Jul

2025

Waiting for Godot

DIY Investor

10 July 2025

We ask what scenarios could finally see UK equities recover…by Jean-Baptiste Andrieux

The first act of Samuel Beckett’s play Waiting for Godot opens with two men, Vladimir and Estragon, talking by a tree. Through their conversation, it is revealed that they are waiting for a man named Godot – someone they are unsure whether they have ever met or if he will ever arrive. While waiting, they discuss various topics, encounter a traveller and his servant, and later meet a messenger boy who announces that Godot will not come today but will likely arrive the next day. Vladimir and Estragon consider leaving but ultimately decide to stay, leading into the second act, which largely mirrors the first, featuring the same setting and a similar sequence of events with slight variations. The messenger boy returns with the same message: that Godot will not come today but surely tomorrow. The play ends unresolved, offering no clarity about who Godot is or whether he ever arrives.

Beckett always remained evasive about who Godot is or what he is meant to represent, leaving room for readers’ interpretations. These have ranged from existentialist readings – where Godot is seen as an allegory for humanity’s search for purpose and meaning in life – to religious ones, with Godot as a metaphor for a messianic figure.

Since there is no definitive answer to Godot’s identity or to what he represents, we decided to offer our own interpretation – seeing him as the long-awaited recovery of UK equities. Here we imagine three possible scenarios for a hypothetical third act, in which Godot (i.e. the long-awaited recovery) finally appears.

Policy shifts

One scenario would involve the UK government – backed by a strong majority and a long runway before the next general election – taking decisive actions to revitalise the UK equity market.

Such measures could include incentivising pension funds to increase their allocation to domestic stocks – for example, through additional tax reliefs or reduced regulatory constraints – for those meeting a domestic investment threshold. A more radical approach would be to mandate that pension funds allocate a greater proportion of their assets to UK equities. While likely to be controversial due to potential conflicts with fiduciary duties, such a move would create more demand for UK equities and could help restore historical allocation trends. For instance, in 2012, defined contribution pensions held 40% of their listed equity exposure in UK shares, compared with just 8% in 2023. Incentives to increase investment in UK equities could also be applied to Stocks & Shares ISAs – for example, by mandating a minimum allocation to UK assets, which is arguably similar in spirit to what the now-defunct British ISA offered.

To enhance the attractiveness of UK-listed companies, the government could consider reducing or eliminating stamp duty on UK equity transactions. While the 0.5% charge per transaction may seem modest, it adds to the overall cost of investing and means UK investors are charged for investing in their home market but not for investing overseas in markets such as the US, Australia, and Germany, where no such tax exists. Cutting or scrapping stamp duty could also benefit investment trusts. As UK-listed entities, their shares are subject to stamp duty – unlike open-ended funds.

In addition, measures aimed at boosting economic growth – which the current government has labelled its ‘number one mission’ – could ultimately benefit UK equities. If successful, such policies could lead to higher corporate earnings, increased dividends, and stronger investor confidence, potentially driving greater demand for UK stocks, with companies more focused on the domestic economy likely to benefit the most. Interestingly, several constituents of the AIC UK All Companies sector have tilted their portfolios toward domestic revenues, offering exposure to a potential improvement in the UK economy. Take Mercantile (MRC), for example: its exposure to domestic revenues currently stands at around 60%, notably through construction-related and homebuilding stocks. Fidelity Special Values (FSV) also has significant exposure to the UK economy, with nearly 40% of the revenues of its portfolio companies generated within the UK (versus about 25% for the FTSE All-Share Index) – notably through housing-related names and businesses tied to UK consumers’ discretionary spending.

Efforts to improve trade relations with key markets could also support UK equities by giving companies – at least in sectors covered by trade agreements – a competitive advantage over foreign competitors. For example, the UK signed trade deals with both the US and India this year, granting preferential access to its companies, albeit in selected industries, in the world’s largest economy and one of the fastest-growing. If the UK government manages to further secure privileged access to key markets, this could bode well for UK large caps, with around 75% of FTSE 100 Index revenues generated overseas.

Lower interest rates

Godot could also take the form of lower interest rates, with the Bank of England having entered a rate-cutting cycle beginning with its first cut in August 2024, followed by three additional reductions. As yields on cash-like instruments would decline in a lower rate environment, dividend-paying equities could become more attractive, offering both income and potential capital appreciation. This scenario could provide a tailwind for the UK equity market, which remains a fertile hunting ground for dividend-paying stocks. For example, the FTSE All-Share Index currently offers a yield of 3.6%, nearly twice that of the FTSE World Index.

However, in our view, the AIC UK Equity Income sector offers a range of options that may be more compelling than simply buying the index for investors seeking exposure to dividend-paying UK stocks, as they can offer higher yields than the market and/or a strong track record of dividend growth. This includes Aberdeen Equity Income (AEI), which boasts one of the highest yields in the sector – around 6.5% at the time of writing – and a record of 24 consecutive years of annual dividend growth. City of London (CTY) is also a strong option for income investors, with the longest dividend growth track record among investment trusts at 58 years and offering a 4.4% yield, higher than the broader market. We think it is interesting that discounts on a number of UK equity income trusts have come in over the past year as rate cuts have become embedded.

JPMorgan Claverhouse (JCH) could also be an attractive option for income investors, boasting a 52-year track record of annual dividend increases, an above-market yield of 4.5%, and currently trading at a c. 5% discount. The managers – Anthony Lynch, Katen Patel, and Callum Abbot – target high-quality companies with strong balance sheets, resilient earnings, and durable competitive advantages, seeking opportunities across the market-cap spectrum. This results in a portfolio exhibiting a mid-cap bias, which, in our view, differentiates JCH from traditional equity-income strategies. We published an updated note on JCH just a few weeks ago.

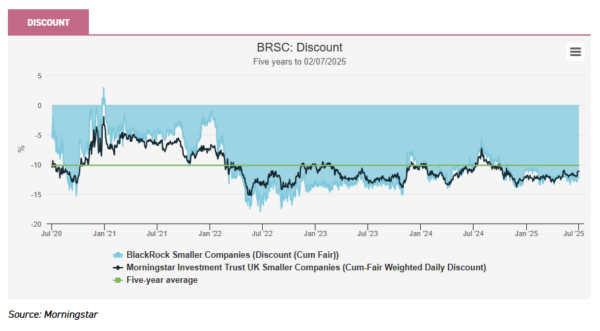

UK mid- and small caps could also be beneficiaries of a more accommodative monetary policy. Lower borrowing costs would be supportive, while a reduced discount rate could increase the present value of future cash flows, which might be particularly beneficial for less mature small caps whose earnings are expected further into the future. In this context, we believe investment trusts in the AIC UK Smaller Companies sector could be attractive propositions, with the sector currently sitting on an average discount of around 11%.

In particular, we think BlackRock Smaller Companies (BRSC), currently trading at a 12.2% discount could offer an appealing mix of recovery potential in UK small caps through a portfolio of what manager Roland Arnold identifies as high-quality companies, alongside the potential closing of the discount. Furthermore, the trust boasts a track record of 22 consecutive years of dividend growth and offers a yield of c. 3.4%.

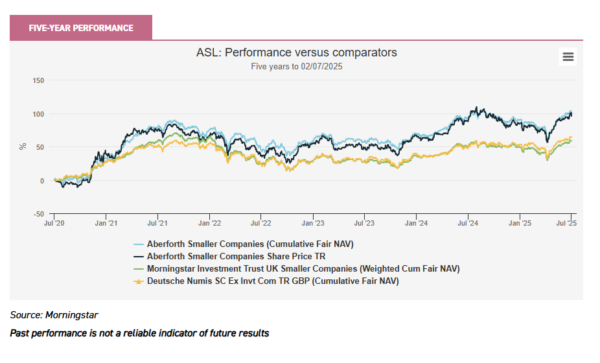

Similarly to BRSC, Aberforth Smaller Companies (ASL) is trading at a double-digit discount of 11.6% and has a strong track record of annual dividend growth, having increased its dividend for 14 consecutive years. ASL differentiates itself from many other UK small-cap strategies through its focus on companies trading at depressed valuations due to what the management team view as temporary or cyclical factors. They believe these share prices will recover as good operating performance is recognised by other investors or market conditions improve. This approach has delivered strong long-term outperformance, with ASL generating NAV and share-price total returns of 100.6% and 95.7% respectively over the five years to 02/07/2025, compared to 64.4% for the Deutsche Numis Smaller Companies ex Investment Companies Index. We discussed recent performance in our new note published last week.

Corporate self-help

A third scenario that could lead to a recovery in UK equities is investors recognising the self-help efforts undertaken by UK-listed companies to reward shareholders, alongside further corporate events that could drive higher returns.

As discussed in our previous article, ‘A new Jerusalem’, many UK-listed companies have been repurchasing their own shares on a significant scale, which can support share prices by increasing earnings per share and signalling confidence to the market. Schroder UK Mid Cap (SCP) provides a strong example of this trend, with 20% of its portfolio companies currently running active buy-back programmes. Combined with UK companies’ efforts to increase dividends, this could lead to higher total returns that investors may eventually recognise. This could be described as a scenario in which the extreme value is itself the cause behind the recovery. A market-wide rise in share buy-backs has also extended to investment trusts, which have been actively addressing discounts, as we discussed in last week’s strategy article. Finsbury Growth & Income (FGT) has been notably proactive, repurchasing nearly 20% of its shares in issue over the past 12 months (as of 04/07/2025).

M&A activity has also emerged as a notable trend, potentially highlighting the value on offer in the UK market, with private equity firms and corporate buyers taking advantage of low valuations to acquire UK-listed businesses. This trend may attract broader investor interest in UK equities, alongside a growing recognition that M&A can benefit shareholders. Acquirers often pay a premium over the current share price to gain control of a company, resulting in immediate gains for the target firm’s shareholders. Even if a bid fails, the target’s shares may re-rate as investors reassess its merits and recognise its underlying value.

ASL has been a notable beneficiary of this M&A activity, with 18 of its holdings having been acquired since the beginning of 2022, while takeover bids have been a significant contributor to its five-year performance. FSV has similarly benefitted, with its holdings regularly being subject to acquisition interest. Notably, four of its portfolio companies received bids in the first three months of 2025 alone.

Conclusion

While a recovery in UK equities has long been anticipated, it has yet to materialise – bringing to mind the elusive Godot. However, we believe there are tangible scenarios through which this recovery could eventually unfold. Both the current and previous governments have acknowledged the challenges facing the UK equity market and have made some attempts to encourage investment in domestic stocks. The now-abandoned British ISA, proposed by the previous government, was arguably one such step. Meanwhile, Rachel Reeves’s anticipated plan to cut the annual tax-free allowance on cash ISAs could nudge savers to invest more broadly, and some may choose to allocate more to UK-listed companies.

Our second scenario – centred on a lower interest rate environment – may already be underway, with the Bank of England having begun its easing cycle and further cuts expected. As discussed, lower rates tend to be more supportive of equities, and we think there is some evidence that high yielding UK trusts are being rewarded with a rerating. Finally, the sustained efforts by UK companies to reward shareholders – through share buy-backs, rising dividends, and ongoing M&A activity – could eventually be recognised by the broader market. That said, these scenarios are not mutually exclusive and could, in fact, unfold simultaneously, reinforcing each other.

Another recent development that could also support UK equities is the growing investor interest in non-US markets since the start of the year. This shift has been driven by concerns over the health of the US economy, the potential impact of tariffs on US businesses, and elevated valuations in the US equity market. Against this backdrop, the FTSE 100 Index has delivered a solid return of 9.5% year-to-date (to 02/07/2025), compared to just 0.1% for the MSCI World and -3.1% for the S&P 500 Index. Yet, UK equities continue to trade on lower multiples than other major markets – as the bar chart below illustrates – which could further attract investor attention.

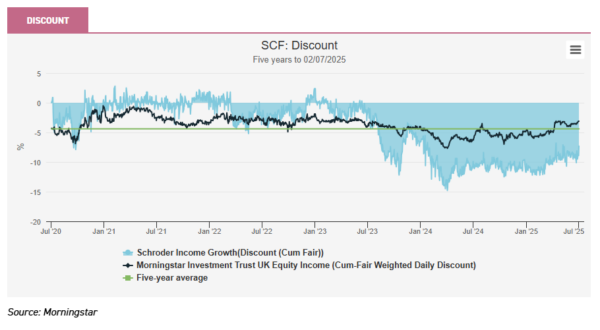

Regardless of which – if any – of these scenarios ultimately materialises, we believe investment trusts could be particularly well placed at this juncture to capitalise on a potential recovery in UK equities. For equity income investors, several constituents of the AIC UK Equity Income sector offer above-market dividend yields and long track records of dividend growth, with some also trading at discounts. These are characteristics that Schroder Income Growth (SCF) combines, offering a yield of c. 4.6%, having increased its dividend for 29 consecutive years, and trading at a discount of c. 7.3% which may indicate a possible disconnect given SCF’s long-term track record, having outperformed the FTSE All-Share Index in the past five years (to 02/07/2025).

Discounts are even wider in the AIC UK Smaller Companies sector, presenting investors with the opportunity to benefit not only from a recovery in UK small caps but also from a potential narrowing of discounts. Moreover, the closed-ended structure of investment trusts is particularly well suited to the less liquid nature of the small-cap market, as managers are not constrained by investor inflows and outflows. For investors interested in a broader approach, the AIC UK All Companies sector offers a range of attractive options, with several constituents investing across the full market-cap spectrum and many boasting a track record of outperformance. For example, MRC – which offers exposure to UK mid-caps with the flexibility to also allocate to small and large caps – has delivered NAV and share price total returns of 57.8% and 52.7%, outperforming the FTSE All-Share ex 100 ex Investment Trusts Index’s return of 51.4% over the five years to 03/07/2025, and is currently trading at a 9.2% discount.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Leave a Reply

You must be logged in to post a comment.