Jan

2026

Two obscure funds that won out in 2025

DIY Investor

16 January 2026

Saltydog Investor assesses two lesser-known portfolios that delivered the goods

Each week, we analyse the performance of thousands of funds.

Over time, certain names become familiar because they regularly feature near the top of our tables. That was broadly true again in 2025.

The leading funds, SVS Baker Steel Gold&Precious Mtls B Acc, WS Ruffer Gold C Acc and Ninety One Global Gold I Acc £, are all very well known to us. However, two less familiar funds also stood out: Barings Korea I GBP Acc and WS Amati Strategic Metals B Acc.

One of the strongest investment themes last year was the rise of artificial intelligence (AI) and the performance of companies such as NVIDIA Corp NVDA 0.00%, which became the world’s first $5 trillion (£3.7 trillion) company.

Nvidia’s success, alongside other AI beneficiaries, helped drive strong returns for many funds in the Technology & Technology Innovation sector.

That group had a difficult first quarter, partly due to concerns around US tariff policies, and fell by 11%.

However, it rebounded in the second quarter, rising by 15%, and gained a further 11% in the third quarter. Fears of a tech bubble led to a brief sell-off in November, but the sector still made a gain in the final quarter, albeit only 1.5%. It finished the year up 15.6%.

The leading fund from the Technology & Technology Innovation sector in 2025 was Polar Capital Global Tech I GBP Hdg Inc, up 43%, followed by L&G Global Technology Index I Acc, up 19.9%.

When people talk about the dominant technology firms, it is easy to focus on the US and the so-called Magnificent Seven: Apple Inc AAPL 0.00%, Microsoft Corp MSFT 0.00%, Alphabet Inc Class A GOOGL 0.00%, Amazon.com Inc AMZN 0.00%, Nvidia, Meta Platforms Inc Class A META 0.00%, and Tesla Inc TSLA 0.00%.

However, it is important to remember others such as Taiwan Semiconductor Manufacturing Co Ltd ADR TSM 0.00% and ASML Holding NV ASML 1.34% from the Netherlands. ASML is the sole supplier of extreme ultraviolet (EUV) lithography tools needed to manufacture leading-edge chips.

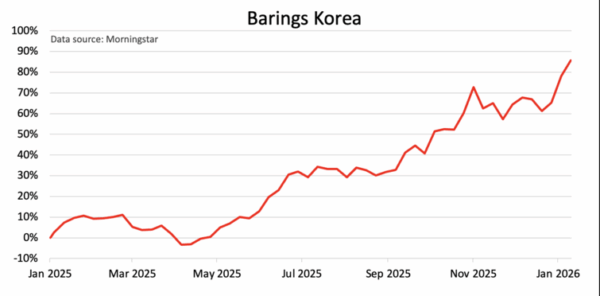

South Korea is another technology powerhouse, especially in semiconductors, smartphones, and displays. Last year, we saw Barings Korea top our tables as the best-performing fund in the second quarter, up 36%, and again as the leading fund in October, up 20.5%.

Barings Korea invests a significant portion of its assets in information technology companies and has a substantial allocation to industrials, with additional exposure to financials, consumer cyclicals, and healthcare. Its two largest holdings are SK Hynix and Samsung Electronics Co Ltd DR SMSN 2.34%, both globally significant businesses.

SK Hynix is a leading global memory-chip maker, producing DRAM and NAND used in AI and data centres. It also has around 60% of the high-bandwidth memory (HBM) market. Its parent, SK Group, is currently building South Korea’s largest AI data centre with AWS in Ulsan.

Samsung Electronics remains Korea’s largest technology company, spanning smartphones, semiconductors, displays, and consumer electronics. It is also one of the world’s most valuable brands.

Another strong trend in 2025 was the dramatic rise in the price of gold, driven by falling real yields, aggressive central bank buying, a weaker dollar, and heightened geopolitical and policy risk. At the beginning of 2025, it was trading at around $2,600/oz and it is now over $4,500/oz.

There are a handful of funds in the Specialist sector that invest in companies that mine and process primarily gold, but to a lesser extent other precious metals. They had a bumper year, with annual gains ranging from 147% to 185%.

However, although the leading gold funds all performed well in the final quarter of the year, the best-performing fund over that period was Amati Strategic Metals, with a three-month return of 32.5%.

The fund is in the Commodities & Natural Resources sector and has a wider remit. Around half the portfolio is still invested in gold-related companies, but there is also meaningful exposure to silver, industrial metals, and speciality metals.

Launched in 2021, the fund takes a broad approach to investing in what it calls strategic metals, those considered vital to the global economy and future structural shifts.

The portfolio covers gold and silver, but also base and speciality metals such as copper, nickel, lithium, manganese, and rare earths.

These materials are essential for everything from traditional industry to the technologies underpinning the energy transition.

They are also critical to AI, with rare earths used in high-performance magnets, semiconductors, and specialist alloys needed for advanced computing and data centres.

That gives the Amati fund a direct link to three of the most powerful global investment themes of the moment: the rising price of gold, the transition to renewable energy, and the growth of AI.

Both Barings Korea and Amati Strategic Metals feature in our top 10 funds list for 2025, although they fell short of the leading gold funds.

Saltydog’s top 10 funds in 2025

| Fund | Investment Association (IA) sector | Annual return 2025 (%) |

| SVS Baker Steel Gold&Precious Mtls B Acc | Specialist | 184.9 |

| WS Ruffer Gold C Acc | Specialist | 168.8 |

| Ninety One Global Gold I Acc £ | Specialist | 165.1 |

| WS Amati Strategic Metals B Acc | Commodities & Natural Resources | 162.1 |

| SVS Sanlam Global Gold &Resources B | Specialist | 155.3 |

| BlackRock Gold and General A Acc | Specialist | 147.3 |

| Barings Korea I GBP Acc | Specialist | 74.0 |

| Artemis SmartGARP European Eq I Acc GBP | Europe Excluding UK | 55.9 |

| Artemis Global Income I Acc | Global Equity Income | 45.1 |

| WS Ardtur Continental European I Acc | Europe Excluding UK | 44.6 |

Data source: Morningstar. Past performance is not a guide to future performance.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Leave a Reply

You must be logged in to post a comment.