Jun

2021

Keystone Positive Change: Profit and purpose

DIY Investor

23 June 2021

Baillie Gifford’s newest investment trust, Keystone Positive Change, got off to a volatile start but its managers have their eyes fixed firmly on the long term; I took an initial stake in Keystone when it proposed the manager change in late 2020.

I added a little more before the decision was ratified, then topped up again when the share price sank in March when tech/growth fell from favour; my position is about where I’d like to be, movements of the share price have left me a few per cent below water, but now that Keystone has published its first results under Baillie Gifford’s, let’s see how things are shaping up.

Key stats for Keystone Positive Change

NB the recent manager change makes the 10-year NAV return pretty meaningless:

- Founded: 1954

- Ticker: KPC (KIT pre-11 Feb 2021)

- Managers: Kate Fox and Lee Qian from 11 Feb 2021

- Management firm: Baillie Gifford (Invesco to 10 Feb 2021)

- Share price: 310p

- Market cap: £192m

- Discount to NAV: 1.3%

- Costs: 0.55% OCF and 1.1% KID

- 10-year NAV total return: +101%

- Benchmark: MSCI All Countries World Index

- AIC sector: Global

- Current dividend and yield: 11.2p and 3.6%, but will be significantly lower and possibly zero from 2022 onwards

- Links: Website – AIC page – Kepler Feb-21 review – Retail webinar

Price data as of 30 Apr 2021

What is Positive Change?

The Positive Change team of seven led by Kate Fox looks for high-quality growth companies, similar to Baillie Gifford’s other trusts and funds; companies should also make a positive impact on society and/or the environment.

The ‘positive impact’ net is cast wide and Fox says less obvious ideas are often her personal favourites; the team also runs the £2.4bn Baillie Gifford Positive Change open-ended fund.

Investing style

A concentrated, low-turnover approach, KPC aims for 30-60 companies and had 33 as of March 2021 with turnover of 20% a year; it aims to beat the MSCI All Countries World Index by 2% per annum over rolling five-year periods.

The fund and the trust look very similar with the same top 10 holdings; differences are that Keystone can employ gearing, can buy slightly smaller as well as private companies. The open-ended fund has done spectacularly well since launch in 2017, sucking in £2.4bn and up 33% p.a. vs its 11.1% benchmark.

‘Companies need to meet both aims of high-quality growth and positive impact to be considered’

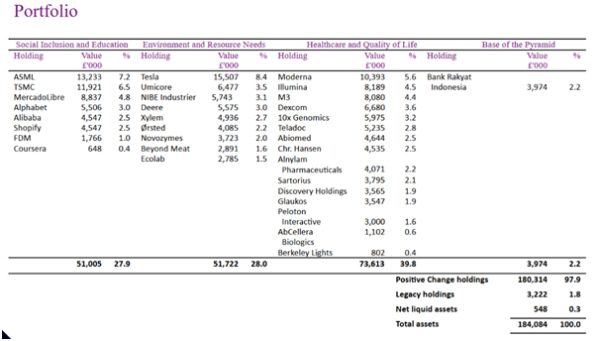

The portfolio is split into these four categories: Social Inclusion and Education, Environment and Resource Needs, Healthcare and Quality of Life and Base of the Pyramid.

The idea generation process is organic with no sector restraints; companies need to meet both aims of high-quality growth and positive impact to be considered, with ongoing monitoring and engagement.

The current portfolio

The largest overlap with other Baillie Gifford trusts is 20% with Scottish Mortgage; each holds Tesla, ASML, Alibaba, Alphabet, MercadoLibre, Shopify, Moderna, Alnylam, and Illumina, although Keystone’s more concentrated approach means it has larger stakes in these companies.

Social rather than environmental?

Healthcare and Quality of Life is the biggest of the four categories right now; overall the portfolio leans heavily towards positive social change rather than environmental change.

Recent additions include AbCellera, which performs antibody discovery services for pharmaceutical and biotech partners, and Peloton, a pioneer of connected fitness equipment for use at home to help drive better health outcomes.

Reviewing the first few months

We all like our investments to get off to flying starts but that wasn’t the case here, although I suspect that will be largely forgotten a few years down the line.

‘Old’ Keystone was a UK trust with a big value slant; it also had quite a high percentage of less liquid holdings, so 40% of the portfolio was sold prior to the vote to change the manager, which achieved 96% approval.

The new portfolio only took a week or two to compile, but the sell-down of the less-liquid 40% meant Keystone missed some of the value rally in January and February and then switched into growth stocks pretty much when the NASDAQ market peaked in mid-February.

Had the vote been at the end of March, it would have been a completely different story, but I’m pretty relaxed about it, and pleased to see Fox and Qian haven’t overreacted to recent volatility either.

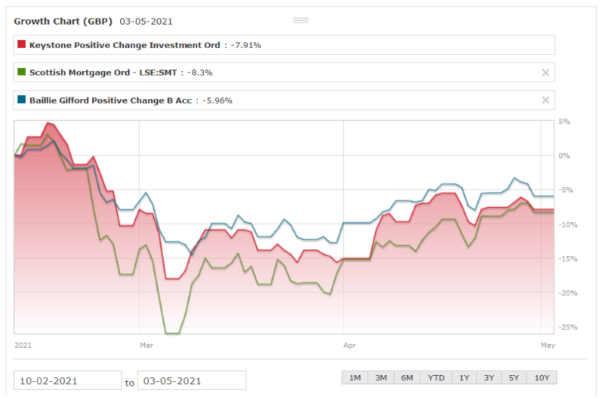

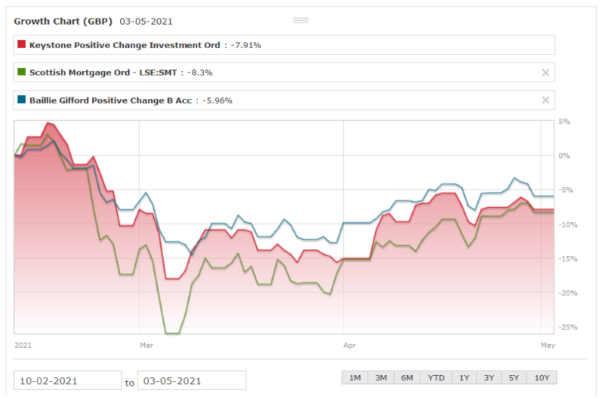

Of course, this wasn’t just a Keystone thing as it also affected many other Baillie Gifford trusts and funds. Here is Keystone, the open-ended fund, and Scottish Mortgage for comparative purposes.

In just a few weeks, Keystone fell nearly 20% and Scottish Mortgage over 25%; they’ve both since recovered to just 8% down. The Positive Change fund fared slightly better, losing 6%.

It’s a good illustration of just how volatile this trust with a focus on growth companies might be; although these type of stocks have been on a seemingly relentless rise for a decade, when they do fall, they seem to fall a lot faster and harder than the overall market.

Discounts and premiums

Keystone of old was a regular buyer of its own shares because its discount to NAV widened to 20%; the vote to change manager narrowed the discount to around 5% and since then it has traded a few per cent either side of NAV.

‘I am happy to take a long-term view on this’

No share repurchases or new share issues have been made since September and the trust has the usual standard authority to issue up to 10% of its shares or buy back 15% without seeking permission from its shareholders.

A couple of large value investors from the Invesco days — Wells Fargo and 1607 Capital Partners — seem to be gradually selling down their positions; continued selling pressure from them could cause the discount to widen a little from its current level.

Skin in the game

The five directors increased their combined holding in Keystone shares from 48,100 to 74,300 (an increase of about £100,000) when the manager change was first proposed; one added 3,500 shares (£10,000) in late March in what looks now to be a pretty well-timed purchase.

Charges and dividends

As with all of Baillie Gifford’s trusts, charges are on the low side; its management charge is waived for the first six months and is then:

- 0.70% of the first £100m of market cap;

- 0.65% between £100m and £250m; and

- 0.55% in excess of £250m.

There is no performance fee.

The base management charge is a little higher than under Invesco so the trust’s next published cost figure may nudge close to 1% with admin costs added; that will make the trust quite a bit more expensive than the 0.53% total charges levied on the open-ended version, which is twelve times the size.

Dividends

Keystone is keeping its 2021 dividend flat compared to the previous year; there will be three interims of 2.4p per share in March, June, and September followed by a 4.0p final in December for a total of 11.2p.

From 2022 onwards, the dividend will just be the minimum required to retain investment trust status, i.e. 85% of income less expenses.

As the open-ended version only has a trailing yield of 0.3%, the trust’s higher expenses may mean it pays no dividend at all.

In summary

In a recent interview the soon-to-be-retired Charles Plowden, senior partner of Baillie Gifford, said he regarded the firm’s investment trusts almost as a shop window for the larger wall of institutional money the firm manages elsewhere.

Indeed, its trusts, with £32bn of assets in total, account for just under a tenth of the £340bn Baillie Gifford looked after at the end of April.

I’m not sure I’m that keen to be thought of in that way, but I am happy to take a long-term view on this position; I’m expecting to see a lot more volatility along the way but also to be compensated for that by higher returns.

The more I hear Baillie Gifford’s various managers speak, the more I like their way of thinking, such as not worrying about short-term news, focusing on how the company is performing, thinking in decades, and not getting carried away by the bumper year they had in 2020.

I may well add more of the firm’s trusts to my portfolio over the next few years but I’m still mulling over exactly which ones.

Scottish Mortgage feels like a one-stop-shop for the best of Baillie Gifford, or perhaps Monks if I want to dial down the volatility a bit.

The likes of Baillie Gifford US Growth and Baillie Gifford China Growth could be interesting as well, although I would expect them to be more volatile than Keystone.

Schiehallion is another interesting trust, as it focuses purely on BG’s unquoted expertise, although I think it’s more difficult to buy in decent size.

To buy this trust login to your EQi account

Select Keystone Positive Change PLC – GB00BK96BB68

Click to visit:

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.