Feb

2018

Take AIM for opportunities

DIY Investor

15 February 2018

There are always money making investment opportunities waiting out in the market. It is only lack of imagination and idleness that stop us professional investment managers from taking them.

There are always money making investment opportunities waiting out in the market. It is only lack of imagination and idleness that stop us professional investment managers from taking them.

This is a fact I have needed to remind myself about in recent months. The UK can appear depressing with the Brexit debate ratcheting up to the point of angry disagreement in which everyone will be a loser and where real wages are falling.

The large consumer stocks, property companies and utilities are facing strong headwinds with a slowdown in economic activity predicted. There is also the structural challenge caused by yesterday’s strong franchises rapidly being reduced to today’s tired business models.

Think how Ladbrokes dominated the betting market only for its market share to be eaten away by the online platforms or the way an internet clothes retail business ASOS went from a start up to having a market capitalisation nearly the same as Marks and Spencer.

It is the rapid speed of change that is making some AIM listed companies such a good hunting ground for opportunities, despite the economic backdrop. ASOS had a value of a few million pounds in 2005 and it now has a market value of £5billion. It is still listed on AIM.

Many of the new, young companies on AIM will fail but this will primarily not be the fault of economy but rather their inadequacies as a business. In the same way the winners will succeed because of their own efforts and excellence of product. It is refreshing every time to meet and talk to a new young company on AIM.

For a start Brexit is unlikely to be mentioned. The successes come in many different areas of activity. A tonic water producer Fevertree and robotics company Blue Prism are two of the stars this year, while Scapa an industrial tape company and Johnson Services, a laundry business, have given very strong returns in recent years.

Success, like failure, comes in many different areas.

An interesting characteristic of Scapa and Johnson Group is that they were both once quoted on the main market. They had become problem riddled old companies. The move to AIM and new management teams meant they rediscovered their purpose and drive. This shows it is not only young companies that succeed on AIM but an old company can reinvent itself. It is the lighter regulations and lower costs that mean some companies leave the main market to join AIM and these can be important factors in their recovery plans.

What therefore is the process for finding a successful investment on AIM? Given there is no blue print for success there is no process for finding a successful investment other than doing the research. If you stay open to new ideas and then see a lot of companies already quoted on AIM or coming to AIM every so often through elements of luck and hard observation the successful investment will be found.

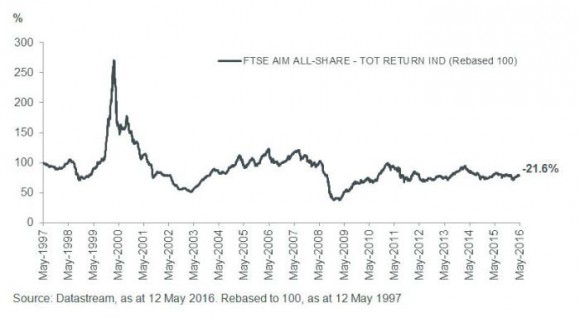

AIM has had a good year but this has not always been the case, in fact the AIM index was down from its launch in 1997 to May 2016 (See chart below).

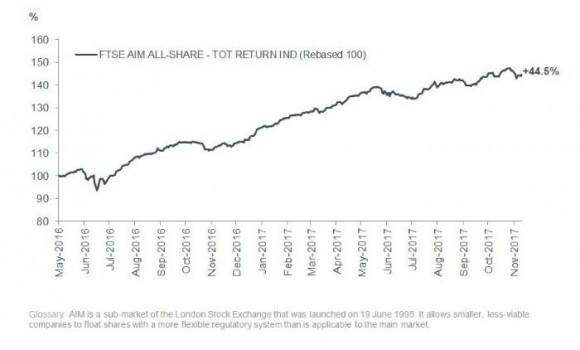

The reasons for this were that investors had chased fashion. There were too many tech companies in the early days with absurd valuations that proved to be businesses of no value and then there was a mining boom when then hype did not match the reality resulting in heavy losses for investors. These two events dragged down the AIM returns. The returns since the nineteenth year anniversary have seen substantial growth driven by a diverse range of stocks (See chart below).

Source: Datastream, as at 21 November 2017. Rebased to 100, as at 12 May 2016

There will be many disappointments but the next generation of dynamic UK companies that will play their part in driving the UK economy forward, regardless of Brexit and politicians, can be found on the over one thousand companies that are on AIM. AIM can therefore play an important part in a well balanced portfolio.

Past performance is not a guide to future performance. The value of an investment and the income from it can fall as well as rise and you may not get back the amount originally invested.

The information in this article does not qualify as an investment recommendation.

For promotional purposes.

Alternative investments Commentary » Alternative investments Latest » Commentary » Equities Commentary » Henderson Partner Page » Investment trusts Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.