Dec

2019

The Nimble Trader – Weekly Markets Report for DIY Investor

DIY Investor

28 December 2019

TNT WEEKLY REPORT

Friday the 27th December 2019.

MARKET TRENDS

FROM TODAY’S COMMENTARY: ‘with the market up 5.25% in December, I would say we’ve had a Santa Rally ’

I FIND IT HELPS ME TO BREAK THE UK MARKET DOWN INTO THREE TIME FRAMES (SHORT, MEDIUM AND LONG) AND TO THEN ESTABLISH HOW BULLISH/BEARISH I AM IN EACH TIME FRAME AND ALSO TO PROVIDE A COMBINED READING

0 1 2 3 4 5 6 7 8 (9)

I’M 100% BULLISH IN THE ONE MONTH TIME FRAME, 100% BULLISH IN THE THREE MONTH AND 100% BULLISH IN THE ONE YEAR. THE COMBINED READING A VERY BULLISH 9.

This market review is provided on the strict understanding that it is not personal financial advice to you in any way shape or form. It is my personal view of the market and any trades I’ve taken, nothing more nothing less.

Please don’t base any of your trading or investing decisions on what I do or don’t think, as I may well be wrong. Always have your own view and make your own decisions and if in any doubt contact a suitably qualified financial advisor.

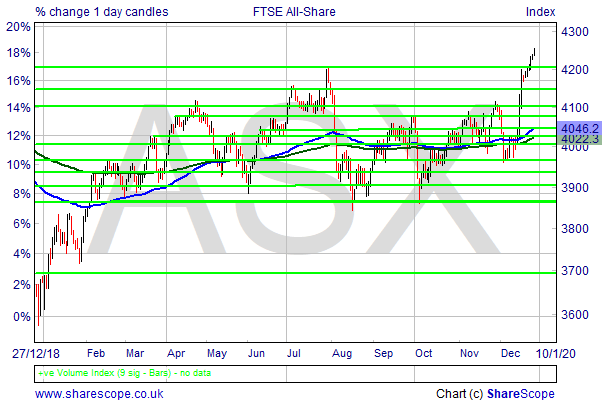

The FTSE All-Share Index (which I think is the best guide to the UK market) is up 5.25% in December, I would say we’ve had a Santa Rally.

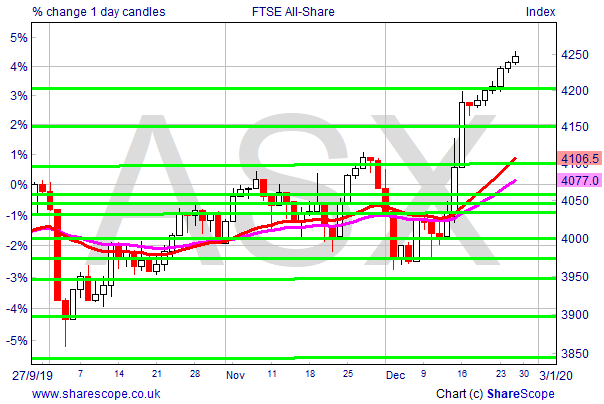

To my eyes the index looks over extended, but there is strong momentum running so it may well go a bit further before the inevitable correction. Let’s look at the stats and the charts.

The ten day moving average is light green, the twenty day moving average is yellow, the red lines are resistance, the green ones support. On the three month chart he red line is a thirty day moving average and the purple a fifty day, on the one year chart the blue line is a one hundred day, the green a two hundred day.

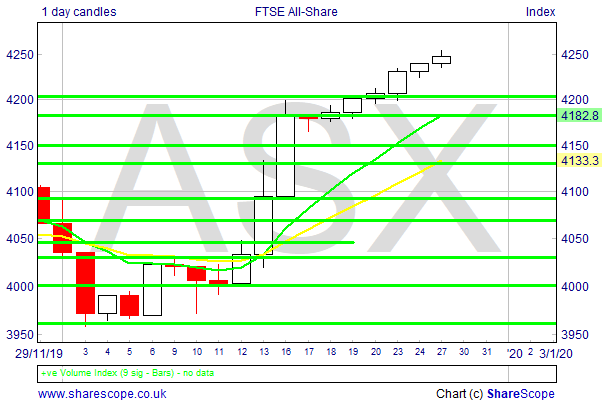

ONE MONTH TIMEFRAME: OUTLOOK 100% BULLISH

The weekly stats are: 4247.6 up 41.32 a rise of 0.98%. In this timeframe I’m watching 4125 and 4275 for signs of a breakout.

Daily Chart

The stats are: today the index is up 8.31 points to 4247.6 a rise of 0.20%. Is that Santa Rally not a thing of beauty? Mind you it does look a bit top heavy does it not.

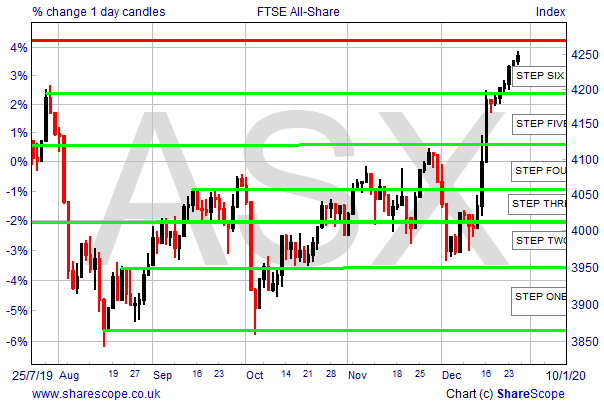

One of the things I think with charts is that it’s vital to look at them from different angles and in different time frames.

In this timeframe we can clearly see the market is going up and down in a series of steps. We’re now more or less in the middle of step six for the first time. The levels I’m watching for a breakout are around 4185 and 4255. Looking at the rise since the beginning of December, it does look a bit like the leaning tower of Pisa, not the most stable thing I’ve ever seen.

THREE MONTH TIMEFRAME: 100% BULLISH

A BEAR flag is waving on this chart. The index is looking unstable in this timeframe, as it’s a bit too far above the moving averages. To firm up, it could do with going sideways for a few days while the averages play catchup.

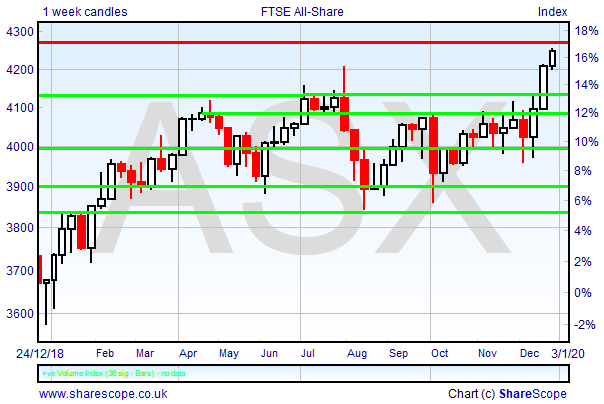

ONE YEAR TIME FRAME: 100% BULLISH

The index powered straight through the resistance at just over 4200, which is now support. We are high above the moving averages which leads me to think that a correction is coming but there is strong momentum running right now. It really is the classic BULL versus BEAR struggle.

WORLD MARKETS

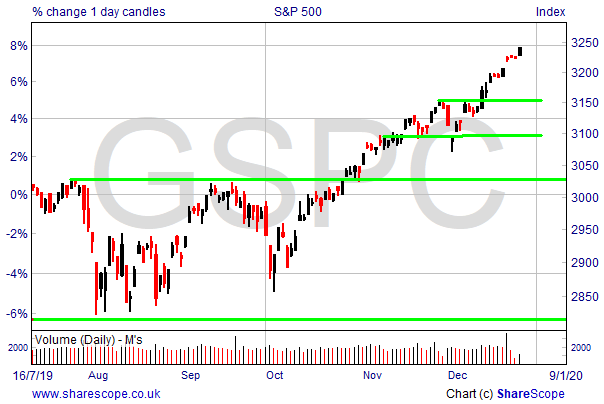

Generally speaking, the world tends to trail around behind the US. My view is that the S&P 500 is the best way to gauge the US market.

For the S&P 500 I’m 100% BULLISH in the one month time frame, 100% BULLISH in the three month and 100% BULLISH in the one year.

The combined reading is a totally BULLISH 9. (Worth saying these figures are based on yesterday’s close) As I write the index is making yet another all time high.

BUT THIS DEGREE OF BULLISHNESS ALSO DEMONSTRATES THE AMOUNT OF GREED DRIVING THE MARKET. MIND YOU, MARKETS CAN STAY IRRATIONAL LONGER THAN IS RATIONAL.

The current little mini BULL run that started in October has to my eyes gone too far too fast in the short to medium term, driven by altogether too much greed.

My reading of the tea leaves brings me to the conclusion that a correction is coming, which if I’m right is no bad thing as it will give the OLD BULL a necessary breather before the next up leg.

But I could easily be wrong, because none of us can every really know what’s coming next, the best we can do is position ourselves having taken an educated guess.

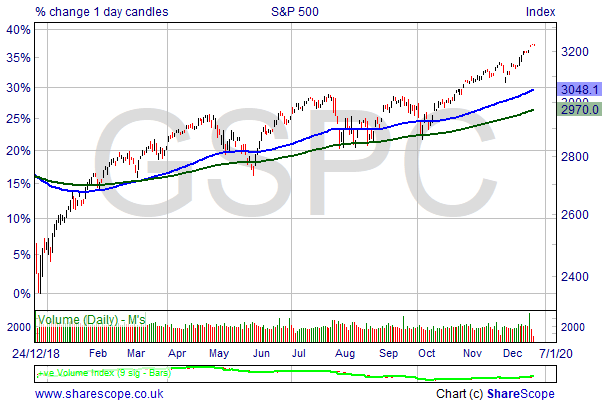

On the subject of not knowing what is coming next. Above is the chart of the S&P 500 for the last year, it’s an almost unbelievable BULL run coming straight off the back of the doom and gloom that was everywhere this time last year.

NIMBLE TRADES UPDATE:

Like I said last week, its really important not to confuse a BULL market with our own ability. As I write all my various portfolios are up at or around all-time highs. Obviously, I’d like to claim the credit for this, but in all truth I can’t.

Sure, I spend a lot of time working out where I think the overall market might be going to try to get a timing edge to begin with, take a lot of care picking which funds and shares to invest in, then have a strict set of rules to guide me as I manage those trades and finally I have a strict criteria for closing them either to a profit or to stem a loss………………………………but at the end of the day, just like you, I’m a passenger in the market and to some extent a hostage to events.

As a LONG ONLY INVESTOR, In the last half of last year it was all but impossible to make money, this year its been all but impossible not to make money.

The market sometimes taketh and some times giveth. Last year it took, this year it gave.

As the market fell last year I moved into cash, with hindsight I was perhaps a little bit slow to do so which cost me money and likewise this year in reverse, again with hindsight I was a little bit too slow going back in which cost me money.

As a result, this year I’ve slightly underperformed the market which irritates me, but I’m consoling myself with the fact that at my age not losing what I’ve already got is more important to me than taking stupid risks chasing every penny of possible profit.

Blowing the back doors off everything in sight is all well and good provided you don’t blow your own balls off in the process. The world is full of idiots throwing their money away, best you and I don’t join then.

Never forget, the stock market is a brilliant mechanism for taking money from those who are stupid and transferring it to those who are half sensible.

So yeah in spite of the slight underperformance, 2019 has been a great year for me, I hope you made a lot of money as well.

FINALLY:

Isn’t it strange how things change in the blink of an eye? And what a contrast this year has been to the second half of last year. Here is another chart courtesy of our friends at ShareScope.

As we know the market topped out in the third week of May 2018 and basically fell from then until this day last year, when it suddenly pivoted round and started going back up.

Last November and December the doom and gloom all over the place was such that people were wondering would they ever get their money back, now there’s altogether toooooooooooo much greed around as the good times roll.

So what’s going to happen in 2020? Well who knows, I certainly don’t. My guess and guess is the operative word, is that there will be a correction before we’re all a great deal older and my view is that this will be healthy as the market is getting itself a bottle ahead of the party.

I also see this as just one move in the current BULL run because markets need to correct every so often to keep some sanity on the table.

But I’m firmly of the view that this very OLD BULL has got the power in his legs for at least one last big run up provided all hell doesn’t suddenly break out somewhere, and that by the 27th of December 2020 the market will be a fair bit higher than it is now.

I think 2020 will be a good year for informed private investors as there are some strong tail winds, the Boris Bounce and election year in the US being the most obvious. I believe there will be money to be banked.

I wonder if I’m right? We’ll know soon enough won’t we?

Moving along, this is the last in the current series of articles from us at Nimble for DIY, I hope our thoughts on the market over the last couple of months have been of interest to you.

To close let me wish you a happy, and perhaps more to the point, prosperous NEW YEAR, I hope the markets are good for you.

Regards,

Tony.

- Please do check out our website https://thenimbletrader.co.uk if you’ve not yet joined us and are interested in finding out what we offer.

Leave a Reply

You must be logged in to post a comment.