Mar

2022

The funds we’ve bought to profit from rising inflation

DIY Investor

15 March 2022

Saltydog Investor has been adding to natural resources funds as commodity prices soar due to war in Ukraine

Most equity funds have had a tough couple of months. Around 90% of the ones that we analyse have made losses over the last four and 12 weeks, and that includes some standard money market and short-term money market funds (which are basically cash).

Not surprisingly, the worst-performing fund is Liontrust Russia, which has lost more than 90% of its value in the last four weeks.

On the whole, there’s not a lot that a professional fund manager can do if his overall sector is going down.

If, for example, you run a UK All Companies fund, then you must stick to the Investment Association (IA) rules for that sector. In which case, the fund must “invest at least 80% of their assets in UK equities which have a primary objective of achieving capital growth”.

Even if the fund manager thinks that the fund is going to lose money, they cannot just sell up and wait for the tide to turn. I am assuming that is probably one of the reasons why all the funds that we follow in the UK All Companies sector are currently reporting four-week losses.

That is also where we have an advantage as private investors.

In our portfolios, we have been reducing our exposure to the markets for several months. At the beginning of this year, the cash levels were already at around 40%, and since then they have gone much higher. For the last month or so, our Tugboat portfolio has been holding 90% in cash and in the Ocean Liner it’s around 70%. We have also sold all the funds that we were holding for most of last year.

Since the beginning of 2022, most stock markets around the world have been going down. One of the main concerns has been soaring inflation and rising interest rates. However, there were a few sectors that initially bucked the trend. The FTSE 100 made a modest gain in January, and there were some funds in the UK Equity Income sector that were making reasonable returns.

The FTSE 100 is interesting because it has very little exposure to the technology companies that benefited so much from the lockdown and work-from-home boom in 2020 and 2021. It, on the other hand, is firmly rooted in the massive international businesses that have done well over the last century; international banks, mining conglomerates, oil and gas giants, insurance, airlines, and shipping companies, among others.

These were the companies that were hit the hardest by the breakdown in international trade, and could be the ones that benefit the most when life returns to normal. We saw signs of this in January, which is when we made some speculative investments in a few funds from the UK Equity Income sector. One was the JOHCM UK Equity Income fund.

Its top 10 holdings include BP, Glencore, Barclays, Anglo American, and Rio Tinto – companies that you think might do well in the current conditions. Unfortunately, it also holds several of the large life insurance companies, which have not had it so easy.

The bottom line is that it has gone down by 8% in the last month, and so we have sold it. We have also reduced our holdings in the Schroder Income and Vanguard FTSE UK Equity Income Index funds.

Earlier this year, we also invested in a couple of funds that focus on energy and natural resources. These are TB Guinness Global Energy and JPM Natural Resources , both of which have served us well. We have recently increased our holding in the JPM Natural Resources fund, and also invested in the Schroder ISF Global Energy fund.

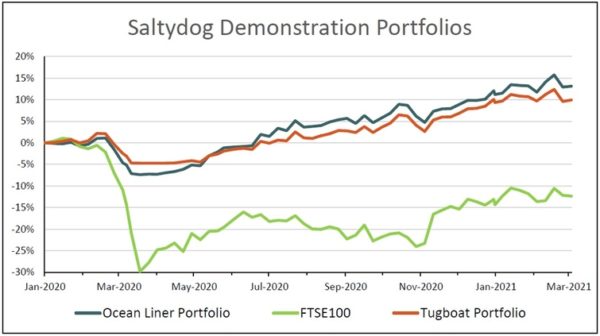

Morningstar/Saltydog Investor. Past performance is not a guide to future performance.

One of the dramatic changes that we have seen over the last few months is the significant rise in annual inflation figures. In January, UK annual inflation was 5.4% and in the US it was 7.5%, its highest rate for 40 years. Last week, the US released its February figure, which was 7.9%!

Even before the war in Ukraine, commodity prices were going up as industries were trying to recover, but the supply chains that used to be there to support them were no longer in place. Now oil and gas prices, which were already rising, have been driven even higher as restrictions are put in place limiting the use of Russian supplies. Oil prices have recently hit a seven-year high. Brent crude briefly went above $130 a barrel, while it was around $50 at the beginning of last year.

There are also concerns over food prices. Russia and Ukraine used to export nearly a third of all global grain production. The price of wheat has doubled since mid-2020 and it has gone up by around 50% in the last month.

Inflation is soaring and is now at levels that haven’t been seen since the 1980s. If this continues, then we would expect funds with exposure to energy and natural resources to continue to do well.

There are a couple of other funds that are also on our radar. They are in the Specialist sector and invest in companies involved with Sustainable Energy. One is Pictet-Clean Energy and the other is Guinness Sustainable Energy.

The investment policy for the Guinness fund is to “invest in the shares of a range of companies in the sustainable energy industry. Sustainable energy means energy not requiring fossil fuels like oil or coal”.

It can invest in companies involved with things such as solar or wind power, hydroelectricity, tidal flow, wave movements, geothermal heat, biomass or biofuels, hydrogen and other types of fuel cells and batteries

These funds had a good run in 2020, when countries were going into lockdown and governments were talking about “building back greener” and “net zero” strategies. They then levelled off for most of 2021, but had a boost at the back end of the year when the UK hosted the UN Climate Change Conference (COP26).

Unfortunately, the momentum waned and their prices fell steeply. They have both fallen by around 20% from last year’s highs.

As the West looks to reduce its dependency on Russian oil and gas, it will be interesting to see if governments start committing more money to green energy. If they do, then these funds may well take off again.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

Commentary » Investment trusts Commentary » Investment trusts Latest » Latest » Mutual funds Commentary » Uncategorized

Leave a Reply

You must be logged in to post a comment.