Dec

2022

Outlook 2023, Emerging markets: can stocks perform despite slowing growth?

DIY Investor

26 December 2022

While emerging market economic growth appears set to slow in 2023, there are four factors which have the potential to support equity markets over the year…by Tom Wilson and David Rees

- Economic growth is likely to slow in 2023 owing to slower global demand for goods, a weaker outlook for commodity prices and tighter domestic policy

- Easing inflation may set the scene for economic recovery in 2024

- A pivot from the zero-Covid policy in China, global disinflation, US dollar stabilisation or depreciation and valuations may be supportive of emerging equity markets in 2023.

Emerging market economies

David Rees, Senior Emerging Markets Economist:

There are at least three reasons to think that emerging market economic growth will slow in 2023.

First, our expectation that the US will follow the eurozone and UK into recession means that global demand for goods is likely to soften. That will be a particular threat to small, open economies in Asia, Central and Eastern Europe (CEE) and Mexico that rely on exports to drive growth.

Second, while the reopening of China’s economy may lend support to demand for natural resources, slower global growth is likely to weigh on commodity prices. At the very least, this suggests that commodity-exporting EMs are unlikely to see the boosts to their terms of trade that are generally needed to drive growth. And there is a risk that this driver will go into reverse.

Third, tighter domestic economic policy will increasingly weigh on growth. Fiscal policy is generally tightening as governments look to repair the damage done to the public finances during the outbreak of Covid-19, while the lagged impact of previous large interest rate hikes will also sap demand. Deteriorating balance of payments positions mean that rates may need to rise further in parts of Asia and CEE if global financial conditions continue to tighten.

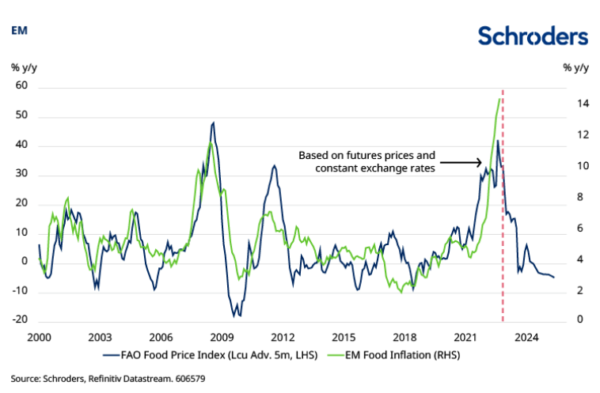

The good news, however, is that EM inflation is around its peak and should start to fall back during the course of 2023. The impact of sharp increases in commodity prices after Russia invaded Ukraine in early 2022 will start to reverse as base effects in food and energy inflation become more favourable. And a combination of tighter policy and slower growth will ultimately weigh on core pressures.

Chart 1: EM inflation to moderate in 2023

Easing inflation will start to relieve pressure on real incomes and probably allow some central banks, notably in Latin America, to begin lowering interest rates again in the second half of the year, setting up a cyclical recovery as we head into 2024.

EM equities

Tom Wilson, Head of Emerging Market Equities:

There are four potential supports for emerging equity markets in 2023:

– A move away from the zero-Covid policy in China

– Global disinflation

– US dollar stabilisation or depreciation

– Valuations that now price weak near-term earnings expectations

China: potential for rebound

China may see a cyclical recovery. The economy has been under pressure due to the zero-Covid policy and stress in the real estate sector. The former especially has impacted economic activity and impeded the transmission of policy support. China now appears to be moving to an endemic approach to managing the virus. New domestically delivered vaccines support a renewed push on vaccine penetration. A move to an endemic state will bring exit waves, but will significantly reduce the risk of persistent macro pressure.

In terms of the real estate sector, prior tightening in combination with a regulatory clampdown on developer leverage (debt) led to a crisis of confidence and a marked downturn in sales in 2022. This is not easy to fix but the authorities are incrementally adding policy support.

Headwinds remain: global growth will weigh on export performance in 2023, while the move to an endemic Covid policy will bring exit waves as herd immunity is established. However, consumption and real estate are now at a low base and a pivot away from the zero-Covid policy is giving the market greater confidence in a cyclical rebound.

Disinflation could drive US dollar weakness

We expect global disinflation (a slowing in the rate of inflation) through 2023. As rising interest rates in EM meet this disinflation, improving real (or inflation-adjusted) interest rates will provide greater support for emerging currencies, which look broadly cheap. The US dollar’s real effective exchange rate (REER) – i.e. its value compared to a weighted average of several other currencies – is expensive versus history and may continue to soften if conviction rises that the Federal Reserve (Fed) is moving successfully to re-anchor inflation and Fed expectations have peaked. A softer US dollar should allow EM currencies to recover, alleviating pressure on EM central banks and financial conditions.

Valuations are relatively cheap

The global growth outlook for 2023 is poor and questions remain as to the path of inflation and interest rates. However, valuations reflect a more difficult earnings outlook. Uncertainty and short-term earnings stress can present investment opportunities. We have begun to deploy cash into stocks where we believe valuations now offer attractive entry points. In particular, we have been adding back to technology companies in South Korea and Taiwan that offer good structural growth. Equity valuations are broadly cheap versus history and an EM currency recovery would enhance returns for US dollar investors.

The coming months may provide opportunities

The economic outlook for 2023 is weak and uncertain and volatility may remain elevated in the near term. While a number of risks remain, not least of which is geopolitical tension between US and China, markets look ahead. Valuations have improved, earnings expectations have been resetting and currencies are broadly cheap. 2023 may bring a peak in the monetary cycle and 2024 may bring better economic conditions. Recently, markets have bounced, but investors should continue to look for opportunities to add exposure in coming months.

Important information

This communication is marketing material. The views and opinions contained herein are those of the named author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds.

This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Ltd (Schroders) does not warrant its completeness or accuracy.

The data has been sourced by Schroders and should be independently verified before further publication or use. No responsibility can be accepted for error of fact or opinion. This does not exclude or restrict any duty or liability that Schroders has to its customers under the Financial Services and Markets Act 2000 (as amended from time to time) or any other regulatory system. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions.

Past Performance is not a guide to future performance. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. Exchange rate changes may cause the value of any overseas investments to rise or fall.

Any sectors, securities, regions or countries shown above are for illustrative purposes only and are not to be considered a recommendation to buy or sell.

The forecasts included should not be relied upon, are not guaranteed and are provided only as at the date of issue. Our forecasts are based on our own assumptions which may change. Forecasts and assumptions may be affected by external economic or other factors.

Issued by Schroder Unit Trusts Limited, 1 London Wall Place, London EC2Y 5AU. Registered Number 4191730 England. Authorised and regulated by the Financial Conduct Authority.

Brokers Latest » Commentary » Equities » Equities Commentary » Investment trusts Commentary » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.