Feb

2023

Financial education – Money lessons for children

DIY Investor

26 February 2023

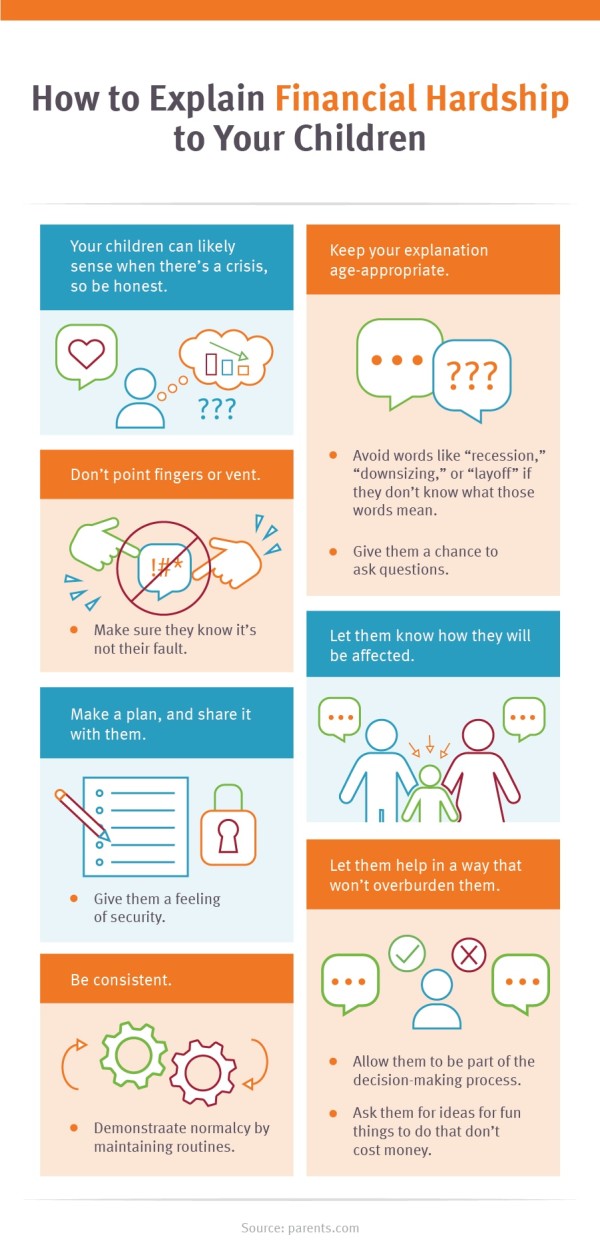

After a layoff in late 2015, finances became tight. My wife and I took on consulting jobs to keep the lights on, but in early 2017, I was completely out of work for a time.

When our daughter complained about not going out to eat as often, or doing as many fun activities, we had to talk to her about the effects of jobs and money. We tried to clearly demonstrate how many advantages she’d had to date, as well as how important cash flow is to getting the things you want.

Now that things are back on track, she better understands conversations about give and take when making financial decisions: why we buy a certain brand of food, or why we choose to purchase something that’s good enough, rather than the very best. When we have conversations and price comes up, she can vocalize and rationalize to herself about how to make these kinds of decisions. Now, for birthdays and other gift-giving occasions, even if the money is coming out of our pockets (not her piggybank), we give her a budget with which to work. It’s our goal to make sure she knows the value of money, as well as how to weather financial hardships.

Ideas for Teaching Children the Value of Money

When the subject is posed to you, “What is the best way to do X for children,” I think the worst thing you can do is to react with hubris and believe you actually know the objective answer. Children, like adults, are uniquely multifaceted, with different learning styles, and we have varied methods of teaching. When I was organizing my thoughts for this article, I posted this question to my friends on Facebook: “What are the best things your parents did to teach you the value of money, and how to be responsible with it?” I followed that up with another question that asked parents what they’d tried and had success with when teaching their kids these lessons.

I ended up with several takeaways and new ideas. The first thing I learned is how few people actually had any kind of formal training or education on finance. In many schools, financial discipline, budgeting, and otherwise living as an adult with fiscal responsibility isn’t really addressed outside the home, at least not for people in my generation.

Second, the people who seem to have grown up with the most financial discipline seem to be those from economically disadvantaged situations. They saw firsthand the situations their parents were in, and either learned from how hard the parents worked to make it better or, interestingly, from their mistakes or inability to handle money responsibly.

Different families had insight not just about whether or not kids should receive an allowance, but also in the application of it. Most who had strong feelings about how they were raised indicated they were paid for doing projects, and household chores were more of an expectation for members of the family. Those with allowances differ as to why and how much.

One woman’s father gladly lent her money whenever she wanted it; however, the loan always had a high interest rate, and a signed contract was required. If she wanted $20 to go to the mall, she’d get the $20, but at a 20 percent interest rate, compounded daily. She learned very quickly the basics of debt and interest, and to be judicious in how she borrowed and how she spent.

Like many people of my generation, my most important lessons about money weren’t learned in school. In fact, outside of learning about denominations and visiting the U.S. Mint on a field trip, I don’t think I learned much about finance at all from any formal education. Honestly, it wasn’t until I saw Hamilton this year that I had any idea that Alexander Hamilton formed our financial systems.

In college, I learned the hard way that credit cards actually incur real debt; they’re not magical money trees. I also learned that not being able to pay those debts responsibly can have far-reaching consequences beyond just getting declined at the register.

Financial Wisdom in Our Culture

In the United States, cash as a medium of currency is disappearing. I couldn’t tell you the last time I handled a dollar bill. I doubt I would need more than 10 fingers to count the number of times I’ve had a cash transaction this year. We use credit cards, debit cards, Apple Pay, VenMo, and PayPal, all manner of ways to pay and take payment for goods and services. Learning the value of money today is a different conversation than it was four years ago (when Apple Pay launched), 20 years ago (when PayPal was founded), or 70 years ago (credit cards were invented in 1950).

With more choice comes more responsibility. Harnessing financial discipline is key to preparedness, but while we as a culture could stand a significant heaping of discipline, I don’t believe becoming a modern miser in the mold of a depression-era patriarch is the best course of action, either. As with most things in life, moderation is key. In my opinion, saving every penny all your life, living in fear of debt, and not spending enough to enjoy the experiences available to you isn’t really living.

Putting Lessons into Practice

It’s a staple bordering on a trope that parents want their children to be better than they are. Smarter, wiser, more skilled, happier, more stable, more successful. This is certainly the way we are in my house, and my 7-year-old is primed to be the first computer programmer-architect-missionary-Earth President-astronaut-fashion designer who sometimes sings in off-Broadway productions. With that career path, our hope is that she’ll never have to worry about providing for herself or her own family. However, since we’ve already walked her through the experience, she has the knowledge she needs to get through her own financial difficulties.

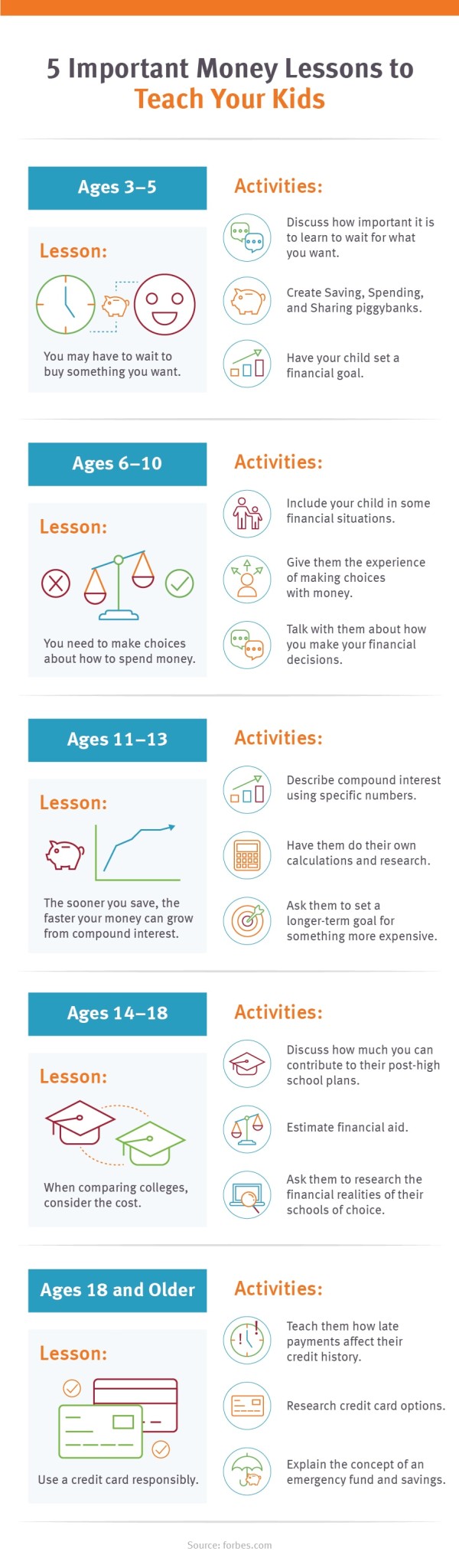

To help make the lesson stick, we decided to follow our friends’ lead: At a young age, they gave each of their kids, as a gift, a bank with three compartments. The compartments were labeled Save, Spend, and Share. Following their example, we bought our daughter a bank and showed her that when she received money as a gift, we needed split it equally between the three compartments. “Spend” money is for anything she wants when she wants it, though with a bit of parental consulting on good choices. “Save” is for larger items, such as a Lego set with a $20 price tag. The Share compartment is for charity or gifts. She has contributed to food drives and Toys for Tots, for example.

When putting money into Save, we try to set attainable goals. If the goals are too inexpensive, nothing is learned. Too far out, and it becomes hard to visualize.

When our daughter was three, we split the money for her. As she’s aged, we let her decide where the money goes, and what her goals will be. Of course, she’s not a financial wizard yet, so we give her some coaching along the way. This hands-on lesson is helping her understand how to use money responsibly.

The Best Way to Teach your Kids the Realities of Money

After being a parent for seven whole years, I think the biggest lesson I’ve taken away is that I am not an expert at being a parent. I’ve found that as much as I love my child, my job is not to ensure that she’s happy with me all the time, but to raise a responsible young woman and do the best I can to give her the tools with which to make good choices. This includes skills in critical thinking and exposure to multiple schools of thought.

In turn, it requires that I keep learning, and keep asking questions. I don’t have a definitive answer to give you on the single best way to teach kids about the value of money, or how to help them learn about financial hardship, but I do have what I think is a great, solid approach: Ask around. Ask your friends, your family. Talk to the people who you feel are the best money managers and ask them what lessons they remember. Find parents you respect, or the parents who have kids who are turning into responsible humans.

For me, it’s not what my mother tried to teach me, but the mistakes I made that gave me the best tools to manage money today. I try to demonstrate to my daughter that while I may seem wise and omniscient, I still make mistakes. I still fall into unfortunate circumstances. We all do. While you can learn from how you got there, the fact is that these circumstances will likely also happen to you. You have any number of choices you can make once you’re dealing with a tough financial situation. It’s how you think about options that will determine how successful you will be.

We’ve given my daughter an allowance for the last couple of years, but thanks to writing this article, I’m likely going to try a different approach going forward. After all, the best way to teach your kids about money may be to keep changing how you teach.

Leave a Reply

You must be logged in to post a comment.