Feb

2022

Three reasons why China could roar in the year of the tiger

DIY Investor

3 February 2022

A wave of policy tightening and stringent regulation targeting sectors from property to technology rocked global investment sentiment towards China in 2021. After a challenging period for Chinese investors, Dale Nicholls, portfolio manager of Fidelity China Special Situations PLC, outlines his reasons as to why he believes China might roar back in the year of the tiger.

Tuesday 1 February marks the Chinese New Year, where millions of people around the globe will celebrate the year of the tiger.

With inflation fears, talk of tapering and an investment-style rotation out of ‘expensive’ growth stocks dominating recent headlines across most global markets, diversification and valuations are as important, if not more, than ever. I am excited that China currently ticks both boxes and believe the year of the tiger brings great opportunities.

Policy diversion brings diversification

The divergence between the US and European monetary policy compared to China is particularly wide at present. China is certainly at a different stage in the cycle with an easing bias, that history shows often supports markets. Having approached the initial Covid-19 pandemic differently to the loose monetary policy of western governments, China’s central bank has more levers to pull to encourage growth after the slowdown of 2021. The recent cut to the borrowing rate of its medium-term loans for the first time since April 2020 is just one example.

More broadly, while I do not expect the government’s drive towards a healthier, less speculative property sector to be reversed anytime soon, one should not be surprised to see some continued policy fine tuning, such as the supportive measures that have recently been announced. We are already seeing signs of accelerating mortgage approvals in some cities and there is significant scope to loosen policy further.

Past the peak of regulation?

We have definitely experienced a period of new regulation as well as some tightening of regulations, and for some businesses, the environment has become more challenging. Still, it is important to keep a long-term perspective and to remember that we have seen periods of tightening regulation before, such as government-imposed restrictions around online gaming in 2018.

Also, we should not lose sight of the ambitious long-term goals and priorities around economic development and innovation. Achieving these will clearly need a healthy and growing private sector, so despite investor sentiment weakening last year, we believe China offers some interesting long term investment opportunities.

Indeed, there is a good chance we are well into, if not past the peak of regulatory reforms, particularly within the technology sector – I would not expect the same degree of intensity that we saw last year and at the end of 2020 to continue.

It is also important to consider that many of the recent reforms are addressing problems that confront countries globally. Big tech and related challenges around anti-trust and data security and privacy are examples, and income inequality is a challenge around the world. Other economies also face many of these challenges and governments will likely act, albeit not as swiftly as Beijing.

Attractive valuations

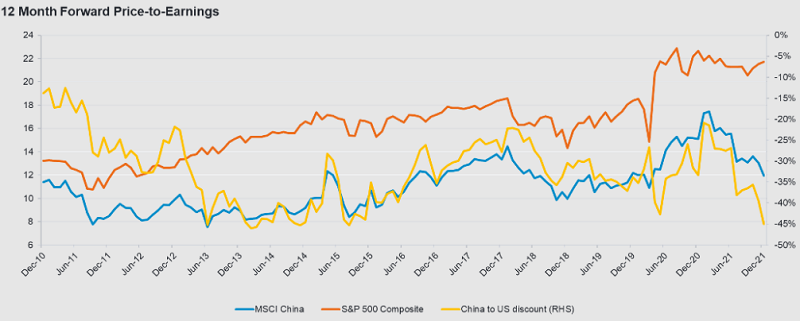

Source: Refinitiv DataStream, 31 December 2021.

As is often the case with broad-based corrections, some stocks with lesser regulatory risk have also been sold off, presenting opportunities. Many smaller companies are down despite the fact they will actually be beneficiaries of regulatory action in areas like anti-trust. Further, the valuation gap versus global peers is now excessive, despite similar regulatory challenges in several markets. With valuations where they are, we believe the risk-reward balance is now clearly in the investor’s favour.

The portfolio continues to have a large exposure to companies that are focused on growing domestic consumption, supported by the ongoing expansion of the middle class. Beneficiaries of this trend aren’t just ‘consumer stocks’ but also in areas like healthcare and technology that also play into the theme of domestic consumption.

Despite the market correction, I also continue to feel positive about the outlook for the unlisted portion of the portfolio and the progress being made in the respective businesses. This includes new unlisted holdings including Tuhu Car, the number one brand for independent auto aftermarket product and services in China; Cutia Therapeutics, an emerging leader in the dermatology and medical aesthetics space in China and Beijing Beisen, a first-class HRM (human resources management) software company and a clear market leader due to its superior cloud and integrated solutions for talent management.

It clearly has been a volatile period, but we have seen times like this before, and most likely will see them again. However, history teaches us that these are usually the periods that offer the most attractive opportunities. Corporate earnings for the market are forecast to grow over 15% for the next twelve months, and the Company’s portfolio should grow well above this level. Meanwhile, the market overall is trading on a price earning multiple that is attractive relative to history and relative to other stock markets globally.

As always, the key thing will be individual companies’ ability to deliver on their earnings potential over time. Our growing team continues to be very active on the ground, engaging with companies and understanding how they are navigating any shifts in the operating landscape, naturally including regulatory change. This in-depth analysis gives us conviction to act and capitalise, in terms of both adding to existing holdings and seeking new ones – both in the listed and unlisted areas of the market.

Important information

Past performance is not a reliable indicator of future returns. The value of investments and the income from them can go down as well as up, so you may get back less than you invest. Investors should note that the views expressed may no longer be current and may have already been acted upon. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. Overseas investments are subject to currency fluctuations. Fidelity China Special Situations PLC can use financial derivative instruments for investment purposes, which may expose it to a higher degree of risk and can cause investments to experience larger than average price fluctuations. This trust invests more heavily than others in smaller companies, which can carry a higher risk because their share prices may be more volatile than those of larger companies and the securities are often less liquid. This Investment Trust invests in emerging markets which can be more volatile than other more developed markets. The shares in the investment trust are listed on the London Stock Exchange and their price is affected by supply and demand. The investment trust can gain additional exposure to the market, known as gearing, potentially increasing volatility. This information is not a personal recommendation for any particular investment. If you are unsure about the suitability of an investment you should speak to an authorised financial adviser.

To find out more visit fidelity.co.uk/china or speak to your adviser

The latest annual reports, key information document (KID) and factsheets can be obtained from our website at www.fidelity.co.uk/its or by calling 0800 41 41 10. The full prospectus may also be obtained from Fidelity. The Alternative Investment Fund Manager (AIFM) of Fidelity Investment Trusts is FIL Investment Services (UK) Limited. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0122/370296/ISSCSO00050/0722

Commentary » investment trust commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.