Apr

2025

Commentary on the S&P 500’s ‘Death Cross’ event

DIY Investor

22 April 2025

Comments from Bret Kenwell, US Investment Analyst at eToro:

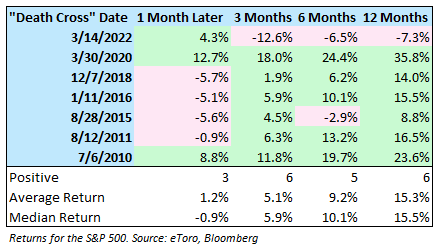

“Earlier this week, the S&P 500 entered what’s known as a “death cross,” an event in technical analysis that occurs when a short-term moving average crosses below a long-term moving average. Generally, it refers to when the 50-day moving average crosses below the 200-day, something the S&P 500 just did for the eighth time since making its Financial Crisis low in March 2009.

“As the name implies, a death cross is viewed as a bearish technical development and is often used as an indicator pointing to more downside ahead. But is that really the case? Looking back over the seven other instances since 2009, we found that one month later, the S&P 500 was lower four times with a median decline of 0.9%. However, three months later, the index was higher six times with a median return of 5.9%.

“When looking at 6 and 12 months later, the data points to a similarly improving situation where the S&P 500 was higher five and six times, respectively, with median gains of 10.1% and 15.5%, respectively.”

The Data

“Further, in almost half of the instances (3/7), the S&P 500 had already made its low for that particular pullback by the time the death cross had occurred. (July 2010, August 2015 and March 2020). Additionally, the largest decline that occurred after the death cross was less than 7% in five of the seven instances.

“That said, not all of the data points were constructive. For example, in two instances (2018 and 2022), the index suffered a further drawdown of 11.1% and 14.5%, respectively. Additionally, in 2022, the death cross occurred on March 14th, but the S&P 500 did not bottom until almost seven months later on October 13th.”

The Bottom Line

“The most recent death cross statistics of the last 15 years aren’t necessarily bullish, but they hardly represent the frightening premonition that the name seems to imply. It’s clear that this lagging indicator did not, even somewhat consistently, show that stocks are bound to fall off a cliff. While that doesn’t mean markets can’t deteriorate from current levels due to ongoing macroeconomic issues, a technical death cross for the S&P 500 isn’t the end-all, be-all knockout that it may seem to be.”

Leave a Reply

You must be logged in to post a comment.