Jan

2026

Why Latin America funds are on a hot streak

DIY Investor

30 January 2026

Saltydog Investor reflects on the resurgence of a niche market

Brazil’s stock market index, the Ibovespa, rose by 8.5% last week, taking its month-to-date gain to 11% and extending the momentum built up over the course of last year.

After a difficult 2024, when it fell by 10%, the Brazilian market recovered strongly in 2025.

Global interest rates had started to ease and investors were turning back towards emerging markets in search of higher returns. The index ended the year up 34%.

Overseas investors would have seen even larger gains as Brazil’s currency, the real, strengthened against the US dollar and, to a lesser extent, against the pound and the euro.

That recovery was reflected more broadly in our sector analysis. The Latin America sector was the best-performing Investment Association sector in 2025, with an average return of 38.9%.

Individual markets

Most of the major markets in the region enjoyed a strong year.

Brazil is the largest economy and accounts for around 60% of the MSCI Emerging Markets Latin America index.

Mexicohas the next largest weighting, and its main stock market index, the IPC, also rose by around 30% in 2025. Stock markets in Chile, Peru, and Colombia did even better.

The Latin America sector is one of the newer Investment Association groupings. It was introduced in 2021 as part of a broader restructuring of the Global and Specialist equity sectors and is reserved for funds that invest at least 80% of their assets in Latin American companies.

Latin America itself is made up of more than 30 countries.

These include around a dozen in South America, such as Brazil, Argentina, Colombia, Peru, Venezuela, and Chile; seven in Central America, (Mexico, Guatemala, Honduras, El Salvador, Nicaragua, Costa Rica and Panama) and a number of Caribbean nations, such as Cuba, Haiti, the Dominican Republic, and Jamaica.

The funds

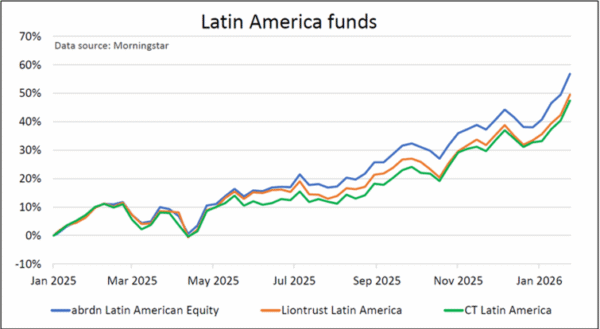

We only track a small number of funds in the Latin America sector, abrdn Latin American Equity A Acc (B41QSW2), Liontrust Latin America C Acc GBP (B909HH5) and CT Latin America Z Acc GBP (B8BQ6V5). These tend to be heavily weighted towards Brazil and Mexico, with some additional exposure to the United States.

Given President Trump’s early tariff actions against Mexico, his tough stance on illegal migration, and his use of tariff threats as leverage over border security and drug trafficking, it would have been reasonable to expect the region to struggle.

The introduction of a universal 10% tariff on ‘Liberation Day’, alongside higher reciprocal rates, increased short-term volatility. However, swift bilateral negotiations secured exemptions for key exports, including agriculture, energy, and metals, which helped to restore investor confidence.

Mexico’s market benefited as nearshoring accelerated, boosting financial and industrial stocks as manufacturers shifted production away from tariff-affected parts of Asia to take advantage of the United States–Mexico–Canada Agreement. Brazil, Chile, and Peru also benefited from rising commodity prices, while Brazil had the added tailwind of a 14% appreciation in the real against the US dollar.

This year has started well. Commodity prices, currency strength, and more favourable tariff terms could continue to support the region in the short term. However, US policy remains unpredictable, and there are signs that the commodity cycle may be moving into a later phase.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.