Apr

2018

Thoughts from SaltyDog Investor

DIY Investor

4 April 2018

The automobile pioneer Henry Ford is thought to have said, “If I had asked the people what they wanted, they would have said faster horses”.

The automobile pioneer Henry Ford is thought to have said, “If I had asked the people what they wanted, they would have said faster horses”.

I use the above quotation as an illustration of how difficult it is for the majority of people to know what is around the corner waiting to become the next trend in technology.

It would seem that it needs individuals to take up a cause in order that sea-changes get made. Elon Musk driving us towards electric cars and storage batteries is perhaps one example. Jeff Bezos pushing the Western World to purchase on-line from his Amazon warehouses is another. Bill Gates at Microsoft making computers part of our lives. Steve Jobs at Apple totally revolutionising communication. The list of people and businesses changing the way we live our lives is endless.

Who today would ever think of purchasing a library of encyclopaedia with Google and Wikipedia on the scene?

Investing in this environment has meant that whilst concentrating on looking for these future trends, I have missed out on some less exciting opportunities that have been staring me in the face. What we at Saltydog have called the UK ‘Slow Property’ funds is such an example.

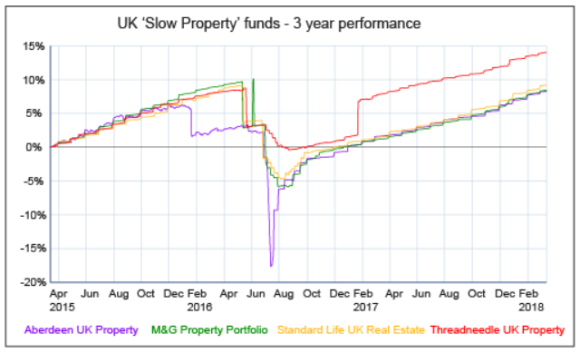

Those of you that were subscribers at the time of Brexit will remember the downward revaluation that took place in July 2016, and the pain that it caused to those of you who, like me, were using this sector as a substitute for cash. At the time I did not understand that these Fund Managers had no alternative but to take this action since they needed to sell properties at potentially fire-sale rates to repay the people exiting the funds. In the event, many of these properties realised book value and the funds quickly recovered these losses. This can be seen clearly in the three year performance graph showing a selection of these funds.

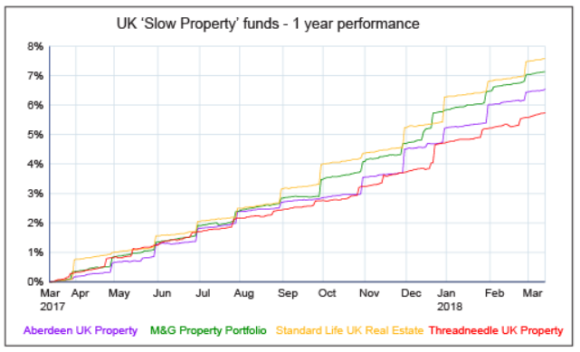

Now when I look at a one year graph I can see that the old style monthly pick-up has re-established itself and is definitely a better alternative than a cash ISA, or even cash itself.

In the last year I would have been better placed with some of my money in these funds, rather than under the bed. This time perhaps not as much as before, and spread between two or three funds.

I will then be on full alert watching out for any political bombshells as tensions escalate between us and the Russians, and the Brexit negotiations continue their meandering!

It is also interesting to observe that during last month’s 10% world correction these slow UK property funds continued upwards without interruption.

Until recently I did not realize just how much Jesse Livermore was a slave to the principles of trend and momentum. He even followed them in his personal life. His third marriage was to a lady who had previously been married four times and each of these four husbands committed suicide. Livermore kept this momentum going by also committing suicide! I wonder if she had a sixth husband.

Best wishes and good investing,

Douglas.

Founder & Chairman

Leave a Reply

You must be logged in to post a comment.