Mar

2021

Don’t discount the property generalists

DIY Investor

4 March 2021

After a host of rent collection figures were announced by property companies for Q1 2021, once again logistics-focused companies led the way – writes Richard Williams

After a host of rent collection figures were announced by property companies for Q1 2021, once again logistics-focused companies led the way – writes Richard Williams

It is not that surprising given the rise in online retailing and the positive impact on demand for logistics space, but it underlines the strength of the sector.

Urban Logistics REIT, LondonMetric and SEGRO all announced near 100% rent collection rates – building on similar figures in previous quarters during the pandemic.

Urban Logistics REIT announced that 99% of rent had been collected for Q1, with the remaining 1% due imminently. LondonMetric said it had received 98% of rent due, with a further 1% expected in the coming weeks; SEGRO’s was slightly below those two – at 88% – but ahead of previous quarters the same period after the due date. SEGRO also said it had now collected 98% of the £417m of rent for 2020.

These figures, at a time of a global pandemic, are impressive.

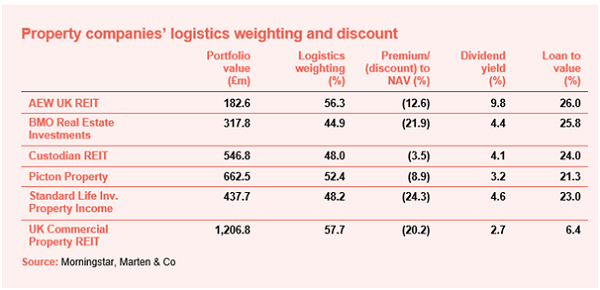

With that in mind, I thought it would be interesting to look at some of the property generalists that have a significant weighting to the industrial and logistics sector (around 50%).

These companies, that own diverse portfolios that could also include some retail, leisure and office assets, haven’t recovered their share price falls from March last year and it feels some have been a victim of investor caution on property, despite their exposure to the buoyant industrial and logistics sector.

These companies are all trading on discounts to net asset value (NAV) some of which are quite chunky and, given the make-up of the portfolios, perhaps unjustified.

BMO Real Estate Investments, which is trading at the one of the widest discounts among the group, said it had collected 94.4% of rent for the second, third and fourth quarters of 2020 and, at 27 January, had collected 82.1% in the first quarter of 2021.

AEW UK REIT, which has a relatively small portfolio worth around £182m, said it had collected 90% of rents billed in the first quarter, while UK Commercial Property REIT’s collection rate was 84% when announced at the start of February.

Custodian REIT, Picton Property and Standard Life Inv. Property Income all had collection rates for 2020 that were 90% plus, and Q1 collection rates in line with previous quarters.

All these figures would most likely have increased since they were announced and do not include deferred rent agreements, which will increasingly be received throughout 2021.

With high weightings to industrial and logistics and strong rent collection, positive sentiment towards generalist property companies should return and the current discounts look increasingly appealing.

Visit:

Alternative investments Commentary » Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary

Leave a Reply

You must be logged in to post a comment.