Aug

2021

Five consistent funds that have doubled in three years

DIY Investor

18 August 2021

Saltydog names the funds that have dependably delivered over the past three years.

The Saltydog system is based on a proven set of algorithms that crunches all the UK fund data and presents it in a way that is designed to help private investors such as ourselves take advantage of market trends.

We have developed our own unique software and reports that analyse thousands of funds, highlighting which sectors are on the up, which are retracting, and then pinpointing the best-performing funds.

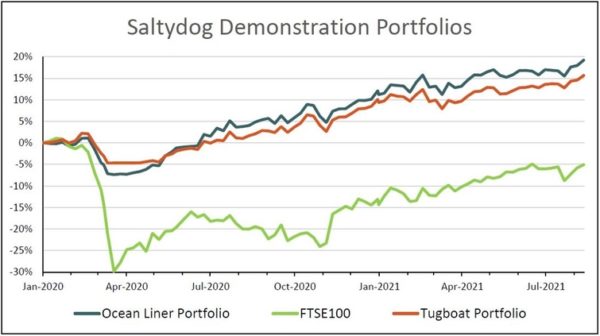

To help our members see how the data can be used, we also run a couple of demonstration portfolios, the Tugboat and the Ocean Liner.

Every Wednesday, we release our analysis for the previous week and decide what changes to make to the portfolios, which means that we can react quickly to market changes. This was particularly useful when markets suddenly fell in the first quarter of 2020, and it meant that we could quickly move into cash and then start to invest again when conditions improved. We managed to miss the worst of the stock market crash and have subsequently gone on to new record highs.

We appreciate that one of the disadvantages of the way in which we manage this portfolio is that it is fairly time-consuming. We pore over all the data and review each holding every week.

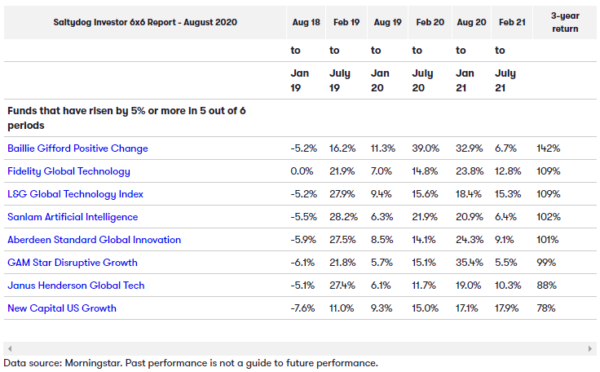

There are some people who like our momentum-driven approach, but do not feel that they can allocate the time on a weekly basis. That is why, in August 2019, we produced our first ‘6 x 6’ report. We wanted to find funds that had performed consistently well over the last three years.

To find the funds, we screen the universe for those that have returned 5% every six months over a three-year period. It is very unusual to find a fund that has managed to achieve the target in all six of the six-month periods, but we can usually find a handful that have done it five out of six times. We have just run our latest report and there are currently eight funds, five of which have also more than doubled in the last three years.

All the funds have a bias towards technology, even though they are not all in the Technology and Telecommunications sector. The leading fund, Baillie Gifford Positive Change, is in the Global sector. It has more than 15% invested in technology, and nearly 40% in healthcare (mainly in pharmaceuticals, biotechnology and medical equipment).

Its largest holding is in Moderna Inc MRNA 2.06%, an American company that focuses on vaccine technologies and has produced one of the Covid-19 vaccines. The next two largest holdings are the Dutch company AMSL, which produces semiconductor equipment systems, and then the electric car company Tesla Inc TSLA 4.02%.

The next two funds in the list are from the Technology and Telecommunications sector, and then there is the Sanlam Artificial Intelligence fund from the Specialist sector. This used to be the Smith and Williamson Artificial Intelligence fund. It was taken over by Sanlam Investments earlier this year, but the management team has not changed. It is a fund that has regularly featured in our tables and its largest holding is in Alphabet Inc Class A GOOGL 0.04%,, the parent company of Google.

The last fund, New Capital US Growth, is in the North America sector but also has Alphabet in its top 10 holdings, along with Amazon.com Inc AMZN 0.42%, Apple Inc AAPL, 1.05%, Facebook Inc Class A FB 0.10% and Tesla.

These giant US technology firms led the recovery last year, but slowed earlier this year as fears mounted that they had become overvalued. They seem to be back on a roll again.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.