA allowances over the years:

| Year | Allowance (£) |

| 1999/00 | 7,000 |

| 2000/01 | 7,000 |

| 2001/02 | 7,000 |

| 2002/03 | 7,000 |

| 2003/04 | 7,000 |

| 2004/05 | 7,000 |

| 2005/06 | 7,000 |

| 2006/07 | 7,000 |

| 2007/08 | 7,000 |

| 2008/09 | 7,200 |

| 2009/10 | 10,200 |

| 2010/11 | 10,200 |

| 2011/12 | 10,680 |

| 2012/13 | 11,280 |

| 2013/14 | 11,520 |

| 2014/15 | 15,000 |

| 2015/16 | 15,240 |

| 2016/17 | 15,240 |

| 2017/18 | 20,000 |

| 2018/19 | 20,000 |

| 2019/20 | 20,000 |

| 2020/21 | 20,000 |

| 2021/22 | 20,000 |

| 2022/23 | 20,000 |

| 2023/24 | 20,000 |

Leave a Reply

You must be logged in to post a comment.