Feb

2022

Why we have moved to cut our losses on this fund

DIY Investor

3 February 2022

Saltydog Investor explains why it has decided to sell a fund that is down 10% since it was purchased earlier this month.

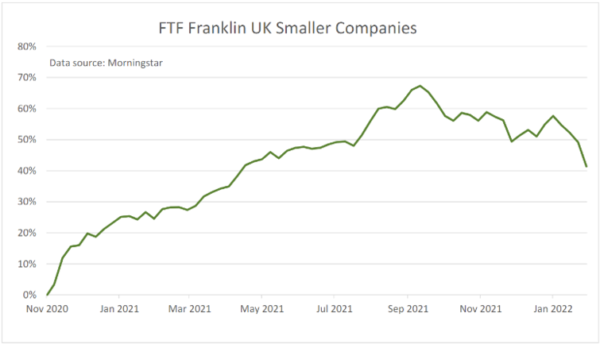

On 6 January 2022, our Ocean Liner portfolio invested in the FTF Franklin UK Smaller Companies fund. We hoped that it would do as well for us as it did in the first three quarters of last year.

Unfortunately, it has been going down ever since. We sold it last week at a loss of 10%.

When you are faced with such a big loss, it is tempting to hold on and wait to see if the price picks up, but unfortunately there is no guaranteeing that it will. In my mind, the fact that something has made a loss is not a good reason to keep it.

I am more inclined to agree with Jesse Livermore, the American momentum trader who made a fortune in the 1929 Wall Street Crash. He said: “Losing money is the least of my troubles. A loss never troubles me after I take it. I forget it overnight. But being wrong – not taking the loss – that is what does the damage to the pocketbook and to the soul.”

It has been a difficult start to the year and although it never feels great seeing the value of our investments go down, at least we have done something to reduce the losses and have cash ready to invest when the markets turn.

We are not holding that many funds and both demonstration portfolios now have more than 75% of their value in cash. To be honest, it would suit us if markets fell further so we could reinvest at a lower price point and with more confidence of a sustained rally.

At Saltydog Investor, we try to take the emotion out of investing. Each week, we look at the performance of thousands of UK-domiciled funds to determine which areas of the market are doing well and which ones are struggling. We then present the data to our members in a way that is designed to help private investors such as ourselves take advantage of market trends.

Our reports highlight which of the Investment Association (IA) sectors are on the up, which are retracting, and then pinpoints the best-performing funds. Having said all that, it is still difficult not to have our ‘favourites’. The founders of Saltydog spent most of their careers in UK manufacturing and have a natural bias towards the UK equity sectors, and UK Smaller Companies in particular.

The UK Smaller Companies sector was affected more than most at the beginning of the Covid-19 outbreak, and in February 2020 it went down by just over 10%. The following month it lost a further 23%. Although the UK sectors then started to recover, they initially lagged behind the US. It was not until later in the year that they started to reappear at the top of our tables. In November 2020, UK Equity Income was the best-performing sector, and the UK All Companies and UK Smaller Companies sectors were not that far behind. The following month, the UK Smaller Companies sector saw the greatest return, up 7.5%, with the UK All Companies and UK Equity Income sectors also making reasonable gains.

On 19 November 2020, both our demonstration portfolios invested in the Franklin UK Smaller Companies fund.

UK Smaller Companies was the best-performing sector in the first quarter of 2021, up 9%, followed by UK Equity Income, up 6.8%. In the second quarter it was in third place, with a three-month return of 8%, although it had a disappointing June, losing 1.7%. It also saw the third-highest return in the third quarter, but it went up only by 3.9%. At that point, it was still the best-performing sector of the year, but the returns were diminishing. Then, in September, the sector went down by 2.5%, and in October it lost 1.9%.

We finally decided to sell the Franklin UK Smaller Companies fund on 27 October 2021, having held it for almost a year.

During this time, we also dipped in and out of a handful of other UK Smaller Companies funds, Premier Miton UK Smaller Companies, Marlborough Nano Cap Growth, ASI UK Smaller Companies, and FP Octopus UK Micro Cap Growth.

After a disappointing November, the UK equity sectors jumped back to the top of our tables in December. UK Equity Income went up by 4.8%, UK Smaller Companies made 4.7%, and UK All Companies gained 4.5%. When we ran our analysis for the last four weeks of 2021, the UK Smaller Companies sector was slightly ahead, and the Franklin UK Smaller Companies fund was featuring in our table of top-performing funds. That is when we went back into it.

It has not worked out for us on this occasion, but funds from the UK Smaller Companies sector have performed well for us in the past, and I am confident that they will again at some point in the future.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Latest » Mutual funds Commentary » Mutual funds Latest » Take control of your finances commentary

Leave a Reply

You must be logged in to post a comment.