Nov

2019

When the Market Goes to Hell in a Handcart

DIY Investor

1 November 2019

Every so often the market goes to hell in a handcart; it’s the way it is. Something or someone, spooks the market and prices fall sharply; because they are falling, the rule of nature that says a body in motion tends to stay in motion.

Once panic sets in, things can get stupid in very short order and before we know it, everything’s going haywire.

‘Once panic sets in, things can easily get stupid in very short order’

For a day trader, increased volatility is probably very welcome; for an investor at the beginning of their ‘career’, shortly to retire or already retired, the loss of 20/30/40/50% of their portfolio’s value is less welcome.

For someone in the middle, accumulating their fund, sharp declines are a buying opportunity as they likely have new money to invest, but even so can be very frightening.

When I say ‘less welcome’ I’m being flippant; losing 50% of your money is in my experience buttock clenching at the very least.

Think about these three different sets of circumstances.

Scenario 1: New to investing, you’ve scrimped and saved to get your starting capital together, delayed gratification because you’ve not bought stuff, cut back, not gone out, made do and mended and what happens?

You buy into the market at the ‘wrong’ time, at a peak just before a savage bear turns up. OOPS, or words to that effect, you lose half your money in the first year. This can put you off investing for life; why try to be sensible just to watch your money get wasted and then evaporate?

If you’re going to do half of your money, you might at least get some pleasure; George Best famously said, ‘half my money I spent on birds, booze and fast cars…the other half I wasted.’

Scenario 2: You did the ‘right’ thing all your working life; saved hard and invested wisely for your old age, you developed a system that worked, building a personal wealth fund of (say) £3m……and retired to live off the income.

For the first 10/15 years it all went fine; you added no ‘new’ money because you were no longer working, but the portfolio trickled up in value and you lived off the dividends rather than re-investing them as you did when building the fund.

Then it all goes wrong; now in your eighties, good health and vitality a distant memory, you no longer feel sharp enough to handle whatever the market throws at you. When that savage bear turns up, you don’t have the confidence you had 25 years ago to follow your system for big declines; you freeze and watch in terror as your capital bleeds away, knowing you can’t replace it.

Scenario 3: An investor part way through building their fund is the best placed of the three – ‘seasoned’ enough to be sanguine about bears as they have encountered one before. They have new money to invest, time on their side and if they’ve learned well, have the confidence that comes from experience.

However, no matter how experienced and confident you are, losing 50% of your money with no end in sight to the doom and gloom is debilitating to say the least.

THINK I’M OVER DRAMATIZING THESE CASES? THINK AGAIN, THEY’RE ALL TOTALLY PLAUSIBLE.

Scenario 1: Many get put off investing by a bad experience before they’ve even really got started; quit and miss out on a brilliant way of creating wealth.

Scenario 2: Others get caught by age and infirmity; fear of losing capital they can no longer replace results in inertia, destroying the wealth they worked so diligently for.

Scenario 3: This takes nerve – you have to have faith in your system and keep going. Like going into a corner too fast in your car, brake halfway round and the ditch beckons, keep the power on and it should work out – unless you’re going stupidly fast.

A quotation from Winston Churchill sums up perfectly what to do when things go badly wrong – ‘Keep calm and KBO’; KBO stands for Keep Buggering On:

- Keeping calm and carrying on is easy to say, but less easy to do when your capital is at risk; but savage market declines are a fact of life and inevitable – accept it.

- Have a clear idea of how you will handle them; there are a number of ways, all with pros and cons.

- Wherever you are on your investing journey, know how you will handle the situation in advance and then deal with it.

My take is that there are four main ways an investor can handle anything from a smallish correction to a full- blown bear market:

- Masterly Inactivity: Do nothing as you expect your portfolio to fully recover with the market.

- Scale out of Positions: Sell out progressively at pre-determined points, go into cash and subsequently buy back at lower prices.

- Hedge: Take a short position in the index (or indices) that most closely correlate to the portfolio; the fall in the portfolio’s value is balanced by the rise in the value of the short.

- Pound Cost Averaging: Add extra money to investments at set regular intervals; buying into a falling market, the average entry price is lower than it would have been and thus profits are greater when the market recovers.

A deep dive is beyond the scope of this short article, but the advantages and dis-advantages of all four are discussed in detail in various articles, podcasts and videos on our website https://www.thenimbletrader.co.uk .

So, why do market ‘crashes’ happen and how do they often start? I’ll run you through my method to protect my portfolio from falling prices.

Why do Markets Crash Periodically?

There is always an underlying fundamental reason – possibly as trivial as the ‘need’ for a correction after a period of excessive optimism, to a full-scale war, not in a faraway country no-one has heard of, but next door.

I’m endlessly fascinated by the markets – they are mostly ‘instant’ execution’ and inherently unstable because it doesn’t take much of an imbalance between buy or sell trades to move prices and once they are moving momentum can really kick in.

Sentiment is so unpredictable, sometimes the market simply shrugs off either good or bad news, other times something of no great consequence causes a major panic; markets are unstable so they fall over every so often.

How do Market Crashes Start?

The underlying reason is in the background and it triggers when something, or increasingly someone does or says something and the move starts; a bit like the start of World War One I suppose, a war of words with lots of huffing and puffing all kicked off when the first soldier got shot.

‘Is that logical? No, but it’s the way the market works’

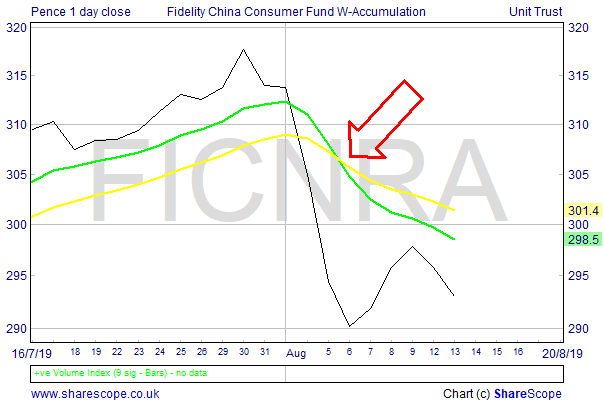

Presently we can see the tensions as economic power shifts to the east; over thirty years as China has risen, the US has fallen. President Trump decided to do battle with this trend, introducing tariffs on Chinese imports, sparking a trade war that simmers away in the background and every so often bursts into life, usually via Twitter, and the markets fall sharply.

The trade war is the underlying reason; whilst investors are well aware of it, they seem to shrug it off until the next Tweet comes out and then they knee jerk.

Is that logical? No, but it’s the way the market works, and we only know after the event, what actually started the move.

So how do I Handle These Situations?

I’m neither a newbie nor drawing down income from my investments; I’m still investing and building both my ISA and my SIPP from their returns and with new money in.

Even so, it’s very easy to get sucked in to doom and gloom as I watch my account going down in value and profits bleeding away in a crash happens; I don’t want to come across as some cocky little tosser who always gets everything dead right – I don’t, but because I’m not one of those rare creatures with an instinctive feel for market direction, I’ve learnt the hard way to follow a strict set of rules.

When something I’m invested in starts falling sharply – an individual share, a fund or the general market – I do nothing, simple as that.

Nothing that is until one or more of the three sets of moving averages I use to guide me into and out of positions inverts, i.e. the shorter of the pair crosses down through the longer. Say the 10 day average crossing down through the 20.

When that happens, I begin to sell, scaling out of my holding; it requires nerve not to just dump the lot as everything in sight is flashing red, but it’s a simple and very clear system to follow.

This does mean that I give back a fair chunk of my profits when prices keep on falling as obviously, I don’t get out anywhere near the top, but getting out at the top can’t be done in real life, only with hindsight. The benefit however is that I don’t get tipped out of winning trades needlessly when a sharp down move quickly reverses as they often do.

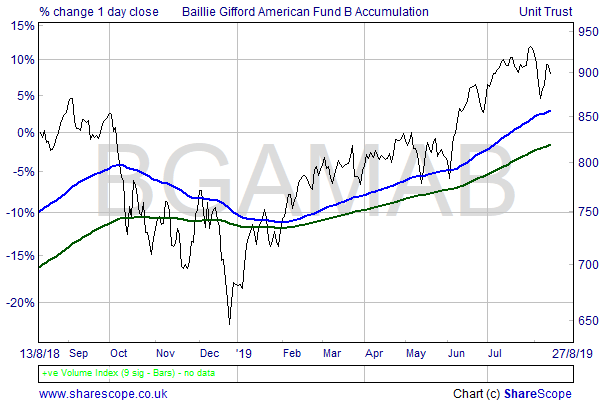

Here’s a good example: Baillie Gifford American Fund fell over 20% to December 2018 but the 100 and 200 day moving averages kept my core position invested. I would have scaled out of some of my position as the two sets of shorter moving averages I use inverted during the decline that started in October, but I didn’t get tipped out of the core position.

Once the market started going back up the shorter moving averages would have crossed back up and I’d have scaled back in to be 100% invested.

You could say ‘why sell and then re-buy, surely you suffer slippage on the trades which will reduce your total profit?’

I do suffer some slippage and with hindsight it would have been better to have hung on in this example, but never forget we don’t know how high or how low prices are going to go and protecting the downside is vital.

It’s a balance between not throwing inherently good trades away at the first hint of trouble and not throwing large amounts of money away when it actually becomes serious when prices really tank.

‘I should say, I no longer suffer catastrophic losses, because there were some all mighty cock ups when I first started’

Do I always come out on top and make money this way? Nah of course I don’t, sometimes I lose, but what I don’t do is suffer catastrophic losses and blow my account up. I should say I no longer suffer catastrophic losses, because there were some all mighty cock ups when I first started.

If you would like to know more detail about my thoughts on market declines, BEAR MARKETS and loads of other topics, ideas and strategies then perhaps you might like to take up our absolutely no catch, no small print, no nonsense 30 day free trial offer of full access to our website.

If you would, please just go to https://www.thenimbletrader.co.uk and follow the process.

Leave a Reply

You must be logged in to post a comment.