Oct

2019

Fears of Recession: Gold, Global Bonds and Gatekeepers

DIY Investor

2 October 2019

Jittery investors are rushing to buy gold and government bonds as the threat of a global recession sparked by Trump and his trade wars intensifies. Such is the fear that according to Deutsche Bank, investors have apparently invested US$15trn (25% of the total bond market) in negative-yielding government bonds — a number that has tripled since October 2018.

CUTTING IT FINE

German 30-year government bonds turned negative for the first time ever last week and the ECB has indicated that rates could be lowered before the end of the year. Key drivers for easing monetary policy are weaker economic outlooks, low inflation and a decline in business and consumer sentiment.

On the last day of July, the US Federal Reserve cut interest rates for the first time in more than a decade, signalling its readiness to provide support as growth slows in the world’s largest economy. Overnight, India, New Zealand and Thailand’s central banks used the US’s cut to mask their own, surprising investors with the aggressiveness of the cuts.

THE CASE FOR GLOBAL BOND FUNDS

In the last few years, global equity has won out against UK equity, but in the bond arena investors typically plumped for UK gilts instead of global bonds.

That’s because asset allocation models usually ignored global bond exposure because the lower expected return – in exchange for the additional currency risk as well as price volatility – meant that UK fixed income dominated the optimisation process.

2018 was a bad year for bonds in particular as the US Fed raised interest rates and the ECB ended its bond-buying programme. Hardest hit were higher-yielding bonds, particularly Emerging Market and Junk bonds, while in a flight to quality saw developed market Government debt buck the trend.

‘With the global economy slowing and rates being cut globally, global bond funds are back in vogue’

With the global economy slowing and rates being cut globally, global bond funds are back in vogue. In the long term, with a Beta of .33 relative to Gilts, Global Bonds are a useful volatility dampener as a constituent of a well-diversified multi-asset portfolio.

Given the broad parameters of the Investment Association’s Global Bond sector, this is hardly surprising.

Currency risk can now be washed away with hedged share-classes, and the liberal rules on the IA sector allow for a broad array of funds with different yield and credit risk characteristics including corporate, government and high yield funds.

At the lower-risk end, the Vanguard Global Short-Term Bond Index fund is hedged to sterling and has an average duration of 2.7 years, a yield of a little under 1.5% and a volatility of less than 1%. With over 3,000 holdings in the fund tracks a benchmark whose return has averaged less than the UK inflation rate.

At the other end of the spectrum, the Pictet Latin American Local Currency Debt fund, which holds fewer than 50 positions in mostly Brazilian bonds yielding over 7%, a volatility of close to 15% and three-year returns of 8.51. The fund has no gatekeeper picks to its name.

GATEKEEPER PREFERENCES

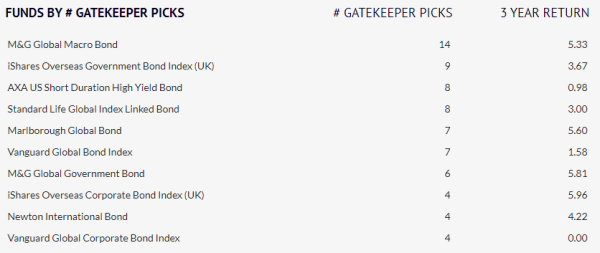

Gatekeepers’ preferred funds tend to be passive offerings from iShares and Vanguard (Vanguard has 11 funds in the sector), as well as M&G’s Global Macro Bond fund and AXA’s US Short Duration High Yield fund.

High-yield and higher-risk funds dominate the top ten funds table for three-year returns. Capital Group’s Global High Income Opportunities leads the field for returns but has just two gatekeeper picks. Amundi Pioneer’s Global High Yield fund and the aforementioned Pictet Latin American LC Debt are second and third and have no gatekeeper picks.

Only six funds in the top ten by three-year returns have any gatekeeper picks and of those that do the funds with the highest number of picks are TRowePrice’s Global High Yield Bond fund and GAM Star Credit Opportunities with just three picks apiece.

In this sector, it would be a canny approach to go active for high yield exposure, and passive for global government bonds. We’ll keep an eye on gatekeepers’ portfolios to see whether they adopt that approach through a more uncertain H2 2019.

To see more global bond and gatekeeper information, click here.

By Graham Bentley & Bella Caridade-Ferreira of Fundscape

By Graham Bentley & Bella Caridade-Ferreira of Fundscape

ABOUT FUNDSCAPE

Established in October 2010, Fundscape is a research house specialising in the end-to-end research and analysis of the UK fund industry. It is the publisher of the quarterly Fundscape Platform Report, widely regarded as the industry benchmark for platform data and statistics in the UK. With many years’ industry experience, its team is well placed to provide unique insight into asset management and distribution trends, including product development, distribution and marketing.

Leave a Reply

You must be logged in to post a comment.