Jun

2025

All that glitters is gold

DIY Investor

30 June 2025

Gold’s record breaking run continues, but are investors too late to the party? By Jo Groves

I’ll be honest, I’ve always had a bit of a love-hate relationship with gold. It’s a bit, well, you know, in-your-face bling. Beloved of rappers in chunky Rolexes, interior designers in Dubai (and Edgware Road) and 1970s carpets. In fairness, I may be pushing the definition of bling with the last one but my parents have kept the faith (and indeed the carpet).

Then again, many things in life divide opinion. Is Bitcoin the genius of financial disintermediation or the emperor’s new clothes? Is Gail’s the artisanal scourge of the high street or simply a pleasant spot for a smoked salmon bagel? And let’s not get started on whether the teabag should be removed before or after the milk (my colleague Steve and I will never reach consensus on this one).

I’d also wager that gold is just as divisive on the jewellery front: you’re either team gold or silver. I’m in the latter camp but one of the (ahem) silver linings of being burgled twice in as many years is a clean slate jewellery-wise. Sadly, the same can’t be said for my insurance premium but on that note, it’s time to park the personal tragedy and meander back to the topic of investing.

A golden era

One thing that’s unlikely to divide opinion, however, is gold’s blockbuster returns. Over the past 25 years, it’s soared by almost 900%, comfortably outpacing even the poster child S&P 500’s 470% gain.

But it’s gold’s recent performance that really sparkles: not only did it hit 40 record highs in 2024 but it’s already chalked up 33 in 2025 and we’re only halfway through the year. Yes, it’s a classic safe haven asset but, even so, I’m not sure any of us quite saw this coming.

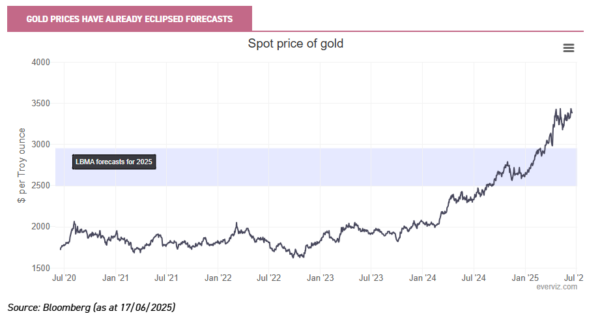

When my colleague Pascal wrote about gold a year ago, forecasts for early 2025 were around $2,600. And, as the graph below shows, the LBMA forecasts for the average price in 2025 were only marginally higher.

But gold has already powered past $3,400, with some analysts now projecting $3,700 to $3,900 by year-end, particularly if the US tips into recession.

Forecasts can, of course, be famously flaky, or as economist John Galbraith once put it, “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.”

What’s fuelling the gold rush?

It’s worth stepping back from the ‘what’ to consider the ‘why’ at this point. Gold has long been the go-to sanctuary or the ‘everything hedge’ in times of volatility. But this rally isn’t just another panic-fuelled spike, there’s a deeper, structural story in play.

Central banks are quietly diversifying away from dollar-based reserves, spurred by the ballooning US fiscal deficit, stagflation fears and the geopolitical risks of sanctions. Since the freezing of Russian assets in 2022, gold buying by central banks has surged five-fold.

And China has become one of the key buyers in recent years. It may have doubled its share of gold in total reserves to 8% but this still pales in comparison to the 70%-plus held in USD and euros.

In a further sign of intent, China recently approved a pilot program allowing major insurers to invest up to 1% of their assets in gold, a move that could inject billions into the gold market.

Retail investors also continue to lap up the shiny metal as a capital preservation instrument, with Asian gold ETF inflows now outpacing North America (which is no mean feat). With volatile equity markets, a lacklustre property market and tight capital controls, Chinese investors are turning to gold as an effective way of preserving capital and reducing domestic exposure.

That said, gold isn’t without its risks, particularly if tailwinds begin to turn into headwinds. A resolution in the Middle East or Ukraine would ease geopolitical tensions (although the current Iran-Israel conflict suggests otherwise). Higher bond yields could also weigh on prices (though gold has held up surprisingly well despite rising yields).

And while central banks are typically long-term, buy-and-hold investors (especially those focused on de-dollarisation), they may become more price sensitive if the rally continues. However, central bank demand should underpin gold prices at current levels, if not fuel further gains.

Finding the golden ticket

For those who’d prefer not to sleep with a gold ingot under their pillow, gold mining equities offer an interesting angle given they’ve lagged the rally in physical gold. Cost inflation (particularly energy and labour) has weighed on margins, but if oil prices fall as expected in 2025, that pressure could ease.

One standout performer is Golden Prospect Precious Metals (GPM) which has delivered a stellar 88% share price return over the past 12 months. A key contributor has been its high conviction exposure to smaller-cap miners such as Ora Banda and Calibre Mining where managers Keith Watson and Rob Crayfourd see compelling valuations. Despite its strong track record, GPM still trades at a 13% discount to net asset value.

For broader exposure, BlackRock World Mining (BRWM) has gold miners as its largest single exposure, alongside copper and other industrial metals. As a result, it’s well-positioned to capitalise on the structural tailwinds from the net-zero transition and demand for AI infrastructure demand, as well as throwing off an attractive 4%-plus yield.

The million-dollar question is when the current run will finally fizzle out? As we’ve seen, gold forecasting is notoriously tricky but if current geopolitical and macro issues persist, both central banks and retail investors could well make gold’s shine last a little longer.

All numbers as at 20/06/2025 unless stated otherwise.

Disclaimer

This is not substantive investment research or a research recommendation, as it does not constitute substantive research or analysis. This material should be considered as general market commentary.

Alternative investments Latest » Brokers Commentary » Commentary » Investment trusts Latest » Latest

Leave a Reply

You must be logged in to post a comment.