Apr

2024

Investing Basics: The advantages of ETF investing

DIY Investor

2 April 2024

There are many reasons to put Exchange Traded Funds at the heart of your investing strategy when you compare their strengths with the alternatives – writes Dominique Riedl

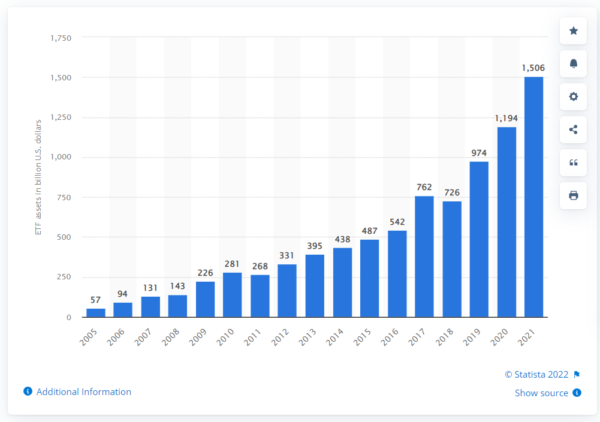

Exchange Traded Funds (ETFs) have grown popular very quickly with individual and professional investors; the number of different Exchange Traded products available to European investors has skyrocketed, and the amount of money invested in such products rose above 1.5 trillion US dollars at the end of 2021.

Total assets under management (AUM) of exchange traded funds listed in Europe from 2005 to 2021(in billion U.S. dollars)

It’s not hard to see why these innovative funds have won assets from active managers and traditional index funds, and are a good option compared to buying individual company’s shares.

Exchange traded funds are:

Easy – They can be bought and sold like any other share.

Transparent – ETFs seek to replicate the returns of a stated index, so when you invest you know you should achieve very close to that index’s returns (after costs and tracking error). Holdings are frequently disclosed.

Flexible – There are ETFs available to track everything from the entire global stock market to particular sectors, countries, or assets.

Let’s look at the advantages in more detail.

Easily traded – ETFs can be bought and sold via any cost-effective online broker that deals in shares.

Liquidity – ETFs can be traded whenever you like during normal market hours, unlike traditional funds that can only be traded once a day.

Cheap to run – Running costs are low compared to active funds (most of which fail to beat the market, and hence will lag the equivalent index tracking ETF).

Simple to understand – Investing in individual company shares is best left to the professionals, but even active funds can require a lot of research – and you’re still never sure how the manager is running your money. In contrast, ETFs aim to match an index, which makes them straightforward investments.

Wide scope – There are 800 ETFs listed on the London Stock Exchange alone, allowing you exposure to most countries, regions, sectors, and asset classes you can think of. There’s no need to feel restricted with ETFs!

Diversification – Buying an ETF gives you instant exposure to the index it follows, which may contain dozens, hundreds, or even thousands of securities. It’s a great way to get very diversified exposure to different asset classes.

Many pay an income – There are many ETFs that pay dividends from their holdings of shares, bonds, or property, and so enable you to build an ETF income portfolio. Lower costs mean more income goes to you.

Typically priced close to assets – The price of most ETFs closely reflects the value of the assets they hold. This is in contrast to investment trusts – an alternative kind of listed fund – where the trust’s shares frequently trade at a premium or a discount to their assets, which means additional risk.

Easy to research – Since you often find more than one ETF on an index, they are easy to compare. With justETF’s powerful tools you can find all the data you need about every ETF. JustETF also makes it easy to compare the cost, risk, and return characteristics of different ETFs.

Can be held in SIPPs and in ISAs – The majority of ETFs available via your online broker can be held within SIPPs and ISAs, meaning your income and capital gains are tax-free.

No stamp duty – Buying most non-AIM UK shares attracts stamp duty at 0.5% – but no stamp duty is payable when you buy an ETF.

Are ETFs always the right choice?

ETFs are worthy contenders in most situations, but there are times when other options may have the edge.

Cash – If you want to hold cash, it may be better to do so using a Cash ISA or savings account rather than a money market ETF. Deposit accounts will save you ETF dealing fees and the regulatory compensation position is clearer.

Temptation to overtrade – Many traders (including hedge funds) use ETFs. However we should acknowledge that frequent trading might be a double-edged sword, increasing costs and potentially reducing returns, compared to investing in a less flexible index fund and so perhaps finding it easier to sit tight.

Not always cheaper – Certain index funds may have lower annual charges than the ETF equivalent, though ETFs are getting ever cheaper, though. One FTSE 100 ETF costs just 0.07% a year. That’s 70p in annual costs for every £1,000 you have invested.

Certain ETFs can be very risky – Irrespective of the asset class they follow, leveraged and short ETFs have downsides that you must appreciate before you even consider purchasing them.

Illiquidity – While most ETFs are very liquid, some small or specialist ETFs may rarely trade, which can mean a costly bid/offer spread. An appropriate mutual fund may be a better alternative.

No outperformance – ETFs only aim to match the returns from an index. Putting your money with an active fund manager might do better, though numerous studies have shown few beat the market long-term.

The decisive advantage

The rise in popularity of ETFs is no accident. Most private investors will find that a portfolio of ETFs can meet all their investment needs, whether they are building up their wealth or looking to generate an income.

Of course, you must do your research. Our strategy builder and screening tools are a great way to get started.

Click to visit our friends at:

Commentary » Exchange traded products Commentary » Exchange traded products Latest » Financial Education » Latest

Leave a Reply

You must be logged in to post a comment.