Aug

2020

August Market: The UK Stock Market Almanac

DIY Investor

5 August 2020

Stephen Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again.

Eckett’s fascinating reference book may have you scratching your head in search of a rational explanation for what is presented, but one thing is for sure, you’ll return to it again and again.

Market performance this month

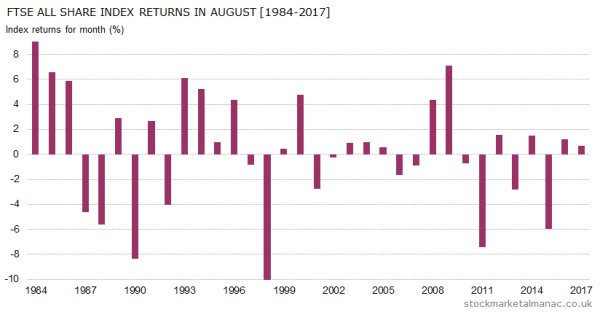

The UK equity market has displayed a rather odd behavior in August since 2011: alternating mildly positive returns for the month in even years, with large negative returns in odd years. However, that pattern broke down last year, in 2017, when the market had a small positive return (0.7%) in an odd year.

Besides that odd pattern, as can be seen in the chart, apart from the anomalous years of 2008 and 2009, since 2000 even when the market does rise in August, the returns are small.

The average August

From 1970 the average return for August of the FTSE All-Share index has been 0.7%, with 63% of years seeing a positive return in the month. But since 2000 the performance has declined and the average return has fallen to zero. As a result, August now ranks ninth of all months of the year.

Sectors

The strongest sectors in August in the last ten years have been: Oil Equipment Services and Distribution, Gas, Water and Multiutilities, and Software and Computer Services. While the weakest sectors in the month have been: Fixed Line Telecommunications, Mining, and Oil & Gas Producers.

Companies

Over the last ten years the FTSE 350 stocks that have tended to perform well in August have been: Fisher (James) & Sons [FSJ], Petrofac [PFC], and Synthomer [SYNT]. Those first two stocks have seen positive returns in August in nine of the past ten years. By contrast, the FTSE 350 stocks that have tended to perform poorly in the month are: Standard Chartered [STAN], Rio Tinto [RIO], and Vedanta Resources [VED]. Rio Tinto has fallen in every August since 2007.

Leave a Reply

You must be logged in to post a comment.